Z-Tech (India) Limited

Company

| Website 🔗 |  |

| Business Activity | Service |

| Division | Environment |

| Sub-class | Parks, Waste Water Management , Geotechnical |

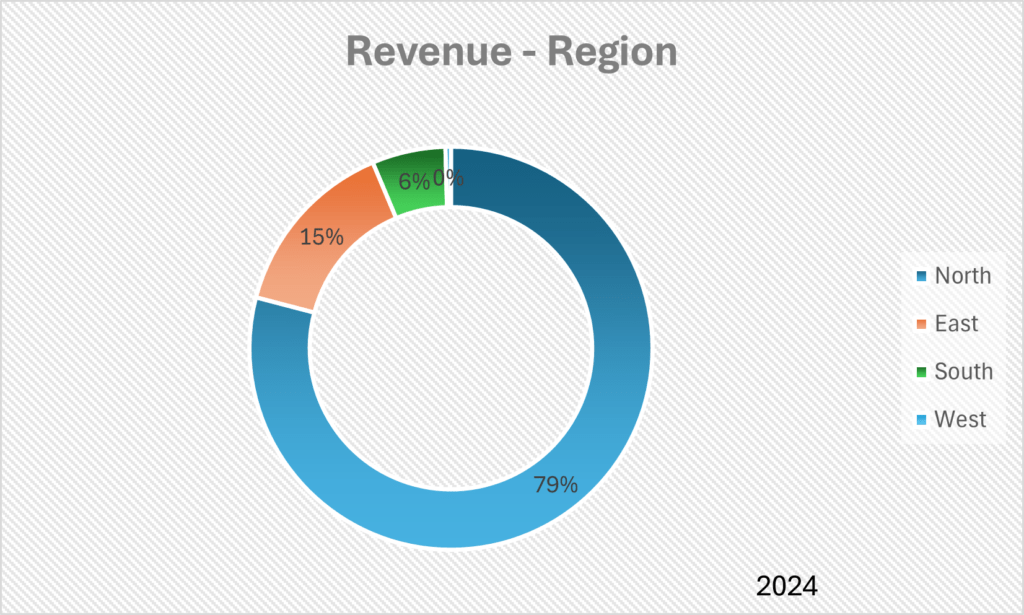

| Location | HQ – New Delhi Godown – Howrah, West Bengal. |

| Establishment Year | 1994 |

Management

| Managing Director | Ms. Sanghamitra Borgohain |

| Educational Qualifications | B.A. Political Science Hons. |

| Experience | Over 13 years in the civil construction industry |

| Annual Salary | ₹ 18 Lakhs |

| Total Number of Employees | 72 |

About

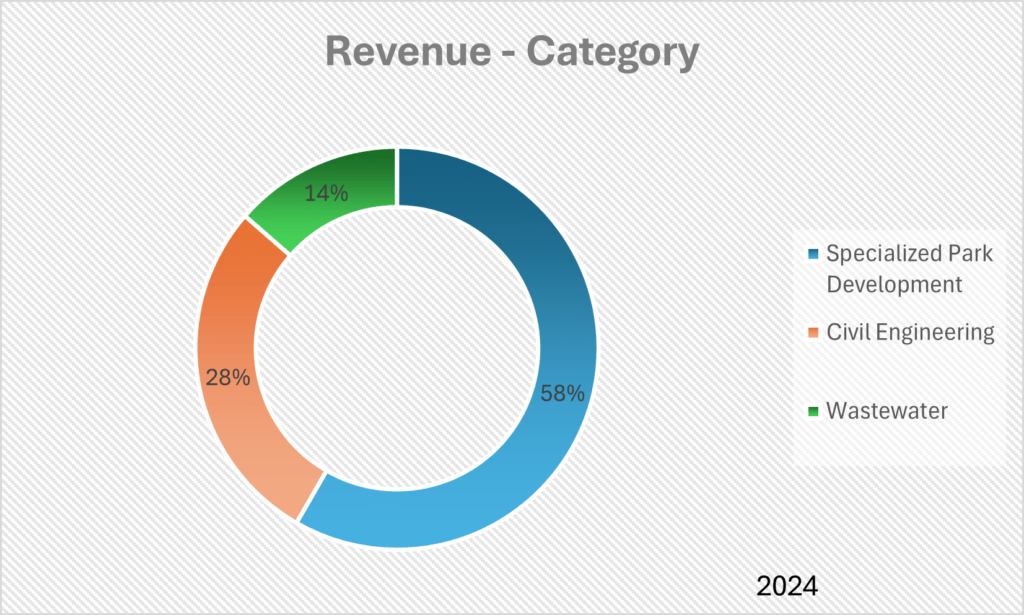

Z-Tech (India) Limited is into three different industries, theme park development, industrial wastewater management and geotechnical solutions with environmental sustainability as the core theme behind all its activities.

