Positron Energy Limited

Company

| Logo Website 🔗 |  |

| Business Activity | 1.Services 2.Trade |

| Division | Oil and Gas |

| Sub-class | 1. Advisory services 2. Gas aggregation and sales |

| Location | Gandhinagar, Gujarat |

| Establishment Year | 2008 |

Management

| Managing Director | Mr. Rajiv Shankarankutty Menon |

| Educational Qualifications | Bachelor of Commerce (B.com) from Sardar Patel University, Gujarat |

| Experience | More than 15 years in Oil & Gas Industry |

| Annual Salary as % of Revenue | 0.4% |

| Total Number of Employees | 140 (67 Engineers, 24 Technicians) |

About

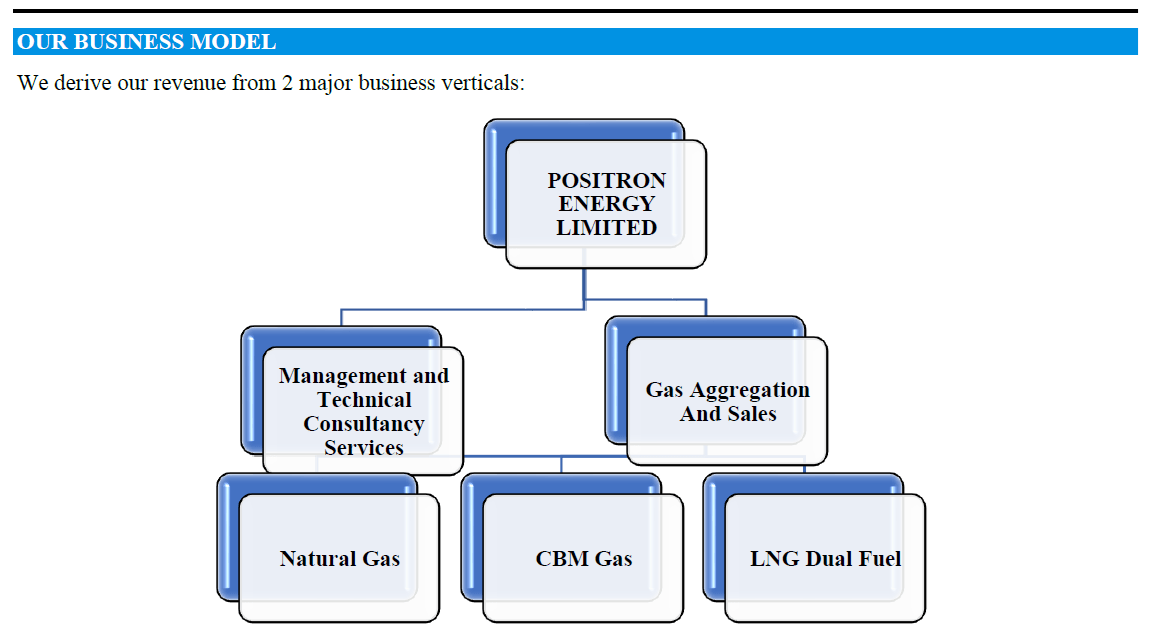

- Positron Energy Limited (PEL) is involved in two main business verticals:

- Management & Technical Advisory Services

- Gas Aggregation and Sales

- Management Consultancy

- Regulatory studies, advisory, and liaisoning services, assisting clients in understanding and complying with regulations related to City Gas Distribution (CGD) in India

- Technical feasibility studies and reports, such as demand assessment studies for geographical areas and clusters, SWOT and gap analyses, technical due diligence studies, project tendering and independent tender evaluation, and assistance with third-party audits and certifications

- Commercial feasibility studies and reports, including pre-feasibility and detailed feasibility studies, preparation of bankable feasibility reports for regulatory and banking submissions, and validation of feasibility studies

- Technical Services

- Project management consultation (PMC) for CGD and Oil and Gas projects

- PMC execution for steel pipeline networks, PE networking, CNG stations, construction methodology development, procedure guidance, network hydraulic studies, and design according to PNGRB guidelines

- Gas Aggregation and Sales: Positron Energy Limited sources different types of gases from various suppliers and sells it to industrial customers across India. Their core business revolves around the strategic sourcing and marketing of natural gas, Coal Bed Methane (CBM) gas and Regasified Liquefied Natural Gas (R-LNG).

- Positron Energy Limited (PEL) has a collaboration agreement with ICOM North America LLC (New Hudson, MI). The agreement is for the installation of ICOM Dual Fuel LNG conversion systems in on-road trucks weighing over 3.5 tons in India. This new system aims to reduce emissions through the utilization of LNG, contributing to environmental sustainability.

