NTPC Green Energy Limited

Company

| Website 🔗 |  |

| Business Activity | Infrastructure |

| Division | Renewable Energy |

| Sub-class | Generation, transmission, and distribution – solar and wind power plants |

| Location | Neemrana, Bhadla, Fatehgarh in Rajasthan, Bilhaur in Uttar Pradesh |

| Establishment Year | 2022 |

Management

| Managing Director | Gurdeep Singh |

| Educational Qualifications | BSc in Mechanical Engineering from Kurukshetra University, Management education program from IIM Ahmedabad |

| Experience | Over 37 years |

| Annual Salary | Not Available |

| Total Number of Employees | 234 |

About

NTPC Green Energy Limited (NGEL) is the largest renewable energy public sector enterprise in India (excluding hydro). It develops and operates solar and wind power plants across various states, with a focus on utility-scale projects, PSUs, and Indian corporations.

Products and Services:

Solar Power:

The Company generates solar power through its network of solar power plants.

Wind Power:

The Company generates wind power through its wind power plants.

Consultancy and Project Management:

The Company provides consultancy and project management services in the field of renewable energy.

Clients:

The company’s clientele comprises:

- Government Agencies: Such as the Solar Energy Corporation of India (SECI).

- State Government Agencies.

- Public Sector Undertakings (PSUs).

- Indian Corporates.

Work Process:

Project Development:

This includes identifying potential project sites, conducting feasibility studies, obtaining regulatory approvals, and securing financing.

Land Procurement:

The company acquires or leases land for its renewable energy projects.

Engineering, Procurement, and Construction (EPC):

The company engages in the engineering, procurement, and construction of solar and wind power plants.

Operations and Maintenance (O&M):

The company operates and maintains its renewable energy projects to ensure optimal performance and longevity.

Raw Materials:

The company purchases a variety of equipment, components, and materials for its renewable energy projects, including:

- Solar Modules.

- Inverters.

- Wind Turbine Generators (WTGs).

- Cables.

- Mounting Structures.

- Trackers.

- Transmission Lines.

- Power Evacuation Systems.

Suppliers:

The company sources its equipment, components, and materials from various domestic and international suppliers. It has a rigorous vendor empanelment process to ensure quality and reliability. By value, 11% of raw materials are imported from China, and the rest are procured within India.

Operations and Maintenance:

Operations and Maintenance services for renewable energy projects are provided through third-party service providers which include

- Robotic dry cleaning of photovoltaic arrays;

- Drone photovoltaic thermography;

- SCB thermography;

- Live dashboards for generation performance monitoring on our plant information server;

- Mechanized module washing and vegetation removal;

- CCTV Surveillance for plant security; and

- Module and string level I-V tracing.

Other Key Aspects:

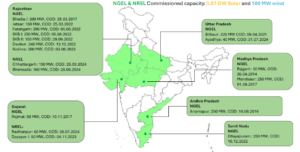

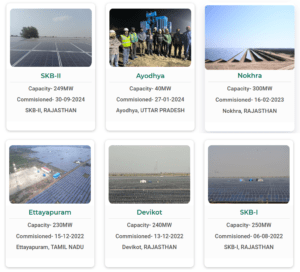

NTPC Green Energy Limited’s operational capacity was 3,071 MW of solar projects and 100 MW of wind projects across six (6) states as of August 31, 2024.

As of June 30, 2024, NTPC Green Energy Limited’s “Portfolio” consisted of 14,696 MW, including 2,925 MW of operating projects and 11,771 MW of contracted and awarded projects.

New Green Energy Solutions:

Current initiatives in green hydrogen and green chemicals include the development of a green hydrogen hub at Pudimadaka and finalizing a tie-up for electrolysers.

