Paramount Dye Tec Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Synthetic fibres and yarns |

| Sub-class | Recycling of waste synthetic fibres |

| Location | Ludhiana, Punjab |

| Establishment Year | 2014 |

Management

| Managing Director | Mr. Kunal Arora |

| Educational Qualifications | Bachelor of Business Administration |

| Experience | Over 10 years |

| Annual Salary | ₹ 60 Lakhs |

| Total Number of Employees | 37 |

About

Paramount Dye Tec Limited is an Indian manufacturing company that specializes in producing synthetic yarns from recycled waste synthetic fibres. It caters to the B2B segment of the textile industry.

Products and Services:

Paramount Dye Tec Limited offers a diverse range of products, including synthetic fibre and yarns. Their primary product is synthetic yarn, produced from recycled synthetic waste fibre. The company offers various types of yarns, including acrylic yarn, polyester yarn, wool yarn, hand-knitting yarn, and acrylic blend yarn. These yarns are used in various textile applications, such as winter wear, thermal wear, and other apparel.

Clients:

Paramount Dye Tec Limited primarily caters to the B2B segment of the textile industry. Their clients include SME manufacturers who use their yarn to produce a variety of products, such as gloves, mufflers, and thermal wear.

Manufacturing Process:

Paramount Dye Tec Limited’s work process involves the recycling of waste synthetic fibres to produce high-quality yarn. The process begins with the procurement of waste synthetic fibres, which are then sorted, cleaned, and processed using specialized machinery. The processed fibres are then used to manufacture different types of yarns, which are subsequently sold to their B2B clients.

Raw Materials:

The primary raw material used by Paramount Dye Tec Limited is waste synthetic fibres. These fibres are sourced both locally and internationally. The company also purchases other necessary materials and services for its manufacturing process, such as chemicals, dyes, and packaging materials.

Suppliers:

The company sources its waste synthetic fibres from various local and international suppliers. The top ten suppliers contribute a significant portion of the company’s total purchases.

Other Key Aspects:

The company is an ISO 9001:2015 and Good Manufacturing Practice (GMP) certified organization.

The company is committed to sustainability and uses recycled waste as its primary raw material.

The company has a strong focus on research and development to improve its products and processes.

Manufacturing Process Flowchart

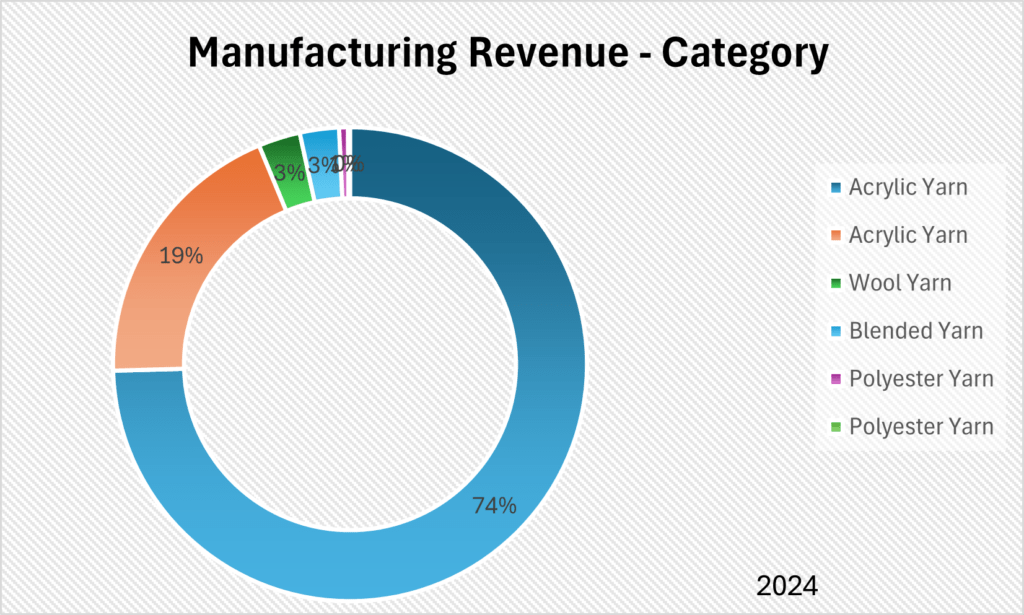

Revenue – Category

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors have issued an unqualified opinion on the company’s financial statements

Non-Compliances and Other Issues:

The company has been in non-compliance with certain provisions of the Companies Act, 2013, for which an application for adjudication has been filed with the RoC. The company also has certain discrepancies and errors in some of its corporate records relating to forms filed with the RoC and other provisions of the Companies Act, 2013.

Contingent Liabilities:

The company has contingent liabilities amounting to ₹0.32 Lakhs as of March 31, 2024, in relation to Income Tax demand/notices before CIT appeals/TDS.