Products Services and Clients:

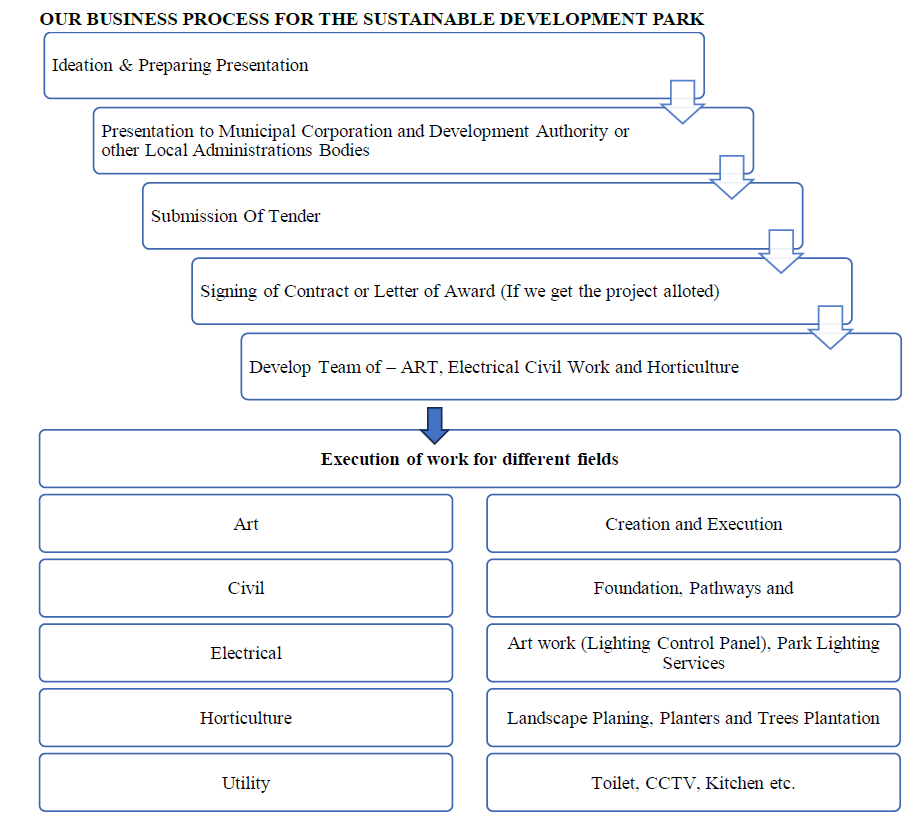

As mentioned Z-Tech (India) Limited’s operations are divided into three primary segments:

Sustainable Theme Park Development:

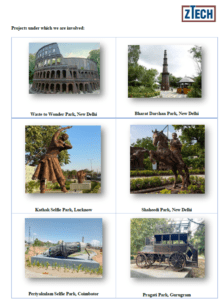

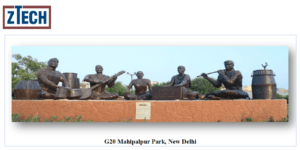

The company specializes in conceptualising, designing, constructing, and operating theme parks that prioritize environmental sustainability. The core of their approach lies in repurposing scrap materials obtained from local administrations into artistic installations, landscaping elements, and park amenities.

- Hybrid Annuity Model (HAM): The company and the government jointly invest in park development, sharing revenue generated from ticket sales.

- EPC & ONM: The company provides engineering, procurement, and construction services and may also handle park operation and management for the government.

- Public Private Partnership (PPP): The company invests in park development, while the government contributes land and scrap materials. Revenue sharing and additional income from events are key features of this model.

Clients: The primary clients for this segment are government bodies, including municipal corporations and development authorities.

