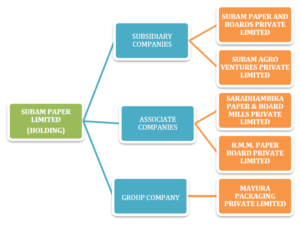

Subam Papers Limited

Company

| Website 🔗 |  |

| Business Activity | Manufacture |

| Division | Paper and Paper Products |

| Sub-class | Kraft Paper, Duplex Board, Corrugated Boxes, Paper Cones, Paper Tubes |

| Location | Tirunelveli, Tamil Nadu |

| Establishment Year | 2004 |

Management

| Managing Director | T Balakumar |

| Educational Qualifications | Bachelor of Mechanical Engineering |

| Experience | Over 19 years of experience in the paper industry |

| Annual Salary | ₹ 48 Lakhs |

| Total Number of Employees | 500 |

About

Subam Papers Limited is an Indian manufacturer specializing in the production of Kraft Paper and Duplex Board using recycled wastepaper. The company is committed to sustainability, utilizing wind and solar power for eco-friendly operations.

Products and Services:

Duplex Board:

This is a high-quality paperboard with a glossy-coated surface on one side and a rough surface on the other. It is known for its durability, strength, and printability, making it ideal for packaging, stationery, and displays.

Kraft Paper:

This sturdy and versatile paper is made from 100% recycled waste paper. It is widely used for its strength, tear resistance, and eco-friendly nature. Kraft paper is available in various shades and is commonly used in packaging, industrial applications, crafts, and e-commerce.

Corrugated Boxes:

These are sturdy boxes made from corrugated paper, known for their cushioning and protective qualities. They are widely used in shipping, storage, displays, and e-commerce.

Paper Cones:

These cones, crafted from recycled wastepaper, are essential in the textile industry for winding and storing yarn and threads. They are also used in various industrial applications and DIY projects.

Paper Tubes and Cores:

These are strong and durable tubes made from recycled wastepaper, used for winding, storing, and transporting materials in various industries, including textiles, paper, film, construction, and packaging.

Clients:

Subam Papers Limited serves a diverse clientele across various industries, including:

- Automobiles

- Textiles

- FMCG

- Food

- Distilleries

- Pharmaceuticals

- Electricals and Electronics

- Printing

Manufacturing Process:

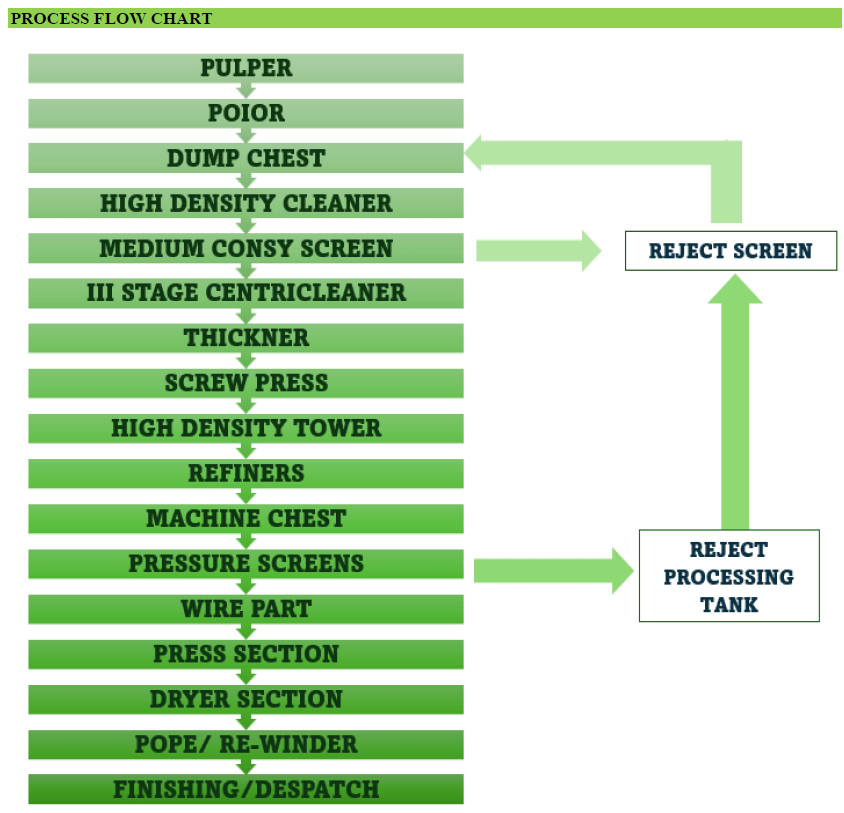

Raw Materials:

The process begins with sourcing high-quality wastepaper, both domestically and internationally.

Pulping:

The wastepaper is then pulped, a process that involves mixing it with water and chemicals to break down the fibers.

Cleaning:

The pulp undergoes a thorough cleaning process to remove impurities and contaminants.

Refining:

The cleaned pulp is refined to enhance its properties and ensure consistency.

Sheet Formation:

The refined pulp is then fed into a paper-making machine, where it is formed into sheets.

Pressing and Drying:

The sheets are pressed to remove excess water and dried using steam-powered cylinders.

Calendaring:

The dried sheets are calendared to achieve a smooth surface.

Coating (for Duplex Board):

An additional coating process is applied to one side of the Duplex Board to create a glossy finish.

Quality Control:

Throughout the process, rigorous quality checks are conducted to ensure the products meet the required standards.

Raw Materials:

Wastepaper:

This is the primary raw material used for manufacturing Kraft Paper and Duplex Board. The company sources wastepaper from both domestic and international suppliers.

Chemicals:

Various chemicals are used in the pulping and refining processes to break down the waste paper fibres and enhance the properties of the paper.

Energy:

The company utilizes a combination of solar power, wind power, and grid electricity to power its manufacturing operations.

Suppliers:

Domestic Suppliers:

The company sources wastepaper from various domestic suppliers in India.

International Suppliers:

To supplement domestic supplies and ensure high-quality raw materials, the company imports wastepaper from international suppliers, primarily in the US, UK, Europe, and Canada.

Other Key Aspects:

Manufacturing Facilities:

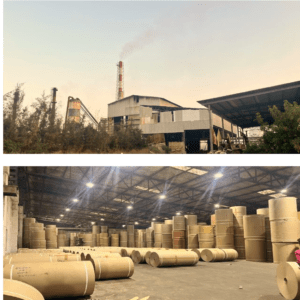

Subam Papers Limited has two manufacturing units in Tirunelveli, Tamil Nadu, India. One unit is dedicated to the production of Duplex Board, while the other manufactures Kraft Paper.

Certifications:

- ISO 9001:2015: The company is ISO 9001:2015 certified, demonstrating its commitment to quality management systems.

- FSC Recycled: The company is also FSC Recycled certified, indicating that it uses 100% recycled materials in its production processes.

Sustainability Initiatives:

Subam Papers Limited is committed to sustainability and has implemented several initiatives to minimize its environmental impact. These initiatives include:

- Renewable Energy: The company utilizes wind and solar power to generate a significant portion of its energy needs, reducing its reliance on fossil fuels.

- Recycling: The company’s use of recycled wastepaper as its primary raw material conserves natural resources and reduces waste.

- Water Management: The company has implemented efficient water management practices, including rainwater harvesting and responsible water usage.