Legal Cases:

Cases Filed Against the Company

Cases Filed by the Company

Tax Proceedings against the Company:

- Direct Tax (TDS): 1 case involving ₹0.32 Lakhs

- Income Tax (Outstanding Demand): 3 cases involving ₹6,95,908

- Income Tax (E Proceedings): 2 cases with an Unascertainable amount involved

SWOT Analysis

Strengths

| Use of recycled synthetic waste as raw materials: The company’s use of recycled waste as a raw material provides a sustainable and cost-effective alternative to virgin fibres. |

| Margin benefits: The company enjoys significant margin benefits due to its cost-efficient production methods. |

| Custom solutions: The company offers customized yarn solutions to meet specific customer requirements, providing flexibility and versatility. |

| Quality assurance: The company’s ISO 9001:2015 and GMP certifications ensure high standards of quality and performance for its products. |

| Simplified supply chain: The company’s ability to manufacture both fibre and yarn simplifies the supply chain for its clients, offering a one-stop solution. |

Weaknesses

| Dependence on a single business segment: The company’s reliance on a single business segment, the manufacturing of fibre and yarn, exposes it to risks associated with that specific market. |

| Dependence on a few suppliers: The company’s reliance on a small number of suppliers for its raw materials creates a potential vulnerability in its supply chain. |

| Geographical concentration: The company’s business is concentrated in one state, Punjab, increasing its exposure to regional economic and market fluctuations. |

| Customer concentration: The company derives a significant portion of its revenue from a small number of customers, increasing its dependence on those specific clients. |

Opportunities

| Expanding into new markets: The company can explore new geographical markets and industry segments to expand its customer base and reduce its dependence on a few key customers. |

| Product diversification: The company can diversify its product portfolio to reduce its reliance on a single business segment and cater to a wider range of customer needs. |

| Strategic partnerships and collaborations: The company can form strategic alliances and collaborations to expand its market reach, access new technologies, and enhance its product development capabilities. |

Threats

| Intense competition: The textile industry is highly competitive, with the presence of numerous domestic and international players. |

| Raw material price fluctuations: The prices of raw materials are subject to volatility, which can impact the company’s profitability. |

| Regulatory and trade barriers: Changes in trade policies, tariffs, and regulatory requirements can affect the company’s operations and profitability. |

| Environmental regulations: Stricter environmental regulations could increase compliance costs and impact the company’s operations. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The textile industry requires significant capital investment and technical expertise, creating barriers to entry for new players. However, the presence of numerous small-scale manufacturers implies a moderate level of threat. |

| Bargaining Power of Suppliers | LOW |

| The company’s reliance on a few suppliers could give those suppliers some bargaining power. However, the availability of alternative suppliers, both domestically and internationally, and raw materials being waste synthetic fibres could mitigate this power. |

| Bargaining Power of Buyers | MODERATE |

| The company’s focus on the B2B segment and the presence of large buyers could give those buyers some bargaining power. However, the company’s ability to offer customized solutions and competitive pricing could moderate this power. |

| Threat of Substitute Products or Services | MODERATE |

| The availability of substitute products, such as natural fibres like wool, cotton, and silk, poses a moderate threat. However, the unique properties and cost-effectiveness of synthetic fibres could limit the impact of these substitutes. |

| Rivalry Among Existing Competitors | HIGH |

| The textile industry is highly competitive, with the presence of numerous domestic and international players. The intensity of rivalry is further fueled by factors such as price competition, product differentiation, and technological advancements. |

Peer Comparison

Since the company has only 3 months of data, it is difficult to provide any comparison.

Green Box

The company plans to set up an additional manufacturing facility at Village Koom Khurd, Ludhiana, Punjab. This expansion is aimed at increasing the company’s production capacity and catering to the growing demand for its products.

Paramount Dye Tec Limited has a strong focus on research and development (R&D) to improve its products and processes. The company has developed advanced technology to recycle pre-consumer waste into premium yarn and fibre, demonstrating its commitment to innovation and sustainability.

Sustainable business model:

The company’s focus on using recycled waste as raw material aligns with the growing demand for sustainable and eco-friendly products.

IPO Funds:

The objects of the company’s upcoming issue of shares are primarily to raise funds for the following purposes:

- Setting up a manufacturing unit: ₹ 1,600.00 Lakhs

- Repayment/prepayment of certain debt facilities: ₹ 450.00 Lakhs

- Expenses towards the registry of land purchased from the promoter: ₹ 100.00 Lakhs

Industry Outlook:

The Indian textiles industry is expected to grow significantly in the coming years, driven by strong domestic consumption and export demand. The government’s support and various initiatives are further expected to boost the industry’s growth.

Amber Box

Dependence on a single business segment:

The company’s reliance on the manufacturing of fibre and yarn exposes it to risks associated with that specific market.

Capacity Utilization:

The current capacity utilization rate of the company’s fibre manufacturing plant is 100%, while the capacity utilization rate of the spinning plant is 95%.

Negative Operating Cash Flow:

The company has maintained a positive operating cash flow in the current period and for the financial year ended March 31, 2023. However, the company had negative operating cash flows for the financial years ended March 31, 2022, and March 31, 2021.

Red Box

Geographical concentration:

The company’s business is concentrated in one state, Punjab, increasing its exposure to regional economic and market fluctuations.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).