Sahasra Electronic Solutions Limited

Company

| Website 🔗 |  |

| Business Activity | Manufacture |

| Division | Electronics |

| Sub-class | Electronic system design and manufacturing (ESDM), Printed Circuit Board Assembly (PCBA), Box Build, LED Lighting |

| Location | Noida, Uttarpradesh Bhiwadi, Rajasthan |

| Establishment Year | 2021 |

Management

| Managing Director | Amrit Lal Manwani |

| Educational Qualifications | Bachelor of Technology in Electrical Engineering from IIT Kanpur Master of Business Administration from Delhi University |

| Experience | 20 years in the electronic manufacturing services industry. |

| Annual Salary | ₹ 175 Lakhs |

| Total Number of Employees | 160 |

About

Sahasra Electronic Solutions Limited (SESL) is an electronics manufacturing company specializing in designing and manufacturing electronic components and systems. The company offers a comprehensive suite of services, including Printed Circuit Board Assembly (PCBA), LED Lighting solutions, Memory products, and IT hardware. SESL serves a diverse clientele across various sectors, including automotive, medical, industrial, and consumer products, with a strong focus on exports.

Products and Services:

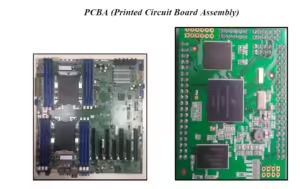

Printed Circuit Board Assemblies (PCBAs):

These are used in various electronic devices across different industries.

LED Lighting Solutions:

SESL provides LED lighting solutions for residential, commercial, and industrial applications.

Memory Products:

The company manufactures memory products such as DRAM modules, Solid State Drives (SSDs), and USB flash storage devices.

IT Hardware:

SESL produces IT hardware components, including motherboards, laptops, computers, tablets, and other accessories.

Clients:

SESL serves a diverse range of clients, including:

- Automotive Industry

- Medical Industry

- Industrial Sector

- IT Sector

- Consumer Products Industry

Manufacturing Process:

Material Receipt and Quality Inspection:

Incoming raw materials and components undergo rigorous quality checks to ensure they meet the company’s standards.

Solder Paste Application:

Solder paste is applied to the bare PCB through a stencil-based process.

Solder Paste Inspection:

The applied solder paste is inspected for proper alignment, coverage, and thickness.

SMD Component Placement:

Surface Mount Device (SMD) components are placed on the PCB using automated machines.

Pre-Reflow Inspection:

The PCB is inspected to ensure all components are correctly placed.

Reflow:

The PCB is passed through a reflow oven to solder the components to the board.

AOI (Automated Optical Inspection):

The soldered PCB is inspected for quality and component placement using automated optical inspection systems.

Inspection:

The final product undergoes a thorough inspection, including manual checks and X-ray inspection, to ensure it meets the required standards.

Packaging and Shipping:

The finished products are packaged and shipped according to customer specifications.

Raw Materials:

Electronic Components: Microcontrollers, ICs, resistors, capacitors, LEDs, and other semiconductors.

Wiring Harness

Plastic Parts

Sheet Metal Parts

Process Consumables

Suppliers:

NMTronics (India) Private Limited

Test & Research India Private Limited

Takaya CorporationTeradyne, Inc.

ETA International PTE Ltd

Electronic components, such as microcontrollers, ICs, resistors, capacitors, LEDs, and other semiconductors, are sourced directly from overseas manufacturers, primarily in the United States, China, and Taiwan, or through their authorized distributors. In some cases, SESL also obtains PCBs from its group company, Infopower Technology Private Limited.

Other raw materials, such as wire harnesses, plastic parts, and consumables, are procured from approved domestic vendors.

