Stanley Lifestyles Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Furniture |

| Sub-class | Luxury Furniture |

| Location | Bengaluru, Karnataka |

| Establishment Year | 2007 |

Management

| Managing Director | Sunil Suresh |

| Educational Qualifications | S.S.L.C examination from the Karnataka Secondary Education Examination Board. |

| Experience | 17 Years |

| Annual Salary | 193.2 Lakhs |

| Total Number of Employees | ~745 |

About

Stanley Lifestyles Limited is a prominent manufacturer and retailer of super-premium and luxury furniture in India. The company stands out in the market with its vertically integrated business model, which allows it to manage every stage of production, from sourcing raw materials to the final sale in its retail stores.

Step down Subsidiaries:

1. Sana Lifestyles Limited 2. Scheek Home Interiors Limited 3. Shrasta Decor Private Limited 4. Staras Seating Private Limited

Product portfolio:

Sofas: A diverse range of sofas, including modern power motion sofas, recliners, and sectionals.

Kitchen Cabinets: Custom-designed kitchen cabinets tailored to specific customer needs.

Beds: Various styles and designs of beds.

Mattresses and Pillows: Products designed to offer comfort and support for sleep.

Dining and Bedroom Furniture: A variety of tables, chairs, dressers, and other furniture pieces.

Contract Manufacturing: Primarily crafting leather automotive interiors for a major automobile company.

Stanley Lifestyles operates two manufacturing facilities, both located in Bengaluru, Karnataka.

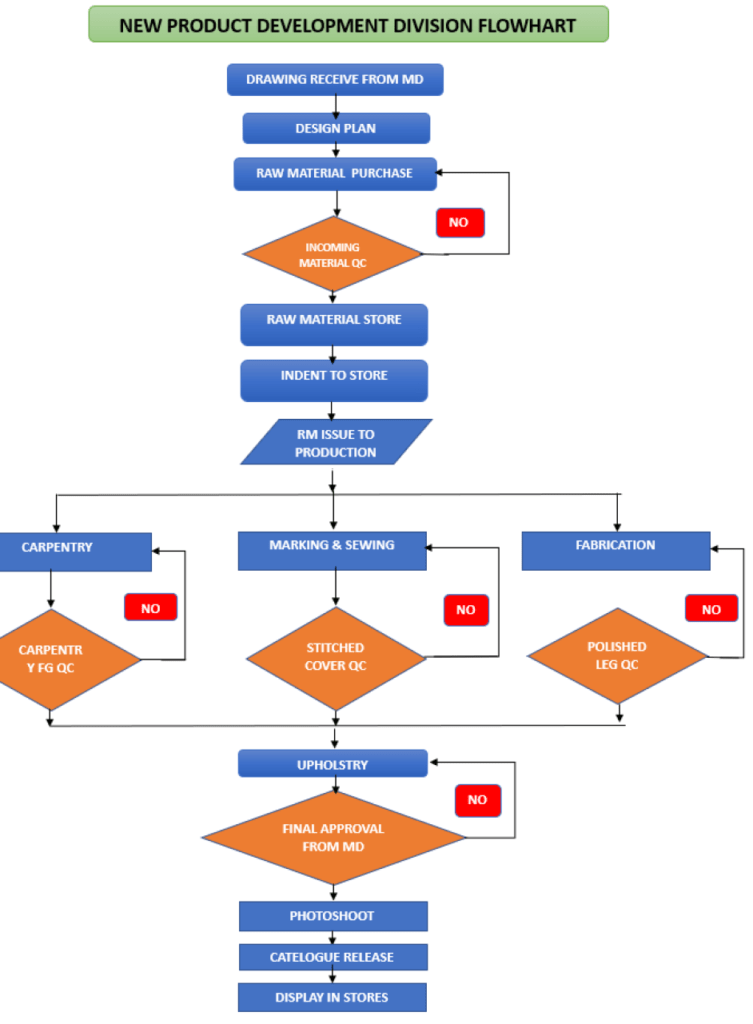

The manufacturing process includes:

Metal Work: Cutting, welding, grinding, and polishing metal components.

Carpentry: Crafting and assembling wooden frames and structures.

Leather Work: Marking, cutting, sewing, and stitching leather upholstery.

Raw Materials

Leather: The company imports premium-quality leather from environmentally responsible, green-certified tanneries in Europe.

Timber: Forest Stewardship Council (“FSC”) certified timber is sourced from reputable vendors in Southeast Asia.

Clients:

Retail Customers: Individuals seeking premium home furnishing solutions.

Hospitality Industry: Providing furniture for hotels, resorts, restaurants, and cafes.

