Vinyas Innovative Technologies Limited

Company

| Website 🔗 |  |

| Business Activity | Manufacture |

| Division | Electronics |

| Sub-class | Electronics System Design and Manufacturing, Electronics Manufacturing Services (EMS) |

| Location | Mysuru, Karnataka |

| Establishment Year | 2001 |

Management

| Managing Director | Narendra Narayanan |

| Educational Qualifications | Electrical & Electronics Engineering from the University of Southern California |

| Experience | Over 3 decades in electronic manufacturing and defense & aerospace sectors |

| Annual Salary | ₹ 73.91 Lakhs |

| Total Number of Employees | 405 |

About

Vinyas Innovative Technologies Limited specialises in design, engineering, and electronics manufacturing services (EMS). They cater to a global clientele of Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) across diverse sectors like aerospace & defence, medical, industrial, telecommunication, automotive, and consumer electronics.

Products and Services:

- Engineering Services:

Design for Manufacturability (DFM), Design for Testability (DFT), PCB design. - Manufacturing Services:

PCB assembly (PCBA), box builds, and system integration. - Testing and Inspection:

AOI (Automated Optical Inspection), ICT (In-Circuit Testing), Environmental Stress Screening (ESS), and functional testing. - After-Sales Support:

Maintenance, repair, and overhaul (MRO) services.

Clients:

Vinyas Innovative Technologies Limited serves a global clientele, including leading OEMs and ODMs in various sectors as mentioned below.

- Defence & Aerospace:

Ground handling equipment, display systems, navigation systems, communication systems, surveillance systems, control systems, and imaging systems. - Medical:

Patient monitoring systems, ICU equipment, surgical devices, diagnostic devices, health tracking & wearables, syringe & infusion pumps, ventilators, hemodialysis machines, laboratory specimen analysis equipment, hospital management sensors, and digital stethoscopes. - Industrial:

Power & energy management systems, industrial automation equipment, controllers, interface devices, and monitoring systems. - Telecommunication:

Telecom infrastructure systems, modems, routers & switches, network security systems, RF equipment, and microwave equipment. - Automotive:

Instrument clusters, maintenance equipment, vehicle tracking systems, sensor modules, lighting systems, climate control systems, security systems, fuel efficiency systems, and monitoring devices. - Consumer:

Water purifying systems, kids’ toys, fitness bands, and smart mirrors.

Bharat Electronics Limited, Hindustan Aeronautics Limited, Elbit Systems Electro-Optics – Elop, and IAI Elta are some of the esteemed clients of the company.

Work Processes:

- Build to Print (B2P):

Clients provide the product design, and Vinyas handles the manufacturing based on those specifications. - Build to Specification (B2S):

Clients provide product requirements, and Vinyas’ in-house design team creates the design before proceeding with manufacturing.

Raw Materials:

- Electronics: Integrated circuits, components, etc.

- Mechanicals: Housings, enclosures, etc.

- Cables and Connectors

- Consumables and Packing Materials

Suppliers:

Domestic Sourcing:

The company actively engages with a network of local suppliers in India, procuring a portion of its raw materials domestically. This approach likely helps in reducing lead times, mitigating import-related risks, and supporting the local economy.

International Imports:

Vinyas also imports a significant portion of its raw materials from various countries, primarily Israel (68%), the USA (6%), and Singapore (4%). This global sourcing strategy allows them to access specialized components and materials that may not be readily available or cost-effective in the domestic market. They have established a “Global Supplier Database” to facilitate this international procurement process.

Marketing:

- Direct Engagement:

The company’s marketing and project management team proactively reaches out to potential clients, particularly targeting the leadership teams of these organizations. This direct approach allows them to showcase their capabilities and initiate discussions about possible collaborations. - Trade Shows:

Vinyas participates in industry trade shows to increase its visibility and connect with a wider range of potential customers. These events provide a platform to network, demonstrate their products and services, and generate leads. - Informational Campaigns:

The company conducts passive marketing campaigns aimed at educating existing and potential clients about how Vinyas’s solutions can enhance their systems and processes. This approach helps establish the company as a thought leader and builds awareness of its capabilities.