Revenue – Category

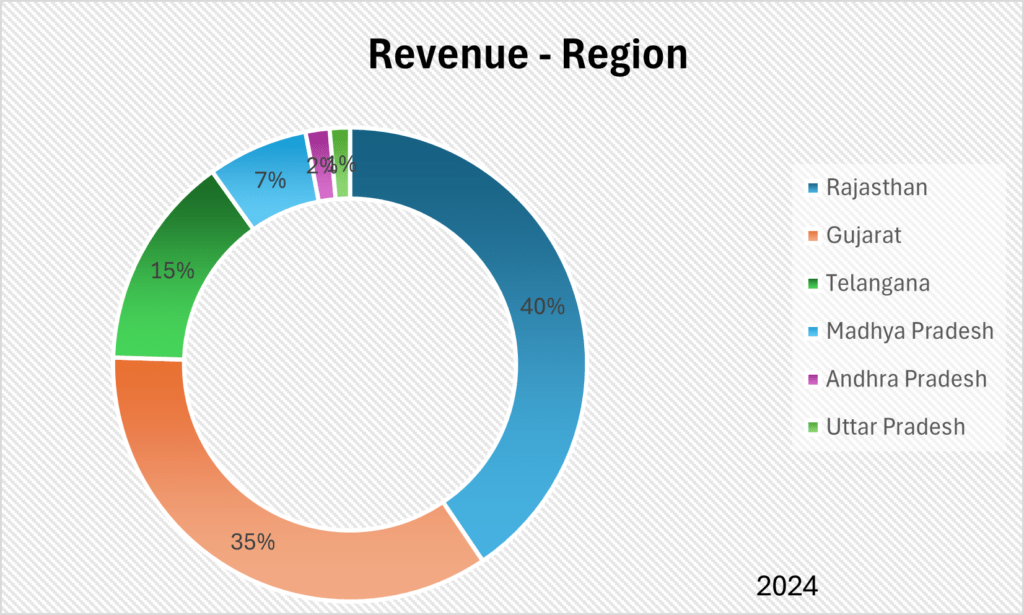

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors have issued an unqualified opinion on the company’s financial statements

Non-Compliances and Other Issues:

The company has not been subject to any material penalties or non-compliance issues related to regulatory and statutory requirements.

Contingent Liabilities:

NTPC Green Energy Limited’s contingent liabilities primarily stem from two ongoing legal cases with the Central Electricity Regulatory Commission (CERC):

- Case 1: Central Transmission Utility petitions for the determination of transmission charges. The outcome of these petitions will determine the transmission charges for a period ending on March 31, 2024, impacting the company’s financial obligations.

- Case 2: Petitions filed by the company seeking compensation for the imposition of safeguard duty, changes in GST rates, and other cost increases related to renewable energy power plants. The company believes a favourable outcome is probable in these cases.

The company’s management believes that the contingent liabilities related to these ongoing legal cases will not have a material impact on the company’s financial position. Sources and related content

Legal Cases:

The company is currently involved in several legal cases, including petitions filed with the Central Electricity Regulatory Commission (CERC) and appeals before the Appellate Tribunal for Electricity (APTEL).

Cases Filed Against the Company

Appeal regarding reimbursement of forecasting charges:

An appeal was filed against the company, challenging an order that declared the company entitled to reimbursement of forecasting and scheduling charges. The appeal seeks to set aside the order and deny the company’s claim for reimbursement. The matter is pending before the Appellate Tribunal for Electricity (APTEL).

Appeal regarding the declaration of the 2020 SGD Notification as a Change in Law event:

An appeal was filed against the company, challenging an order that declared the 2020 SGD Notification as a Change in Law event. The appeal seeks to set aside the order and deny the company’s claim for compensation due to the imposition of safeguard duty. The matter is pending before the Appellate Tribunal for Electricity (APTEL).

Appeal regarding the applicable tariff for a solar PV power station:

An appeal was filed against the company, challenging an order that directed the application of a lower generic tariff for a solar PV power station. The appeal argues that the order is contrary to regulations and seeks a higher tariff for the project. The matter was remanded back to the Central Electricity Regulatory Commission (CERC) for reconsideration.

Writ petition regarding alleged land encroachment and compensation:

A writ petition was filed against the company, alleging unlawful encroachment and the laying of a high-tension power line on private agricultural land during project development. The petition seeks the removal of the power line and the grant of adequate compensation. The matter is currently pending.

Cases Filed by the Company

Petition against Telangana DISCOMS for Change in Law event:

The company filed a petition seeking compensation due to increased costs from changes in GST rates and basic customs duty on solar inverters. The case is pending, awaiting a decision on whether these changes constitute a Change in Law event under the Power Usage Agreements (PUAs).

Petition for non-operationalization of Long Term Access (LTA) and Deviation Settlement Mechanism (DSM) penalties:

The company filed a petition to recover transmission charges and seek compensation for financial losses incurred due to the non-operationalization of LTA and DSM penalties. The case is pending, with replies and rejoinders filed by both the company and the respondents.

Petition for declaration of the Working Group Report as a Change in Law event:

The company filed a petition seeking a declaration that the Working Group Report, 2022, issued by the Central Electricity Authority (CEA), constitutes a Change in Law event. The petition argues that the report introduces new requirements for demonstrating dynamic reactive power capability, leading to additional costs and changes in project configuration. The matter is currently pending.

Petition for determination of project-specific tariff:

The company filed a petition seeking the approval of a levelized tariff for a solar PV project in Ayodhya, Uttar Pradesh. The petition also seeks approval for deviations in certain parameters and the recovery of differential costs and fees. The matter is pending, with an order allowing the amendment of the petition and the filing of replies and rejoinders.