Corporate Clients: Supplying furniture to offices and commercial spaces.

Real Estate Sector: Meeting the furnishing needs of residential and commercial properties developed by real estate companies.

Distribution Network:

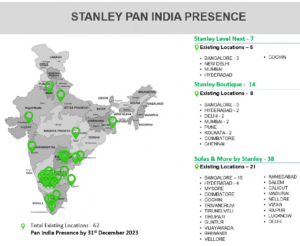

As of December 31, 2023, the company has 38 COCO stores and 24 FOFO stores

Company-Owned and Operated Stores (COCO): Stanley Lifestyles Limited primarily distributes its products through a network of company-owned and operated stores. This model gives the company direct control over the retail experience, ensuring brand consistency and customer service standards.

Franchisee-Owned and Operated Stores (FOFO): While the COCO model dominates, the company also utilizes a franchisee model to expand its reach. This approach allows for faster expansion, especially in new geographic markets. Stanley Lifestyles Limited carefully selects and vets its franchisees, providing training and support to maintain brand standards.

B2B Segment and Distribution Arrangements: The company is exploring opportunities to expand its presence in the business-to-business (B2B) segment. This could involve partnering with interior designers, architects, and other businesses to supply furniture for commercial projects.

Work Flow Chart

Revenue – Category

Revenue – Region

Audit and Legal

For the nine months that ended on December 31, 2023, the company’s sales to related parties represented 0.24% of the revenue from operations. In the same period, purchases from related parties represented 3.70% of the cost of goods sold.

The auditor did not audit the financial statements of some subsidiaries for periods ending December 31, 2023, and FYs 2021-23

Stanley Retail Limited and Sana Lifestyles Limited received letters from the Registrar of Companies (RoC) concerning inquiries about violations such as related party transactions without approvals, failure to constitute an internal complaints committee, erroneous reporting in financial statements, and delays in filing statutory forms.

Maternity Benefits Case Against Stanley Retail Limited: A former employee, filed a complaint alleging unlawful termination during her pregnancy to deny her maternity benefits. The Labour Officer and Inspector ordered Stanley Retail Limited to pay ₹3.74 million in compensation and medical bonus. The company has appealed the order, and the case is pending

Stanley Lifestyles Limited – Import Duty Bond Enforcement: The Assistant Commissioner of Customs issued an order demanding ₹3.80 million in import duty. The claim alleges Stanley Lifestyles Limited violated an EPCG license by not fulfilling export obligations. The company sought an extension on the license and is awaiting a decision

M/s Alif Enterprises & Ors. have filed suit against the Group for non-payment of rent, hoarding and other maintenance charges for the space allocated in ‘Atria Mall’. The Group has filed a counterclaim against M/s Alif Enterprises & Ors. for loss suffered due to the poor maintenance in ‘Atria Mall’.

Contingent Liabilities amount to 4.32 Cr, of which the Atria Mall Case involves 2.63 Cr

SWOT Analysis

Strengths

| Strong Brand Recognition: Stanley Lifestyles Limited is positioned as the largest and fastest-growing brand in India’s luxury and super-premium furniture market. |

| Wide Product Portfolio: The company offers a comprehensive range of home solutions, encompassing various furniture categories and price points, enabling it to cater to a broad customer base. |

| Pan-India Presence: With strategically located stores across India, Stanley Lifestyles Limited has established a strong retail footprint. |

| Vertically Integrated Operations: The company benefits from vertical integration in its manufacturing processes, allowing for greater quality control and potential cost advantages. |

Weaknesses

| Legal and Regulatory Challenges: The company and its subsidiaries are involved in several legal cases and claims, including those related to contracts, labour disputes, and taxation. |

| Legal and Regulatory Challenges: The company and its subsidiaries are involved in several legal cases and claims, including those related to contracts, labor disputes, and taxation. |

| Dependence on Third-Party Manufacturers: While vertically integrated to some extent, Stanley Lifestyles Limited relies on third-party vendors for certain product components, making it vulnerable to supply chain disruptions and potential quality control issues. |

| Dependence on Imported Leather: Relying on imported leather, while ensuring ethical and environmental standards, could expose the company to price fluctuations and currency exchange risks. |

| Geographic Concentration of Sales: A substantial portion of the company’s sales originates from stores located in southern regions of India. This concentration exposes the company to risks associated with events specific to these regions |

Opportunities

| Expanding Retail Presence: The company aims to increase its retail footprint both domestically and internationally, capitalizing on the “Stanley” brand appeal. |

| Growth in the Luxury Furniture Market: The luxury and super-premium furniture market is expected to grow, presenting opportunities for Stanley Lifestyles Limited to expand its customer base. |

| Increasing Brand Awareness: Stanley Lifestyles Limited plans to further enhance its brand visibility and reach through targeted marketing efforts. |