Industrial Waste Water Management:

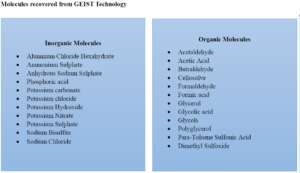

The company offers specialized wastewater treatment solutions to industries generating chemical-laden wastewater. They utilize the acquired GEIST technology from Earl Exim Private Limited, which focuses on recovering valuable chemicals from industrial wastewater, promoting a “wealth out of waste” philosophy.

The GEIST technology comprises of a bouquet of technologies that include freeze crystallization, calcium magnesium recovery, stable bleaching powder technology, selective extraction and monochloroacetic acid, and caters to various industries that excrete the chemical laden water.

- Design, Build, and Operate Model (DBO): The company finances, constructs, and operates the wastewater treatment plant, sharing revenue from recovered chemicals with the client.

- EPC & ONM: The company provides engineering, procurement, and construction services for the plant and may also handle its operation and management.

- Engineering and Supervision Model: The company offers engineering and maintenance consultancy services for the plant.

Clients: The clientele for this segment comprises industrial units across various sectors, including fertilizers, pharmaceuticals, and chemical production, that generate chemical-laden wastewater.

Geo-Technical Specialized Solutions:

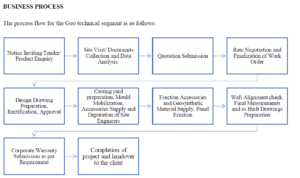

The company provides a range of geotechnical engineering services, including the design, supply, and construction of retaining walls, reinforced soil structures, asphalt reinforcement, coastal and river protection, drainage systems, ground improvement, erosion control, soil stabilization, and landslide mitigation.

- The business model for this segment is primarily EPC & ONM, where the company focuses on providing engineering, procurement, and construction services.

Clients: The clientele for this segment includes various entities involved in infrastructure and construction projects, such as government agencies, public sector undertakings, and private companies.

Raw Materials and Suppliers:

Sustainable Theme Park Development:

The primary raw material for this segment is scrap, which the company sources from local administration dump yards.

Industrial Waste Water Management:

The raw materials for this segment comprise the equipment and components needed to set up water treatment plants. These include items such as pumps, tanks, heat exchangers, reactors, dryers, and filters.

The company sources these raw materials from domestic suppliers located in the states of Maharashtra and Gujarat.

Geo-Technical Specialized Solutions:

The raw materials would likely include construction materials such as concrete, steel, geotextiles, geogrids, and other specialized materials used in geotechnical engineering projects procured from domestic suppliers.

Other Key Aspects

The top ten customers accounted for 77.5% of revenue from operations in FY 2024.

M/s Terramaya Enterprises Private Limited is the Promoter of the company with majority stake.

Process Flowchart

Revenue – Category

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors provided an unqualified opinion on the Financial Statements of Z-Tech (India) Limited.

Related Party Transactions:

The related party transactions for the period ending March 31, 2024, amounted to approximately 5.10% of total Revenue.

Non-Compliances and Other Issues:

Non-compliance with GST, Income Tax, and other laws:

The company has faced penalties or liabilities in the past for non-compliance with certain provisions, including delays or errors in filings under the Companies Act, GST Act, Income Tax Act, and EPF Act.

Contingent Liabilities:

As of March 31, 2024, there is no contingent liability on the Z-Tech (India) Limited.

Legal Cases:

Litigation by the Company:

M/s Garg Enterprises Vs Pan India Infra Projects Pvt. Ltd:

This is an insolvency proceeding initiated by the NCLT Bench, Mumbai, against Pan India Infra Projects Pvt. Ltd. Z-Tech India Limited is involved in this proceeding as an operational creditor.

Z-Tech (India) Private Limited Vs Simplex:

This is an arbitration proceeding initiated by Z-Tech (India) Limited against Simplex. The proceeding seeks recovery of Rs. 33.5 Lakhs towards a work order carried out by Z-Tech for Simplex.

Civil Proceedings against the Company:

M/s ABCI Infrastructures Pvt. Ltd. Vs. M/s Z-Tech (India) Pvt. Ltd.

The dispute revolves around a work order issued to Z-Tech for the design and construction of a reinforced earth wall. ABCI Infrastructures claims that Z-Tech’s progress was slow and terminated the contract, demanding a refund and liquidated damages totalling Rs. 46.5 Lakhs

M/s Jyoti Plastic Works Private Limited vs. Z-Tech (India) Private Limited

The suit has been filed by Jyoti Plastic Works for the recovery of Rs. 6.1 Lakhs towards unpaid invoices for goods supplied, along with 18% p.a. interest.