Other Key Aspects:

Research and Development:

Sahasra Electronic Solutions Limited (SESL) has a dedicated Research and Development (R&D) team. This team focuses on several key areas, including:

- Electronics hardware designing

- System architecture

- Mechanical design

- Component engineering

- Optics design

Quality Assurance and Certifications:

Sahasra Electronic Solutions Limited is an EN 9100:2018 certified company, demonstrating its commitment to maintaining high-quality standards in its manufacturing processes.

Business Process Flowchart

Revenue – Category

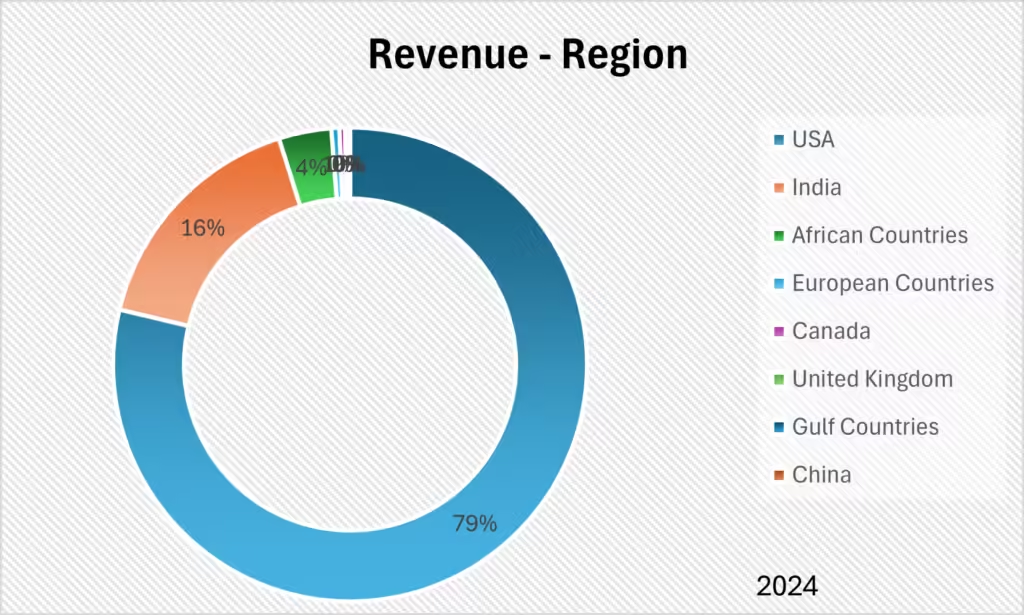

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors of Sahasra Electronic Solutions Limited have made the following remarks and qualifications in the Independent Auditor’s Report:

Emphasis of Matter

- The company has made provisions for employee benefits based on management estimates instead of actuarial valuations according to AS 15.

- Assets and liabilities of the erstwhile proprietorship firm, Sahasra Electronic Solutions, were transferred to the company on February 21, 2023, based on a succession agreement.

- Business activities from February 22, 2023, to March 31, 2023, were carried out by the proprietorship firm on behalf of the company due to approval from NSEZ in the next financial year.

- Long-term investments are yet to be transferred to the company’s name.

- Allotment of share capital was done in a board meeting held on April 26, 2023.

Related Party Transactions:

Sahasra Electronic Solutions Limited has entered into various transactions with its directors, promoters and group companies and they form a significant portion of its sales and purchases for FY 2024. These transactions, inter-alia include sales, purchases, remuneration, loans and advances, purchase, sales, rent expenses, reimbursement of expenses etc.

| Nature of transaction | Amount (₹ in lakhs) | Percentage of turnover |

| Sales | 6508.56 | 63.32% |

| Purchase | 1530.34 | 14.89% |

Non-Compliances and Other Issues:

Late Filing of GST Returns:

The company has incurred late fees and penalties for delayed filing of GST returns due to operational reasons.

Trademark Ownership:

The company does not own the trademark it uses for business purposes, which could lead to legal challenges in the future.