- Our ‘Gas on Wheel’ solution stands as a pioneering initiative in providing innovative and efficient solutions for the monetization of stranded gas from isolated fields. This unique approach caters to industries, commercial clusters, and geographically remote areas where pipeline connectivity is a challenge.

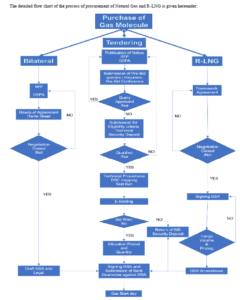

- Active Tendering Process: Positron Energy Limited actively participates in tendering processes to secure natural gas at competitive rates. This involves engaging with major private Oil and Gas companies through both tendering and bilateral agreements for Gas Sale and Purchase Agreements (GSPA).

- Formula-Linked Pricing: To mitigate market risks associated with fluctuating gas prices, the company utilizes formula-linked pricing. This pricing model aligns with the Crude Index and is adjusted monthly, providing stability and transparency for both PEL and its customers.

- Gas Transportation Agreements: Once gas purchase agreements are finalized, the company secures Gas Transportation Agreements (GTA) with pipeline network operators. This ensures efficient and reliable transportation of the gas to customer locations.

- Long-Term Contracts: The company primarily engages in long-term contracts with its customers for the sale of natural gas. These contracts are established based on mutually agreed-upon formulas, ensuring long-term supply stability and predictable pricing structures.

Work Flow Chart

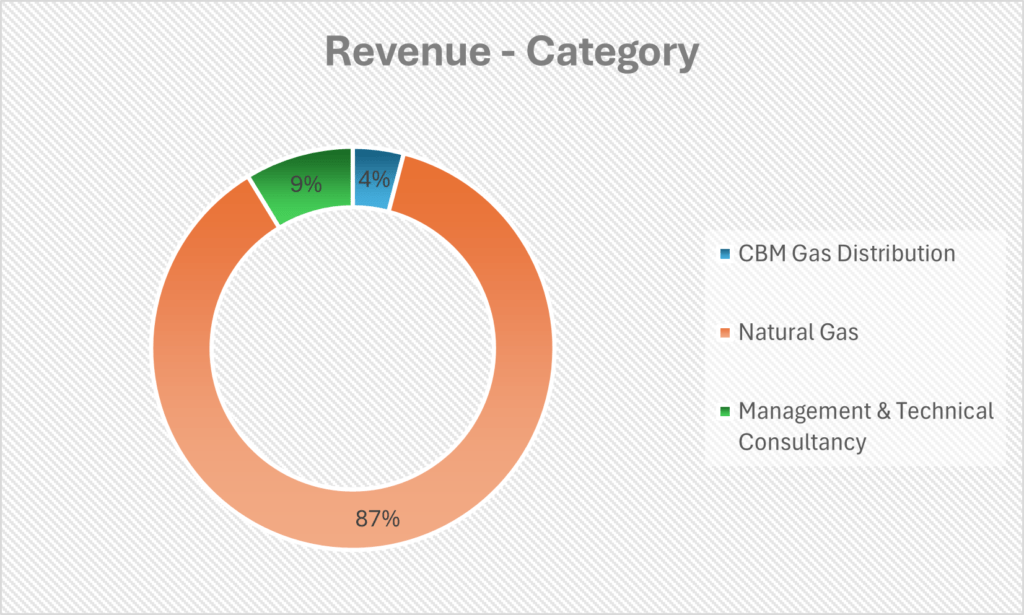

Revenue – Category

Revenue – Region

Audit and Legal

- The auditors highlight that there were no qualifications in the audit reports issued by the statutory auditors for the past few years.

- Positron Energy Limited has been fined for previous delays in filing its Goods and Services Tax (GST) and Employee Provident Fund (EPF) returns.

- The company’s gas supply agreements (GSAs) and gas transportation agreements (GTAs) include “Take or Pay” clauses. These clauses mean that the company must either accept the agreed-upon quantity of natural gas or pay for the gas even if they don’t take delivery.

- Unregistered Logo: The company has not registered its corporate logo, raising concerns about the company’s ability to protect its brand

SWOT Analysis

Strengths

| Experienced Leadership and Execution Team: The company has been operating since 2008 and has served 9 of the top 10 oil and gas companies in India. |

| Diversified Portfolio for Future Growth: Positron Energy Limited offers a wide array of services, including gas aggregation and sales, management consultancy, technical services, and project management. |

| Strong Customer Relationships: The company has a proven track record of working with major government PSU entities and private companies in the oil and gas sector. |

| Adaptability to Changing Gas Pricing Landscape: Positron Energy Limited’s business model is designed to adapt to the fluctuating gas pricing landscape in India. |