Manufacturing Process Flowchart

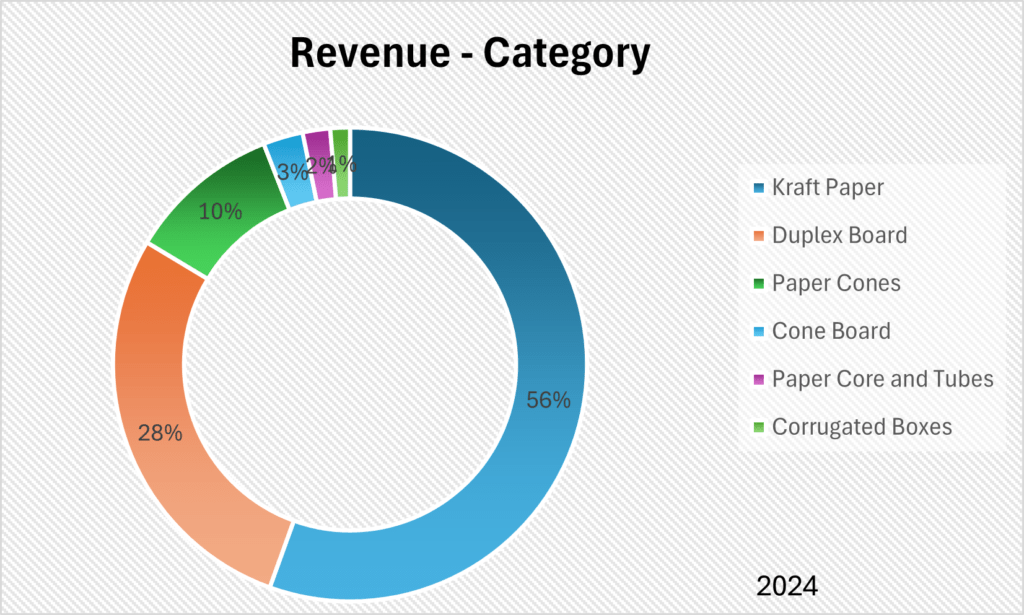

Revenue – Category

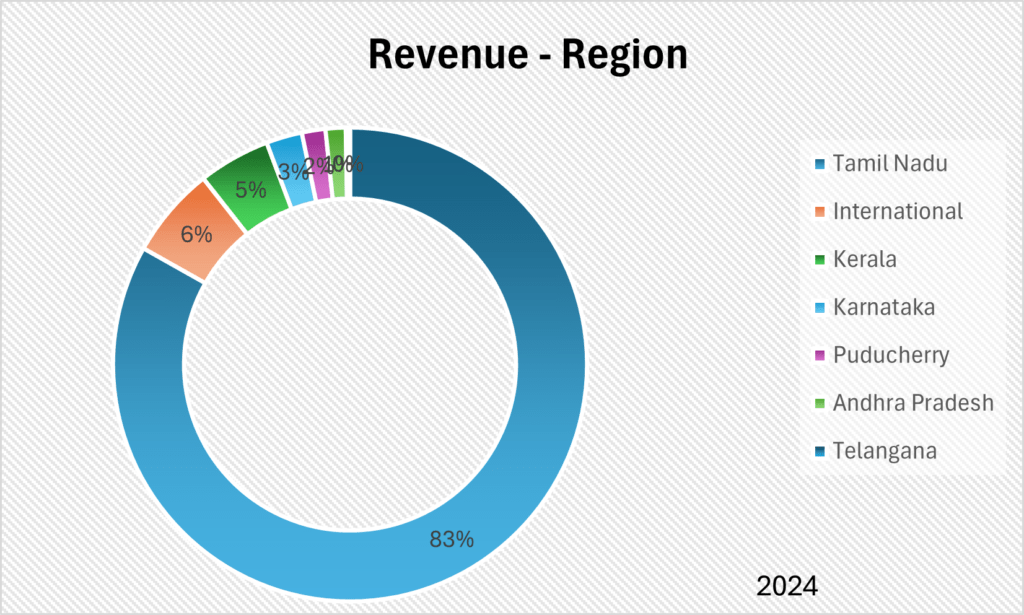

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors have issued an unqualified opinion on the company’s financial statements

Non-Compliances and Other Issues:

Delay in Filing of Statutory Forms with the Registrar of Companies (RoC):

The company has incurred penalties for delays in submitting statutory forms to the RoC. These delays have resulted in additional fees being imposed at the time of filing.

Delay in Filing of TDS Returns:

The company has received notices for non-deduction of TDS.

Delay in Filing of GST Returns:

The company has received GST notices for the non-payment of the demanded amount.

