Platinum Industries Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Speciality Chemicals |

| Sub-class | PVC Stabilizer |

| Location | Palghar, Maharashtra |

| Establishment Year | 2016 |

Management

| Managing Director | Krishna Dushyant Rana |

| Educational Qualifications | Bachelor’s degree in commerce from Mumbai University |

| Experience | Over 17 years in the chemical industry |

| Annual Salary | 241 Lakhs |

| Total Number of Employees | 97 |

About

Overview:

Platinum Industries Limited is a multi-product speciality chemicals company specializing in manufacturing stabilizers. Its primary business segments encompass PVC stabilizers, CPVC additives, and lubricants. They are the third largest PVC stabilizer manufacturer in India, holding a 13% market share as of 2022-2023.

Manufacturing Facilities:

As of March 31, 2023, the company operates from one manufacturing facility located in Palghar Maharashtra. This facility spans 7,400 square meters.

Products:

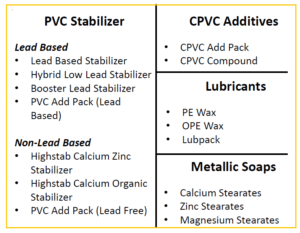

Platinum Industries Limited offers a diverse product portfolio, which includes:

Lead-Based Stabilizers: Lead-based stabilizers, hybrid/low lead stabilizers, booster lead stabilizers, and PVC add packs (lead-based and lead-free).

Non-Lead Based Stabilizers: Highstab calcium zinc stabilizers, Highstab calcium organic stabilizers, PVC add packs, and CPVC add packs.

Other Products: CPVC compounds, PE wax, OPE wax, Lubpack, calcium stearates, zinc stearates, and magnesium stearates

Applications:

These products find applications across various industries and product segments, including PVC Pipes, PVC Profiles, PVC Fittings, Electrical Wires and Cables, SPC Floor Tiles, Rigid PVC Foam Boards, and Packaging Materials.

Raw Materials:

Platinum Industries Limited uses various raw materials in its manufacturing process. Some key raw materials include stearic acid, litharge, and PE (Polyethylene) waxes. The company sources its raw materials from various suppliers in and around Maharashtra, India. It also imports raw materials such as stearic acid, polyethylene wax lumps and flakes, titanium dioxide, chlorinated polyethylene, and CPVC resin from Indonesia, Japan, China, Germany, and the USA.

Clients:

Platinum Industries Limited primarily operates on a business-to-business (B2B) model. Its clients are mainly from various application industries, including the pipes and tubes industry. The company also has a distribution network of 12 distributors across India to cater to non-B2B customers. The company exports its products to 30 countries.

Key Strategies:

Expanding Manufacturing Capacity: The company has plans to enhance its production capabilities to meet increasing demand.

New Product Development: Continuous focus on research and development to introduce new and innovative products.

Strengthening Distribution Network: Expanding its reach by adding more distributors, particularly in untapped regions.

Increasing Export Sales: Actively seeking opportunities to grow its presence in international markets.

Strategic Partnerships: Exploring collaborations and partnerships to enhance technological capabilities and market access

Technical Collaborations: The company has entered into a Technical Collaboration Agreement with HMS Concept E.U. (HMS), an Austrian company, to bolster its technical expertise in the field of stabilizer manufacturing