Contingent Liabilities:

As of March 31, 2024, the company’s total contingent liabilities amounted to ₹4,463.81 lakhs. These liabilities include claims against the company not acknowledged as debts, guarantees given on behalf of the company, and other commitments.

- Claims against the company not acknowledged as debts: ₹7.14 lakhs

- Guarantees given on behalf of the company: ₹3250 lakhs

- Other commitments: ₹1206.67 lakhs

Legal Cases:

Cases Filed Against the Company

M/s. APVM Electronics Pvt. Ltd. Vs. Sahasra Electronic Solutions Limited:

Complaint filed against Sahasra Electronic Solutions Limited by APVM Electronics Private Limited, alleging non-payment of dues amounting to ₹39.88 lakhs. The complaint was filed on August 30, 2024, before the Securities Exchange Board of India (SEBI). In response, SESL filed a response on September 11, 2024, acknowledging a due amount of ₹17.89 lakhs as of that date.

Cases Filed by the Company

Tax Proceedings against the Company:

SWOT Analysis

Strengths

| Dedicated solutions for ESDM services: The company offers a comprehensive suite of ESDM services, including PCB assembly, box build assembly, and design solutions, catering to diverse industries. |

| Established manufacturing capabilities: The company possesses advanced manufacturing facilities equipped with modern machinery and a skilled workforce, enabling efficient and high-quality production. |

| Quality assurance: The company is EN 9100:2018 certified, demonstrating its commitment to quality management systems and ensuring high product quality standards. |

Weaknesses

| Dependence on key customers: The company’s revenue is heavily reliant on a few key customers, including group companies, making it vulnerable to customer loss or changing procurement strategies. |

| Dependence on key products: The company is significantly dependent on the sale of PCBAs, which exposes it to risks associated with changes in demand or technological advancements in the PCBA market. |

| Limited operating history: The company has a limited operating history, making it difficult to assess its long-term financial performance and sustainability. |

| Working Capital Management: SESL’s business is working capital intensive, with inventories and trade receivables forming a major part of its current assets. Effective management of inventory and trade receivables is crucial for the company’s financial health. |

Opportunities

| Invest in expanding technological capabilities and manufacturing capacities: The company can continue to invest in advanced technology and expand its manufacturing capacity to improve operational efficiency, customer satisfaction, and profitability. |

| Increase geographical reach and expand customer base: The company can further expand its global reach and customer base by tapping into new international markets and leveraging its capabilities in the cost-effective manufacturing of high-quality products. |

| Diversification of product range: The company can leverage its R&D capabilities to further diversify its product portfolio and tap into new market segments with high growth potential. |

Threats

| Regulatory changes: Changes in government policies and regulations, particularly those related to SEZ benefits, export obligations, and environmental regulations, could adversely affect the company’s business operations and financial performance. |

| Technological advancements: Rapid technological advancements in the electronics industry could render the company’s products or processes obsolete, requiring continuous investments in R&D and innovation. |

| Supply chain disruptions: The company’s reliance on third-party suppliers for raw materials and components exposes it to supply chain disruptions, which could affect production and timely delivery of products. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The ESDM industry is experiencing high growth, attracting new players. However, significant capital investment and technical expertise are required, posing moderate barriers to entry. |

| Bargaining Power of Suppliers | MODERATE |

| Sahasra Electronic Solutions Limited relies on a mix of domestic and international suppliers for raw materials and components. The bargaining power of suppliers is moderate due to the availability of alternative suppliers and the company’s efforts to build strong relationships with key suppliers. |

| Bargaining Power of Buyers | MODERATE |

| The company serves diverse industries and geographies, reducing reliance on individual buyers. However, some buyers, particularly large businesses, may have moderate bargaining power due to their purchasing volumes. |

| Threat of Substitute Products or Services | MODERATE |

| The rapid pace of technological advancements in the electronics industry poses a moderate threat of substitute products, requiring continuous innovation and adaptation. |