Contingent Liabilities:

The company has contingent liabilities amounting to ₹3486.41 Lakhs as of March 31, 2024.

| Particulars | Amount (₹ in Lakhs) |

| Income Tax demands / Notices before CIT Appeals / TDS | 1,486.41 |

| Bank Guarantees / Corporate Guarantees | 2,000.00 |

Legal Cases:

Cases Filed Against the Company

MSME Development Act:

A Case of the MSME Development Act for recovery of Rs. 1,36,39,326 has been filed by Ms. Jayam Papers Chemicals against the Company in the MSE Facilitation Council towards the remaining amount due for goods supplied with interest calculated in terms of the MSMED Act. Accordingly, the matter is still ongoing before MSE Facilitation Council.

Commercial Original Suit:

Filed by PG Exports LLC, a proprietorship firm of USA, against the Company on August 31, 2023, before the Principal District Judge, Tirunelveli. The Plaintiff has alleged that the company did not pay an outstanding amount of Rs. 45,67,478.72 as of August 31, 2020. A legal notice was sent by the plaintiff to our Company on April 27, 2023. The Company has filed a reply contesting the facts and the matter is still pending in the Court.

Cases Filed by the Company

The company has filed multiple cases against various customers for non-payment of dues for the purchase of Kraft paper.

Tax Proceedings against the Company:

The company has received two notices for discrepancies of ₹282.71 Lakhs and ₹1,494.72 Lakhs in the GST returns for FY 2020-21 and FY 2021-22, respectively. The company is in the process of responding to these notices.

SWOT Analysis

Strengths

| Established Market Presence: Subam Papers Limited boasts a long-standing presence in the Indian paper and packaging industry, with over two decades of experience. This established presence translates to strong relationships with customers and suppliers, contributing to operational stability and market reach. |

| Sustainable Business Practices: The company demonstrates a strong commitment to sustainability through various initiatives, including the use of 100% recycled wastepaper, renewable energy sources like wind and solar power, and responsible water management practices. |

| Strategic Location: The company’s location in Tirunelveli, Tamil Nadu, provides logistical advantages. Its proximity to the Tuticorin port facilitates efficient import and export operations, while the nearby Thamirabarani River ensures a reliable and sustainable water source for manufacturing processes. |

| Expansion and Diversification: Subam Papers Limited is actively pursuing expansion and diversification strategies. This includes capacity expansion through its subsidiary, Subam Paper and Boards Private Limited, and a focus on developing value-added products like corrugated boxes, paper cones, and paper tubes. These strategies position the company for future growth and market penetration. |

Weaknesses

| Dependence on Wastepaper: The company’s heavy reliance on wastepaper as its primary raw material exposes it to fluctuations in wastepaper prices and availability. Disruptions in the supply chain or significant price increases can impact the company’s profitability and operational efficiency. |

| Limited Brand Awareness: While Subam Papers Limited has a strong presence in certain regions, its overall brand awareness may be limited compared to larger, more established players in the paper and packaging industry. This can pose challenges in expanding into new markets and attracting a wider customer base. |

| Product Concentration: A significant portion of the company’s revenue is generated from two main products. |

Opportunities

| Industry Growth: The paper and packaging industry in India is experiencing robust growth, driven by e-commerce expansion, rising consumer demand, and increasing urbanization. |

| Government Initiatives: Supportive government policies, such as the ‘Make in India’ initiative and Production Linked Incentive (PLI) schemes, promote domestic manufacturing and investment in the paper and packaging sector. |

| Export Potential: The company can explore opportunities to expand its presence in international markets, particularly in regions with high paper consumption and demand for sustainable packaging solutions. |

| Technological Advancements: Investing in advanced manufacturing technologies and automation can enhance production efficiency, reduce costs, and improve product quality. |