Other Key Aspects:

Preferred Partner in Defence & Aerospace:

Vinyas Innovative Technologies Limited highlights its status as a favoured Indian offset partner for foreign OEMs in the defence sector.

Quality Control

Vinyas is compliant with numerous electronics industry standards for quality, safety and integrity of the manufacturing processes. Vinyas is certified to:

- Organization – ISO 9001:2015

- Aerospace & Defence – AS 9100-D and Defence Industrial License.

- Medical Devices – ISO 13485:2016

They implement various quality initiatives like Six Sigma, Lean Management, and 5S. They also have an Automated Quality Traceability System (AQTS) for real-time data access and product tracking.

Vinyas obtained the MSME Sustainable ZED Gold Certificate from the Ministry of Micro, Small & Medium Enterprises, India, in 2023, further emphasizing their commitment to quality and sustainability.

Expansion in System Integration:

Vinyas aims to strengthen its system integration capabilities and expand its PCB assembly and system integration business. They plan to collaborate with OEMs in India, Israel, and the US to capitalize on opportunities in areas like radars, electronic warfare, and missile systems.

Customer-Approved Suppliers:

Vinyas emphasizes quality and compliance by primarily sourcing from suppliers who have been vetted and approved by their customers. This practice ensures that the raw materials meet the stringent quality and performance standards demanded by their clients, particularly in sectors like defence and aerospace.

Manufacturing Process Flowchart

Revenue – Category

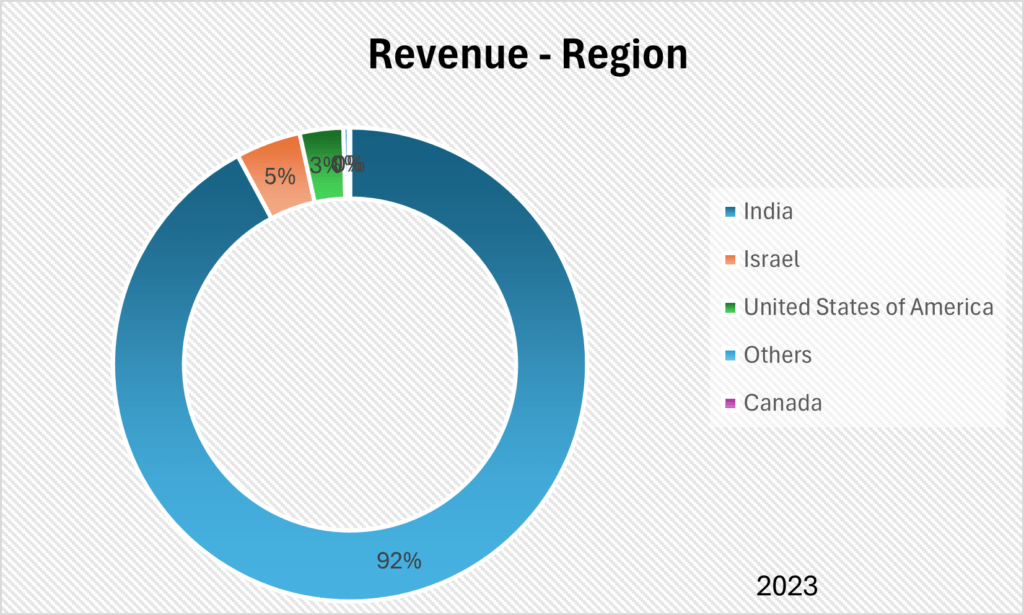

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors suggest that the company’s financial information is presented fairly and in accordance with the relevant accounting standards.

Related Party Transactions:

Vinyas Innovative Technologies Limited has related party transactions representing 4.86% of the total revenue for FY 2024.

Non-Compliances and Other Issues:

Delayed Statutory Filings and Payments:

The company in the past delayed filing statutory returns and making payments related to GST and employee benefits.

Lack of Intellectual Property Protection:

Vinyas currently does not have any registered intellectual property, relying on confidentiality agreements and common law protections. This leaves them vulnerable to potential infringement claims and loss of competitive advantage.