Tax Proceedings against the Company:

Notices under Section 143(1)(a) of the Income Tax Act, 1961, for various assessment years, where the prescribed time limit for response has lapsed, inconsistencies in provisions for gratuity payments and other deductions and few other inconsistencies aggregating to an amount of Rs. 22.1 Lakhs.

SWOT Analysis

Strengths

| Focus on Sustainability and Innovation: Z-Tech’s commitment to eco-friendly practices and innovative solutions aligns with global trends and could attract environmentally conscious clients and investors. The company’s R&D efforts and acquisition of the GEIST technology demonstrate its innovative capabilities. |

| Diversified Business Model: Operating in three distinct segments provides a degree of diversification, reducing reliance on any single market and potentially offering more stable revenue streams. |

| Well-Organized Organizational Structure: The company’s clear management structure, with a corporate group overseeing three business verticals, facilitates effective management and coordination of its diverse operations. |

Weaknesses

| Dependence on Government Tenders: The company’s reliance on government contracts, particularly in the Sustainable Theme Park Development segment, makes it vulnerable to policy changes and budget cuts. |

| Limited Operating History in Key Segments: The company has a relatively short track record in the Sustainable Theme Park Development and Industrial Wastewater Management segments, which increases uncertainty about their future performance and growth potential. |

| Concentration of Revenue: A significant portion of the company’s revenue comes from a limited number of customers, increasing its vulnerability to client-specific risks. |

| Working Capital Requirements: The company’s operations are working capital intensive, requiring significant funds to manage day-to-day expenses and support growth. This could strain the company’s financial resources and limit its flexibility. |

Opportunities

| Industry Growth: The waste management, industrial wastewater treatment, and geotechnical services industries are all projected to grow significantly, providing ample opportunities for Z-Tech to expand its business and market share. |

| Government Support and Policies: The Indian government’s focus on infrastructure development, waste management, and sustainable solutions creates a favourable environment for Z-Tech’s business, potentially leading to increased project opportunities and revenue growth. |

| Geographical Expansion: Expanding its operations into new regions, particularly South India, could provide Z-Tech with access to untapped markets and a broader customer base, driving further growth. |

Threats

| Intense Competition: The company faces increasing competition from established players and new entrants in all its business segments. This competition could lead to price pressures, reduced margins, and the need for continuous innovation to stay ahead. |

| Regulatory and Compliance Risks: The company operates in sectors subject to various environmental, safety, and industry-specific regulations. Changes in these regulations or non-compliance could result in penalties, legal actions, or reputational damage. |

Porter’s Five Forces1

| Threat of New Entrants | LOW – MODERATE |

| Sustainable Theme Park Development: Moderate. While the concept is innovative, it requires significant capital, specialized skills, and government approvals, creating barriers to entry. Industrial Wastewater Management: Moderate The technology and expertise required can be a barrier, but the growing demand for sustainable solutions might attract new players. Geotechnical Specialized Solutions: Low. This segment demands substantial technical expertise, experience, and a proven track record, making entry challenging for new firms. |

| Bargaining Power of Suppliers | LOW |

| Sustainable Theme Park Development: Low. The primary raw material is waste, readily available from local administrations. Industrial Wastewater Management: Low to Moderate. Suppliers of equipment and chemicals might have some bargaining power, but Z-Tech can likely switch suppliers if needed. Geotechnical Specialized Solutions: Low. Raw materials like geotextiles and geogrids are likely sourced from multiple suppliers, limiting their power. |

| Bargaining Power of Buyers | LOW – MODERATE |

| Sustainable Theme Park Development: Low. The government is the primary buyer, and their focus on sustainable solutions limits their bargaining power. Industrial Wastewater Management: Moderate Industrial clients have some bargaining power as they can choose from different providers based on cost and effectiveness. Geotechnical Specialized Solutions: Low to Moderate. While there might be some price sensitivity, the specialized nature of the services limits buyers’ bargaining power. |

| Threat of Substitute Products or Services | LOW – MODERATE |

| Sustainable Theme Park Development: Low. The unique concept and focus on sustainability limit direct substitutes. Industrial Wastewater Management: Moderate. Alternative wastewater treatment technologies exist, but Z-Tech’s GEIST technology offers a unique value proposition. Geotechnical Specialized Solutions: Low. While alternative solutions might exist, the specialized nature of the services limits the threat of substitutes. |

| Rivalry Among Existing Competitors | MODERATE |

| Sustainable Theme Park Development: Low to Moderate. The concept is relatively new, and there might be limited direct competition. Industrial Wastewater Management: High. Several established players and new entrants are vying for market share in this growing segment. Geotechnical Specialized Solutions: Moderate to High. Competition is likely strong, with several companies offering similar services. Differentiation based on expertise and track record is crucial. |