Threats

| Competition: The luxury and super-premium furniture market is highly competitive, with both domestic and international players vying for market share. |

| Economic Downturn: A decline in economic conditions could impact consumer spending on luxury goods, potentially affecting demand for the company’s products. |

| Raw Material Price Volatility: Fluctuations in the costs of key raw materials, such as wood and leather, could pressure the company’s profit margins. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| Stanley Lifestyles Limited operates in a niche market with high entry barriers due to the need for significant capital investment, brand building, and established distribution networks. |

| Bargaining Power of Suppliers | MODERATE |

| While the primary raw materials timber and leather are readily available in the market, the company imports them from specific regions for quality maintenance and those suppliers can have bargaining power. |

| Bargaining Power of Buyers | MODERATE |

| Stanley Lifestyles Limited targets the luxury and super-premium segments, where price sensitivity may be lower, consumer purchasing decisions are influenced by factors such as pricing, brand image, and customer service |

| Threat of Substitute Products or Services | MODERATE |

| Alternative furniture options exist at lower price points, Stanley Lifestyles Limited differentiates itself through its focus on design, quality, and brand image. |

| Rivalry Among Existing Competitors | HIGH |

| Stanley Lifestyles Limited needs to compete with both domestic and international brands vying for the market share. |

Peer Comparison

Stanley Lifestyles Limited does not have any listed industry peers that match the size and scale of its business operations, making direct comparisons difficult.

Strong Retail Presence: With a retail presence three times the size of its nearest competitor according to Red Seer Report, the company enjoys a significant advantage in reaching customers.

Comprehensive Home Solutions Provider: Unlike some competitors focused on specific categories or price points, Stanley Lifestyles Limited offers a comprehensive range of home furniture solutions, catering to a wider customer base.

Green Box

Investment in Subsidiaries for Store Expansion and Renovation: A significant portion of the IPO proceeds will be directed towards investments in subsidiaries. This investment will primarily fund the opening of new stores under the “Stanley Level Next,” “Stanley Boutique,” and “Sofas & More by Stanley” formats. Additionally, it will support the opening of strategically important “anchor stores”.

Industry Growth: The Indian furniture and home goods market is experiencing robust growth, driven by factors such as rising disposable incomes, urbanization, and evolving consumer preferences. The organized market segment, to which Stanley Lifestyles Limited belongs, is witnessing even faster growth compared to the traditional market. By Fiscal 2027, the organized market is projected to capture 35% of the total market share, expanding at an annual growth rate of 36%

Research and Development: The company demonstrates a strong emphasis on research and development (R&D), particularly in product design and innovation. With a dedicated product development division, the company consistently introduces new products in line with market trends and customer preferences. This commitment to R&D is evident in the introduction of 24 new products in FY 2021, 76 in FY 2022, 88 in FY 2023, and 71 during the 9M of FY 2024.

Strong Financial Performance: Stanley Lifestyles Limited exhibits a track record of consistent profitability and financial growth. The company has been profitable for the past 10 years.

Operating Cash Flow: Stanley Lifestyles Limited has maintained a positive net cash flow from operating activities over the past three years. The company recorded ₹32.98 Cr in Fiscal 2021, ₹28.52 Cr in Fiscal 2022, and ₹67.97 Cr in Fiscal 2023. For the 9M ending December 31, 2023, the company generated ₹12.57 Cr from operating activities

Targeted Advertising: The company employs a multi-faceted advertising approach, utilizing both traditional and digital media channels. Its advertisements appear in premium lifestyle magazines, home décor publications, and airline inflight magazines.

Amber Box

Current Capacity Utilization: For FY 2023, the manufacturing facility at Bommasandra (only Seating) reported a capacity utilization rate of 62.31%. While the capacity utilization for the Electronic City facility varied with the seating and beds division operating at 70.03% capacity, while the kitchen and cabinetry division at 20.33%

Red Box

Reliance on South India: A significant portion of Stanley’s sales comes from stores in southern India, making the company vulnerable to adverse developments in those regions.

Regulatory Risks and Corporate Governance: Stanley has faced multiple instances of non-compliance with regulatory filings, and corporate social responsibility (CSR) requirements, potentially leading to notices or penalties. Along with other major compliance issues and labour-related disputes as mentioned in the Audit and Legal section raise Concerns on the Company’s Governance.

Images

- For Porter’s Five Forces, force value of “LOW” is considered good. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).

This is exactly what I was looking for. Thanks for the useful information.