| Rivalry Among Existing Competitors | MODERATE – HIGH |

| The ESDM industry is highly competitive, with the presence of established domestic and international players. SESL faces moderate to high competitive rivalry, requiring it to maintain its competitive edge through product quality, technology, cost, delivery, and service. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers for FY 2024 is as follows:

| Key Performance Indicator | Sahasra Electronic Solutions Limited | Kaynes Technology India Limited | Trident Techlabs Limited |

| Revenue from Operations (Rs. Crores) | 101.1 | 1804.6 | 72.6 |

| EBITDA Margin | 34.86% | 14.08% | 21.99% |

| PAT Margin | 32.26% | 10.16% | 12.90% |

| Return on Equity (ROE) | 54.09% | 10.63% | 28.32% |

| Return on Capital Employed (ROCE) | 42.50% | 10.20% | 24.26% |

| Debt to Equity Ratio | 0.36 | 0.13 | 0.41 |

Green Box

IPO Funds:

Funding capital expenditure for the installation of additional plant and machinery at a new manufacturing facility in Bhiwadi, Rajasthan. The new machinery will be used to manufacture a variety of electronic products, including PCB assemblies, LED lighting solutions, memory products, and IT hardware.

Investing in the company’s subsidiary, Sahasra Semiconductors Private Limited, to finance its capital expenditure requirements for the installation of additional plant and machinery.

Financial Performance:

Sahasra Electronic Solutions Limited has demonstrated strong financial performance in recent years, with a consistent increase in revenue and profitability. This positive trend, if sustained, can further fuel the company’s growth and expansion plans.

SESL has a strong export orientation, with over 80% of its revenue in Fiscal Year 2024 coming from exports to countries like the USA, Rwanda, Tunisia, and others.

Industry Outlook:

The National Policy on Electronics (NPE) 2019, even with its revised targets due to the pandemic, aims for a turnover of US$300 billion by 2025-26. This indicates a substantial potential market for SESL’s products and services.

Amber Box

Export Obligations:

To continue availing the benefits of being located in an SEZ, the company is required to meet certain export obligations. Failure to meet these obligations could result in the withdrawal of benefits and negatively impact the company’s financial condition.

Dependence on SEZ Benefits:

The company’s manufacturing facility is located in a Special Economic Zone (SEZ) in Noida, Uttar Pradesh, which allows it to avail of certain tax and other benefits. However, if the government decides to reduce or eliminate these benefits, it could adversely affect the company’s financial performance.

Unrealistic Growth in Revenue and Profit:

The company’s revenue and profit show an exceptional increase from 2022 to 2024. While growth is expected, the scale of this increase raises concerns about its sustainability.

Limited Operating History:

The company was incorporated in 2023 and has a limited operating history, making it difficult to assess its long-term financial performance and sustainability.

Capacity Utilization:

As of March 31, 2024, the current capacity utilization rate of Sahasra Electronic Solutions Limited’s manufacturing facility in Noida, Uttar Pradesh, is 55.00%.

Negative Operating Cash Flow:

The company’s subsidiary, Sahasra Semiconductor Private Limited, has negative cash flows from operating activities, indicating potential financial difficulties.

Red Box

Dependence on Related Party Transactions:

A significant portion of the company’s revenue comes from related party transactions, which raises questions about the company’s ability to generate revenue from independent sources. It is crucial to assess the fairness and transparency in those transactions on a regular basis.

Customer Concentration:

Sahasra Semiconductor Private Limited is heavily reliant on a few major customers, including group companies, for a significant portion of its revenue. In Fiscal Year 2024, the top ten customers accounted for 95.78% of total revenue.

Product Concentration:

SESL generates a significant portion of its revenue from the sale of PCBAs. In Fiscal Year 2024, PCBAs accounted for 87.18% of total revenue. This reliance on a single product category makes SESL vulnerable to market fluctuations, technological shifts, and changes in demand within the PCBA segment.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).