Peer Comparison

Due to Z-Tech (India) Limited’s diverse operation segments, there are no listed peers that are strictly comparable based on Key Performance Indicators. But the following companies can be considered as peers segment-wise.

Theme Park:

1. Wonderla Holidays Limited

2. Nicco Parks & Resorts Limited

Waste Water Management:

1. Ion Exchange (India) Limited

2. Felix Industries Limited

3. NCC Limited

Geotechnical solutions:

1. H.G. Infra Engineering Limited

Green Box

IPO Funds:

Working Capital Requirements:

The company aims to raise a significant portion of the IPO proceeds, specifically Rs.23.7 Crores to fulfil its working capital needs. This includes managing day-to-day operational expenses, procuring inventory, and handling receivables and payables. The increased working capital will support the company’s growth and expansion plans.

Efficient Business Model:

The company’s business model focuses on careful project selection and cost optimization, leading to improved efficiency and profit margins.

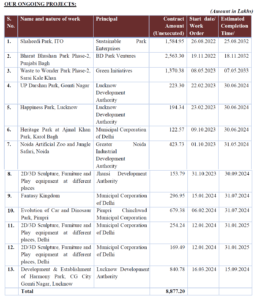

Healthy Project Pipeline:

The company’s three business segments have a good number of ongoing projects. The existence of a healthy project pipeline might suggest that the company has sufficient capacity to take on new projects.

Strong Execution Capabilities:

Z-Tech’s proven track record in executing complex projects and its commitment to quality and timely delivery enhance its reputation and credibility in the market. The company’s ability to consistently meet or exceed client expectations could attract more business opportunities and contribute to its growth.

Industry Outlook:

The industries in which Z-Tech (India) Limited operates are poised for significant growth in the coming years.

The global metal recycling market is projected to expand at a CAGR of 6% from 2023 to 2036.

The industrial wastewater treatment market in India is projected to grow at a CAGR of 11.22% from 2023 to 2028

The global geotechnical services market is also expected to witness a CAGR of 6.5% from 2022 to 2027, propelled by factors such as urbanization, infrastructure development, and the increasing use of geotechnical instruments.

Debt:

The company’s debt-to-equity ratio is 0.06, indicating a low level of debt relative to its equity. This suggests that the company is not heavily reliant on debt financing and has a healthy capital structure.

Amber Box

First-Generation Entrepreneurs:

The promoters of the company are first-generation entrepreneurs. While this is not inherently an issue, it can sometimes lead to challenges in terms of experience and established networks, which could impact decision-making and growth strategies.

Technological Advancements:

The rapid pace of technological advancements in the industries Z-Tech operates presents both opportunities and challenges. The company can leverage new technologies to improve its services and efficiency, but it also needs to adapt quickly to avoid obsolescence.

Red Box

Limited Operating History in Key Segments:

The company has a relatively short operating history in its Sustainable Theme Park Development and Industrial Wastewater Management segments. The lack of a long track record in these areas increases the uncertainty associated with their future performance and growth potential.

Execution Risks:

The company’s business involves inherent operational risks, such as project delays, cost overruns, and accidents. These risks could disrupt operations, impact profitability, and lead to legal and financial liabilities.

Maintaining Focus:

Managing operations in unrelated sectors can be challenging and might lead to a dilution of focus and resources.

Operating Cash Flow(OCF):

Z-Tech (India) Limited had negative OCF for FY 2024 and FY 2021, and near zero OCF for FY 2023. The negative operating cash flow in the most recent period and FY 2021 raises concerns about the company’s ability to sustain its operations and fund its growth plans through internal cash generation.

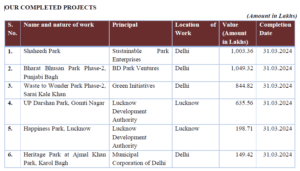

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).