Threats

| Competition: The paper and packaging industry is highly competitive, with the presence of both large multinational companies and smaller regional players. Subam Papers Limited faces competition in terms of pricing, product innovation, and market reach. |

| Regulatory Changes: Changes in environmental regulations or government policies related to waste management, import/export, or taxation can impact the company’s operations and profitability. |

| Currency Exchange Rate Fluctuations: The company’s reliance on imported wastepaper exposes it to fluctuations in currency exchange rates. Significant currency depreciations can increase the cost of raw materials and impact profitability. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The paper and packaging industry requires significant capital investment and regulatory approvals, creating barriers to entry for new players. However, the presence of smaller, niche players and the potential for technological disruptions can moderate this threat. |

| Bargaining Power of Suppliers | LOW – MODERATE |

| The company’s reliance on wastepaper, which has a fragmented supplier base, reduces the bargaining power of individual suppliers. However, the company’s dependence on high-quality wastepaper and the potential for supply chain disruptions can increase the bargaining power of suppliers collectively. |

| Bargaining Power of Buyers | MODERATE – HIGH |

| The packaging industry has a mix of large and small buyers. Large buyers, such as major FMCG companies, have significant bargaining power due to their purchasing volumes. However, the company’s focus on value-added products and customized solutions can moderate the bargaining power of buyers. |

| Threat of Substitute Products or Services | LOW – MODERATE |

| While alternative packaging materials, such as plastics and bio-based materials, exist, paper-based packaging remains dominant in many industries due to its recyclability and sustainability. However, the company needs to stay innovative to compete with alternative materials and packaging solutions. |

| Rivalry Among Existing Competitors | HIGH |

| The paper and packaging industry is highly competitive, with the presence of established domestic and international players. Competition is based on pricing, product quality, sustainability, and customer relationships. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers for FY 2024 is as follows:

| Metric | Subam Papers Limited | Three M Paper Boards Limited | Kuantum Papers Limited |

| Revenue from Operations (₹ in Crores) | 494 | 272 | 1,211 |

| Operating Profit Margin (%) | 14.2 | 8.58 | 29 |

| Return on Equity (ROE) (%) | 18.6 | 21.1 | 18.8 |

| Return on Capital Employed (ROCE) (%) | 17.9 | 15.6 | 19.8 |

| Debt to Equity Ratio | 0.77 | 0.73 | 0.42 |

Green Box

Sustainability Focus:

Subam Papers Limited has a strong competitive advantage due to its commitment to sustainability. Its use of recycled wastepaper, renewable energy sources, and efficient water management practices aligns with the growing global demand for eco-friendly products and packaging solutions.

Integrated Operations:

The company’s fully integrated manufacturing facility enables efficient production and quality control. Its in-house laboratory and automated processes contribute to maintaining high standards and meeting customer specifications.

Customization:

The company offers customized packaging solutions, including a range of shades, sizes, and printing options for its Kraft Paper and Duplex Board products. This flexibility caters to diverse customer needs and enhances the company’s value proposition.

IPO Funds:

Investment in Subsidiary:

A significant portion of the net proceeds will be invested in the company’s wholly-owned subsidiary, Subam Paper and Boards Private Limited, to finance its capital expenditure requirements. This investment will support the subsidiary’s expansion plans and nearly double its manufacturing capabilities.

Industry Outlook:

The paper and packaging industry in India is expected to grow at a CAGR of 26.7% from 2020 to 2025, driven by e-commerce growth, rising consumer demand, and supportive government policies.

Amber Box

Seasonality:

The paper and packaging industry can experience some degree of seasonality, with demand fluctuations depending on factors such as festive seasons, agricultural cycles, and economic conditions.

Capacity Utilization:

| Product | Installed Capacity (MTPD) | Annual Capacity (Tons) | Utilization (Tons) |

| Kraft Paper | 300 | 93,600 | 93,081 |

| Duplex Board | 140 | 47,200 | 43,963 |

Negative Operating Cash Flow:

The company has maintained a positive operating cash flow in FY 2022 and 2024 but experienced a negative operating cash flow in FY 2023.

Red Box

Limited Market Penetration:

Compared to larger, more established players in the paper and packaging industry, Subam Papers Limited has limited market penetration in certain regions and product segments.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).