Contingent Liabilities:

As of March 31, 2024, Vinyas Innovative Technologies Limited reported total contingent liabilities of ₹4,794 lakhs. The breakdown of these liabilities is as follows:

- Outstanding Bank Guarantees: ₹4,094.00 lakhs

- Demand of Income Tax: ₹47.56 lakhs

- Demand of VAT: ₹2.40 lakhs

- Pending Litigation (Charter of demands – Labour): ₹650.00 lakhs

Legal Cases:

Cases Filed Against the Company

The company was facing 4 civil cases, with a quantifiable amount of ₹650.00 lakhs. One significant case involved a dispute with the President of the Mysore District General Employee’s Union regarding the retrenchment of 45 employees from the Tirupati unit. The company stated that these dismissals were due to pending demands and followed a domestic enquiry.

Cases Filed by the Company

The company had initiated 8 civil cases, mostly counters regarding the retrenchment of 45 employees with a quantifiable amount of ₹650.00 lakhs

Tax Proceedings against the Company:

Tax Cases:

There were 18 ongoing tax-related cases against the company, with a quantifiable amount of ₹ 47 lakhs.

SWOT Analysis

Strengths

| Established Presence in Defence & Aerospace: Vinyas has a strong foothold in the defence and aerospace sector, being a preferred Indian offset partner for foreign OEMs. This positioning allows them to tap into the growing demand for Indigenous defence manufacturing in India. |

| End-to-End Solutions: The company’s integrated business model, encompassing design, engineering, manufacturing, testing, and after-sales support, provides a comprehensive value proposition to clients. |

| Focus on Quality and Compliance: Vinyas holds key certifications like AS 9100D and ISO 9001:2015, demonstrating its commitment to quality management and adherence to industry standards. |

| Strong Financial Performance: Vinyas has exhibited consistent financial growth, showcasing its ability to navigate challenges and capitalize on market opportunities. |

Weaknesses

| Customer Concentration: A significant portion of the company’s revenue is derived from a single customer (51% for FY 2023), creating a dependence that could impact its financial stability if that relationship is disrupted. |

| High Working Capital Requirements: The nature of Vinyas’s business necessitates maintaining high levels of working capital to finance inventory, raw material purchases, and product development. |

| Dependence on Key Personnel: The company’s success is heavily reliant on its promoters and key managerial personnel. The loss of their services or expertise could disrupt operations and hinder growth. |

Opportunities

| Growth in Defense Sector: The Indian government’s focus on Indigenous defence manufacturing and initiatives like “Make in India” presents significant growth opportunities for Vinyas. |

| Expansion into New Sectors: The company’s expertise and capabilities can be leveraged to expand its presence in other sectors like medical, industrial, and automotive electronics, tapping into their growth potential. |

| Global Market Expansion: The company’s experience in serving international clients can be further utilized to expand its global footprint and tap into new markets. |

Threats

| Intense Competition: The electronics manufacturing industry is highly competitive, with both domestic and global players vying for market share. Vinyas needs to continuously innovate and maintain cost-efficiency to stay competitive. |

| Regulatory Changes: The company operates in a regulated environment, and any adverse changes in regulations or policies, especially in the defence and medical sectors, could impact its operations. |

| Supply Chain Disruptions: The company relies on both domestic and international suppliers, making it vulnerable to supply chain disruptions due to factors like geopolitical tensions, natural disasters, or pandemics. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The barriers to entry in the EMS industry are moderately high due to the need for significant capital investment in technology and infrastructure and the requirement for specialized skills and certifications. However, the potential for new entrants, especially from larger diversified competitors or foreign companies, poses a moderate threat. |

| Bargaining Power of Suppliers | MODERATE |

| The company relies on domestic and international suppliers for raw materials and components. The availability and cost of these materials can be volatile, and the company’s dependence on customer-approved suppliers limits its flexibility. |

| Bargaining Power of Buyers | MODERATE – HIGH |

| Vinyas’ customers, particularly in the defence and aerospace sectors, have significant bargaining power due to their stringent quality requirements, large order volumes, and the availability of alternative suppliers. |