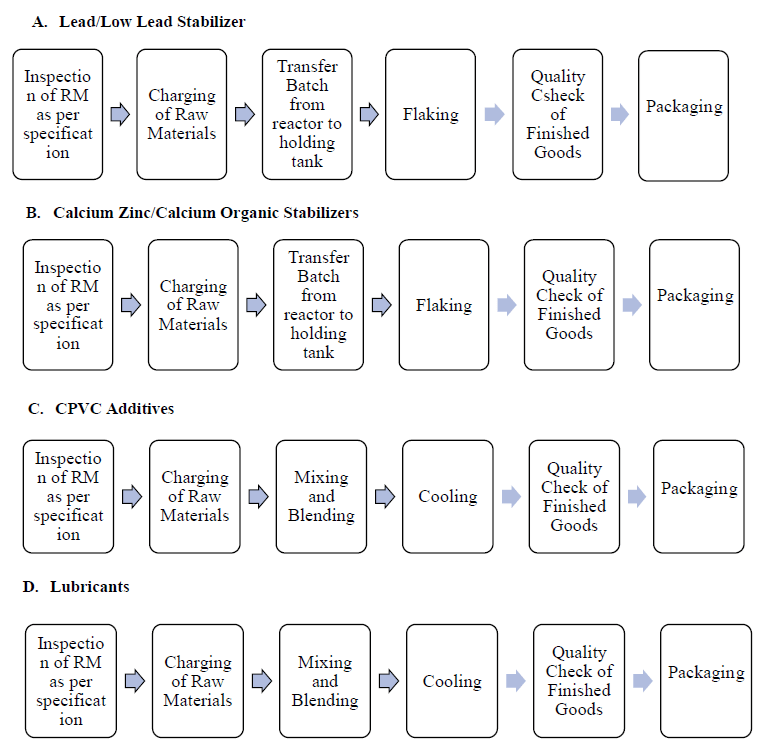

Work Flow Chart

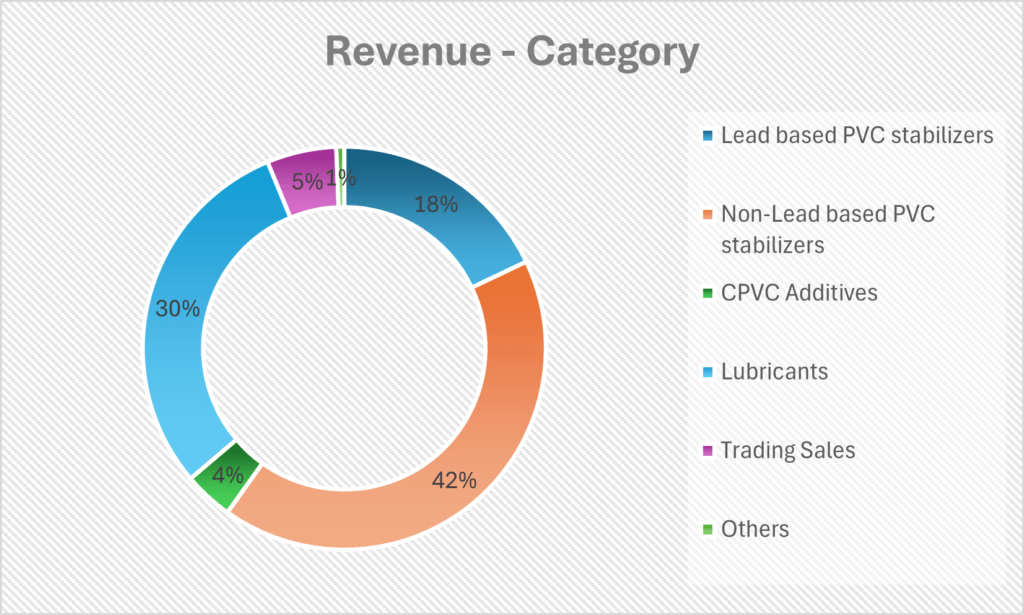

Revenue – Category

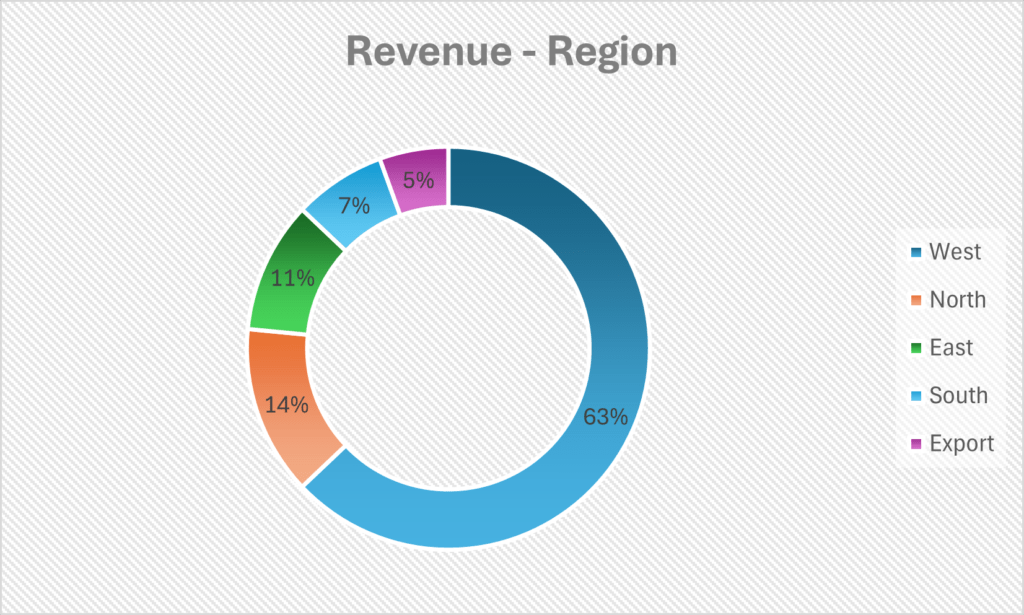

Number of Centers – Region

Audit and Legal

Civil Suit against Promoter: In the past, a civil suit was filed against Krishna Dushyant Rana, the company’s promoter, by Cipla Limited, for recovery of an amount of ₹3.25 Crore concerning the goods sold, supplied and delivered by Cipla Limited leading to a three-month detention sentence. Although this event occurred before the company’s incorporation, it merits attention as it directly involves a key promoter.

Contingent Liabilities:

As of September 30, 2023, the total contingent liabilities amounted to ₹4.32 Crore primarily related to bank guarantees.

SWOT Analysis

Strengths

| Consistent financial performance |

| Research & Development, and Sustainability |

| Diverse product portfolio catering to various industries |

| Significant entry barriers within the speciality chemical industry |

Weaknesses

| Dependence on third-party suppliers |

| Reliance on a limited number of customers. Top 3 customers contribute 75% of revenue. |

Opportunities

| Growth in the PVC market |

| Expansion into new product lines |

| Increasing demand for eco-friendly products. |

Threats

| Competition from domestic and international players |

| Volatility in raw material prices and availability |

| Compliance with environmental regulations and potential changes in those regulations |

Porter’s Five Forces1

| Threat of New Entrants | LOW – MODERATE |

| The specialty chemical industry has high entry barriers, which reduces the threat of new entrants. This is due to the specialized knowledge, technology, and regulatory requirements needed to operate in the market. |

| Bargaining Power of Suppliers | MODERATE |

| Platinum Industries sources raw materials from multiple suppliers. However, the specialized nature of some chemicals and the need to import them could give certain suppliers leverage. |

| Bargaining Power of Buyers | MODERATE – HIGH |

| Platinum Industries relies on a limited number of customers and distributors for its revenue. This suggests that buyers hold a degree of bargaining power. |

| Threat of Substitute Products or Services | LOW – MODERATE |

| The specialized nature of chemicals and additives offered by Platinum Industries means substitutes may not be readily available. However, innovation in alternative materials or chemical formulations could pose a threat over time. |

| Rivalry Among Existing Competitors | MODERATE – HIGH |

| PVC stabilizer market in India is highly fragmented with Platinum Industries holding a 13% market share, ranking as the third-largest player. |