Weaknesses

| PEL seems to have poor bargaining power with both buyers and suppliers due to a concentrated base. Very few buyers and suppliers contribute to significant portion of their revenues and costs respectively. |

| Company lacks diversity: it has revenues concentrated both in category (Natural Gas – 87%) and region (Gujarat, Karnataka, Andhrapradesh – 82%) |

Opportunities

| Growing Demand for Gas in India: India’s demand for natural gas is projected to increase, presenting growth opportunities for companies involved in gas distribution and related services. |

| Increasing Focus on Clean Energy: The global shift towards cleaner energy sources, including natural gas, presents opportunities for companies like Positron Energy Limited involved in gas distribution and management. |

Threats

| Competition in the Oil and Gas Sector: The Indian oil and gas sector is competitive, with both public and private players and Multinational companies with a global reach. |

| Changes in Government Policies and Regulations: The oil and gas industry is subject to government policies and regulations. Any adverse changes could negatively impact Positron Energy Limited’s business. |

Porter’s Five Forces

| Threat of New Entrants | MODERATE – HIGH |

| The entry barriers are not strong. |

| Bargaining Power of Suppliers | HIGH |

| Top 1 supplier contributed 83% to company purchases, making them heavily dependent on one supplier and resulting in a huge bargaining power of supplier. |

| Bargaining Power of Buyers | HIGH |

| Top 3 buyers contributed 66% of total revenue for the latest period, suggesting that the buyers are few and significant, increasing their bargaining power. |

| Threat of Substitute Products or Services | MODERATE |

| Oil and gas industry face threat of substitution from other sources of energy like Solar power for industries and electric batteries for vehicles. |

| Rivalry Among Existing Competitors | HIGH |

| Positron Energy competes with small and big companies, PSUs and other MNCs |

Peer Comparison

- PEL states that there are no listed companies with a comparable size, industry, or business model, which makes direct comparison challenging

Green Box

- The company strategically shifted towards gas aggregation in FY 2018-19, supplying Coal Bed Methane (CBM) gas to industrial units. Recognizing the growing demand, the company further expanded into Natural Gas aggregation in 2022

- Positron Energy Limited’s competitive advantages include its customized solutions, adaptability to changing gas prices, alignment with government reforms, diversified portfolio, and experienced leadership.

- Indian Government is planning to double its oil refining capacity to 450-500 million tonnes by 2030. This ambitious target signifies a commitment to bolstering the oil and gas sector, presenting potential growth opportunities for companies operating within this industry.

- As per recent GOI declarations, in India, the share of natural gas in the energy basket is 6.7%. The Government has set a target to raise the share of natural gas in the energy mix to 15% in 2030, which aligns with the Company’s shift towards natural gas recently.

- Operating Cash Flow: OCF turned positive in the last couple of years, which was negative before that. But both the Trade Receivables and Trade Payables have increased significantly in the last year.

- Debt to Equity ratio (D/E) and Debt service coverage ratio(DSCR) have improved in the last year. D/E has come down from 1.31 to 0.69 and DSCR increased from 5.63 to 13.96

Amber Box

- Dependence on Government Policies: The company acknowledges its reliance on government policies, particularly in the energy sector. For instance, the pricing and allocation of natural gas, a core component of the company’s business, are subject to government regulations. Any adverse changes in these policies, such as restrictions on selling margins or shifts in allocation criteria, could significantly impact the company’s revenue and operations.

- Influence of Major Players: Positron Energy Limited operates in a market with dominant players, such as large Oil Marketing Companies (OMCs). These OMCs could potentially influence government policy decisions in their favour, posing a risk to the company’s growth prospects.

- Varying VAT Regimes: The company highlights challenges arising from differing Value Added Tax (VAT) rates across Indian states. This variation complicates the company’s efforts to optimize end-user gas prices while maintaining profitability in all its operational regions. Despite meticulous VAT application in pricing strategies, the company acknowledges the possibility of incurring losses in some states due to price fluctuations

Red Box

- Evolving Regulatory Landscape: The Oil and Gas industry in India is characterized by an evolving regulatory framework. The government’s recent establishment of the ‘Kirit Parikh Committee’ to recommend a fair pricing mechanism for natural gas exemplifies this dynamic environment. The committee’s recommendations could lead to price fluctuations, impacting the company’s profitability and business operations

- Group Companies of Positron Energy Limited namely, Positron Gas Limited, Positron Venture Private Limited, and Sairama Infraenergy Private Limited are also engaged in similar business and all of the Company directors are also directors on the boards of all Group Companies.

- As a result, conflicts of interest may arise in allocating business opportunities among the Companies.

- Further, the Company has not entered into separate non-compete agreements to avoid the conflict of interest with the Group Companies

- Contingent Liabilities: The company has 16.4 Cr contingent liabilities which are almost entirely comprised of Guarantees (Including Guarantees given for the director’s loan)

Images

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided in this website (StocKernel.com).