| Threat of Substitute Products or Services | LOW |

| The threat of substitute products or services is relatively low for Vinyas, especially in the defence and aerospace sectors where they provide specialized and critical solutions. |

| Rivalry Among Existing Competitors | HIGH |

| The EMS industry, particularly in India, is highly competitive with several established players and the potential for new entrants. Vinyas faces competition from global EMS companies and large, mid-sized, and small Indian EMS companies. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers for FY 2024 is as follows:

| Key Financial Performance FY 2024 | Vinyas Innovative Technologies Limited | Cyient DLM Ltd. | Centum Electronics Ltd. | Aimtron Electronics Ltd |

| Revenue from Operations (₹ in Crores) | 317 | 1,192 | 1,091 | 93 |

| Operating Profit Margin (%) | 11 | 9 | 8 | 26 |

| Return on Equity (ROE) (%) | 17.6 | 11.1 | 3.65 | 31.3 |

| Return on Capital Employed (ROCE) (%) | 19.5 | 14.1 | 10.1 | 34.4 |

| Debt to Equity Ratio | 0.75 | 0.21 | 1.11 | 0.28 |

Green Box

IPO Funds:

Working Capital Requirements: The company plans to allocate all proceeds from the IPO to fulfil its working capital needs. This includes funding for inventory, managing receivables and payables, and supporting the overall operational expenses associated with its growth and expansion plans.

Indigenous Integrated Approach:

Vinyas emphasizes its position as an indigenous Indian company with fully integrated electronic system design and manufacturing capabilities. This allows them to offer end-to-end solutions, from conceptualization to final product delivery, ensuring greater control over quality and timelines.

Focus on Mission-Critical Applications:

The company specializes in manufacturing products for safety-critical systems in sectors like defence, aerospace, and medical devices. This focus requires a high level of precision, reliability, and adherence to stringent quality standards, setting them apart from competitors catering to less critical applications.

Technological Innovation and Adaptability:

Vinyas showcases its commitment to innovation by continuously investing in cutting-edge technologies and developing in-house solutions for complex manufacturing processes. Their ability to adapt to evolving industry needs, as demonstrated during the COVID-19 pandemic by manufacturing ventilators and oxygen concentrators, highlights their agility and responsiveness.

Global Network and Customer-Centric Approach:

The company has established a global network of suppliers and customers, enabling them to source materials efficiently and cater to diverse market needs.

Increased Revenue Visibility

The company’s revenue visibility has improved due to the transition of various defense and aerospace programs from the prototyping phase to series manufacturing resulting in a robust order book pipeline extending over the next 5-6 years.

Industry Outlook:

Modernization of Defence Forces:

India is undergoing a large-scale modernization of its armed forces, which will necessitate the adoption of advanced electronic systems and technologies.

Specifically, the Indian strategic electronics market is projected to grow at a CAGR of 7%, reaching USD 15 billion by 2032. This growth is expected to be driven by demand for various applications, including tactical communication systems, battlefield management systems, network-centric warfare systems, and avionics.

The Indian medical devices market is anticipated to grow at a remarkable 37% CAGR, reaching USD 50 billion by 2025. Factors such as the rising number of medical facilities and favourable government policies are contributing to this growth.

The Indian automotive electronics market is also projected to experience substantial growth, with a CAGR of 17%, reaching USD 18 billion by 2027.

Red Box

Dependence on Government Contracts and Policies:

A significant portion of the company’s revenue comes from defence and aerospace contracts, making it susceptible to changes in government policies, budget allocations, or defence procurement procedures. Any adverse changes in these areas could negatively affect Vinyas’ business.

Working Capital Requirements:

Vinyas has significant working capital needs, which can strain its cash flow and financial flexibility. The company’s reliance on external financing to meet these requirements adds another layer of risk, especially in volatile economic conditions.

Regulatory Risks:

Operating in sectors with stringent quality and regulatory standards, Vinyas faces compliance risks. Any failure to adhere to these regulations could result in penalties, contract cancellations, and reputational damage.

Negative Operating Cash Flow:

Vinyas Innovative Technologies Limited has seen a considerable negative operating cash flow for FY 2024.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).