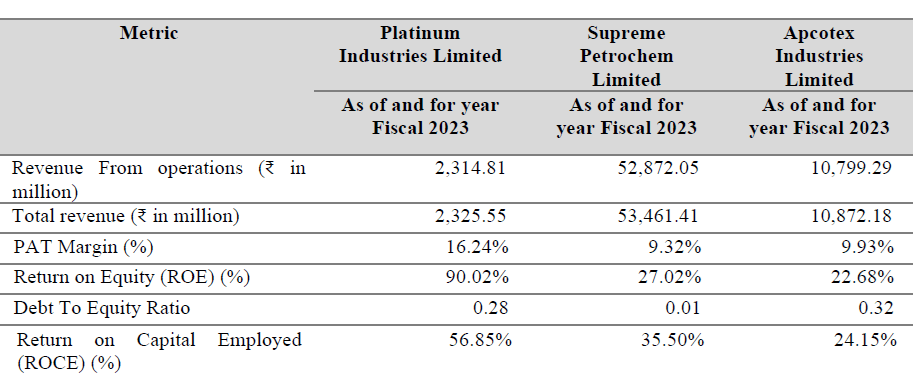

Peer Comparison

There are no listed companies that exclusively undertake the manufacturing of PVC stabilizers and CPVC additives. Hence, a proxy set of listed peers Supreme Petrochem Ltd and Apcotex Industries Ltd are considered.

Green Box

Investment in Subsidiary (Platinum Stabilizers Egypt LLC):

The Company is setting up a new facility in Egypt to produce PVC stabilizers and CPVC additives, with a capacity of 30,000 tonnes per annum, operational by Q2 FY2025-26. Located near the Suez Canal, it will enhance market access in the Middle East and North Africa.

Domestic Capacity Expansion: The company also aims to establish a manufacturing facility at Palghar, Maharashtra, India (Proposed Facility 2) with capacity of 60,000 MTPA. It will expand non-lead-based stabilizer capacity, and the first phase is expected to be operational by Q4 FY2024-25.

Technical Collaboration:

Platinum Industries also benefits from a technical collaboration with Dr. Horst Michael Schiller, a renowned scientist with extensive experience in the PVC industry

The success of R&D:

The company’s commitment to R&D has resulted in the introduction of new product categories, including low lead-based stabilizers, calcium zinc-based stabilizers, and organic-based stabilizers. Platinum Industries continuously strives to meet evolving market demands and customer needs through its R&D efforts

Amber Box

As of March 31, 2023, the facility’s estimated installed production capacity and utilization were low averaging around 25% for various chemical categories, which is very low. While it provides an opportunity to quickly increase production when required until then under-utilization will adversely affect the profit margins.

| Product Category | Capacity Utilization |

| Lead-Based Stabilizers | 27.70% |

| Non-Lead Stabilizers | 25.64% |

| CPVC Additives | 12.48% |

| Lubricants | 21.49% |

Industry Outlook: The PVC stabilizers market, both globally and in India, is expected to grow steadily. The global market is estimated to grow at a CAGR of 4% by volume from 2022 to 2027, while the Indian market is projected to grow at a CAGR of 7% by volume during the same period.

Red Box

Operating Cash Flow:

Platinum Industries has experienced negative operating cash flow in FY 2022. While the company has shown significant revenue growth and improved profitability, negative cash flows can pose challenges to operational flexibility and the execution of growth plans.

Concentration Risk:

Platinum Industries generates a significant portion of its revenue from a small number of customers. This concentration exposes the company to significant risk if a key customer reduces orders, experiences financial difficulties, or switches to a competitor.

Ambitious Growth Strategy:

Platinum Industries has ambitious plans to expand its manufacturing capacity and geographic reach, particularly in Egypt and other new regions. While these initiatives offer significant growth potential, they also carry substantial execution risks. Expanding into new geographic regions, like the MENA region, presents numerous challenges, including unfamiliarity with culture, local market dynamics, regulations, and competition.

Images

- For Porter’s Five Forces, the force value of “LOW” is considered good. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).