Tax Proceedings against the Company:

SWOT Analysis

Strengths

| Strong Parentage and Government Support: NTPC Green Energy Limited is a wholly-owned subsidiary of NTPC Limited, a Maharatna Central Public Sector Enterprise (CPSE) under the Ministry of Power, Government of India. |

| Large and Diversified Project Portfolio: The company has a significant presence in the solar and wind energy sectors, with a portfolio of 14,696 MWs of operating, contracted, and awarded projects as of June 30, 2024. |

| Experienced Management Team: The company’s management team comprises professionals with extensive experience in the renewable energy sector. Their expertise enables effective decision-making, project execution, and stakeholder management. |

| Strong Credit Ratings: The company enjoys strong credit ratings from leading Indian rating agencies, reflecting its financial stability and ability to meet its debt obligations. These ratings enhance the company’s access to capital and lower its borrowing costs. |

Weaknesses

| Limited Operating History: As a relatively young company, established in 2022, NTPC Green Energy Limited has a limited operating history compared to some of its established peers. |

| Dependence on Key Customers: The company derives a significant portion of its revenue from a few key customers, primarily government agencies and PSUs. This dependence on a concentrated customer base increases the company’s vulnerability to any changes in those customers’ policies or financial conditions. |

| Concentration of Projects in Certain Regions: A significant portion of the company’s operational projects is located in Rajasthan, exposing it to risks associated with regional economic conditions, regulatory changes, and natural calamities. |

Opportunities

| Growth in Renewable Energy Demand: The renewable energy sector in India is experiencing rapid growth, driven by government initiatives, increasing environmental concerns, and declining costs. This presents a significant opportunity for NTPC Green Energy Limited to expand its project portfolio and market share. |

| Expansion into New Technologies and Markets: The company has the opportunity to diversify its business by venturing into new renewable energy technologies, such as green hydrogen, green ammonia, and energy storage systems. Additionally, the company can explore new geographic markets within India. |

| Increased Government Support and Incentives: The Indian government’s continued focus on renewable energy is likely to result in increased policy support and financial incentives for the sector. This could benefit NTPC Green Energy Limited by lowering project costs and improving profitability. |

Threats

| Regulatory Changes: Changes in government policies and regulations, such as those related to renewable purchase obligations (RPOs) or feed-in tariffs, could impact the company’s financial performance and project viability. |

| Competition: The renewable energy sector in India is highly competitive, with the presence of several large and established players. NTPC Green Energy Limited needs to continuously innovate and improve its efficiency to maintain its market share and profitability. |

| Natural Calamities and Climate Change: The company’s renewable energy projects are exposed to risks associated with natural calamities and climate change, such as floods, droughts, and storms. These events could damage infrastructure, disrupt operations, and impact the company’s financial performance. |

| Rising Interest Rates: The company’s reliance on debt financing makes it vulnerable to fluctuations in interest rates. Rising interest rates could increase the company’s borrowing costs and impact its profitability. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The renewable energy sector in India has high entry barriers due to significant capital investment and regulatory requirements. However, the industry is attracting new players due to government incentives and growing demand. |

| Bargaining Power of Suppliers | LOW |

| The company has access to a diversified supplier base, reducing its dependence on any single supplier. |

| Bargaining Power of Buyers | MODERATE |

The company’s buyers are primarily government agencies and PSUs, which have some bargaining power due to their size and influence. However, the company’s long-term PPAs provide some protection against price fluctuations.

| Threat of Substitute Products or Services | LOW |

| The threat of substitute products or services is currently low, as renewable energy is a key focus area for the Indian government and is expected to grow significantly in the coming years. |

| Rivalry Among Existing Competitors | HIGH |

| The renewable energy sector in India is highly competitive, with the presence of several large and established players. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers for FY 2024 is as follows:

| Financial Metric | NTPC Green Energy Limited | Adani Green Energy Limited | ReNew Energy Global PLC |

| Revenue from Operations (₹ in millions) | 19,625.98 | 92,200 | 81,948 |

| Operating EBITDA Margin (%) | 88.99% | 82.28% | 71.57% |

| PAT Margin (%) | 17.56% | 13.67% | 5.06% |

| Net Debt/Equity (x) | 1.98 | 2.9 | 4.48 |

| Interest Coverage (x) | 2.64 | 1.71 | 1.54 |

Green Box

Capacity Expansion Plans:

The company plans to continue growing its project pipeline through prudent bidding and strategic joint ventures. The company also plans to expand into new business areas, such as green hydrogen, green chemicals, and energy storage systems.

Positive Operating Cash Flow:

The company has maintained a positive operating cash flow in the last three fiscal years.

IPO Funds:

The company’s primary objective behind its upcoming issue of shares is to raise capital for the repayment/prepayment of outstanding borrowings and general corporate purposes.

Industry Outlook:

The renewable energy industry in India is expected to continue its strong growth trajectory, driven by government support, declining costs, and increasing demand. The industry’s growth is further supported by India’s commitment to achieving 500 GW of non-fossil fuel-based energy capacity by 2030.

Amber Box

Capacity Utilization:

The company capacity utilization rate is 23.97% for solar projects and 19.78% for wind projects for FY 2024.

(Capacity Utilization refers to the weighted average of CUF of installed capacity in the portfolio as on given date)

Debt Structure:

The company has a moderate level of debt, with a net debt-to-equity ratio of 1.98 as of March 31, 2024.

Red Box

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).