Mach Conferences and Events Limited

Company

| Website 🔗 |  |

| Business Activity | Service |

| Division | Business Event Management |

| Sub-class | MICE |

| Location | Noida, Uttar Pradesh |

| Establishment Year | 2004 |

About

Mach Conferences and Events Limited(MCEL) specializes in providing end-to-end solutions for the MICE (Meetings, Incentives, Conferences, and Exhibitions) industry.

Products and Services:

MCEL offers a comprehensive range of MICE and event management services, including:

Events & Conference Management:

The company handles all aspects of event planning and execution, from venue selection and agenda creation to speaker coordination and attendee management.

Destination Management:

MCEL manages the logistical aspects of events at specific destinations, including venue selection, accommodation arrangements, transportation, local activities, and on-site coordination.

Other Services:

Hotel/Venue Booking, Ticket & Visa Arrangements, Airline Ticket Booking, Logistics Management, Foreign Exchange Services etc.

Clients

MCEL primarily caters to corporate clients, focusing on the Banking, Finance, and Insurance sectors. The company has also served clients in hospitality, infrastructure, FMCG, and other industries.

Recognition:

Awards:

“Best MICE Company” by India Travel Awards North 2023 and “Best MICE Organiser” by India MICE Awards 2018.

Memberships:

Pacific Asia Travel Association (PATA) and Indian Association of Tour Operators (IATO).

IATA Certification:

For professional standards in promoting and selling international air passenger transportation.

Future Plans

Expansion into B2C Segment: Launching a travel B2C portal called “BookMyYatra.com” to leverage its existing customer base and expand its market reach.

Diversification into Religious Tourism: Exploring opportunities in the religious tourism sector, recognizing its potential for economic growth and cultural promotion.

Operational Highlights (FY 2024)

Number of Events Completed: 90

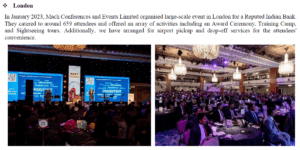

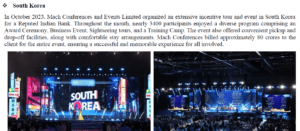

Locations: Events were conducted in various domestic and international locations, including London, Mussoorie, Bangalore, South Korea, Paris, Goa, Srinagar, and Singapore.

Average Revenue per Event: ₹263.62 lakhs

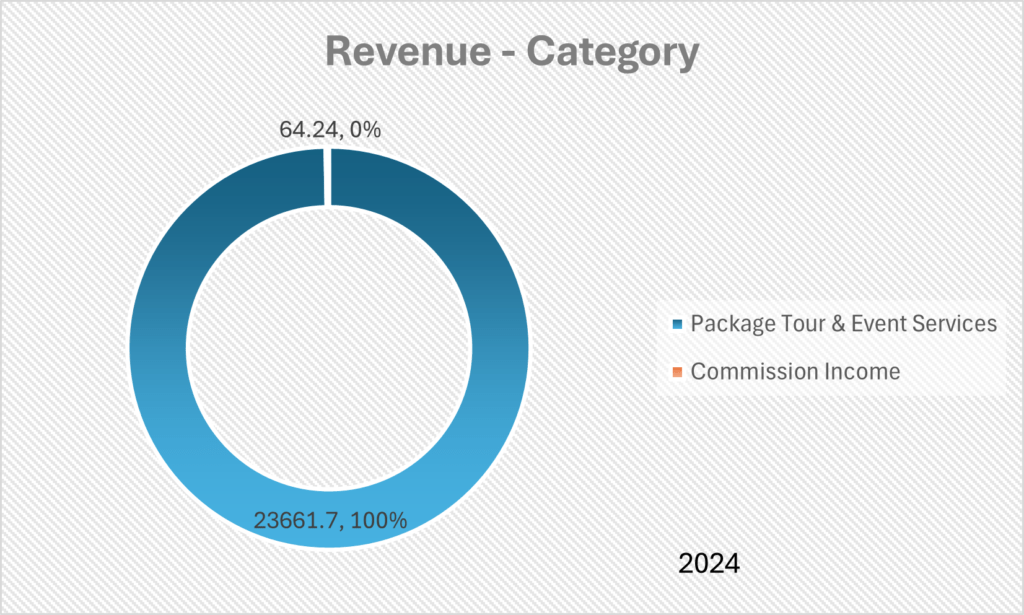

Sources of Revenue:

Package Tour & Event Services: This includes the planning, organization, and execution of various aspects of MICE events. This is the major revenue stream for the company, contributing to 99.73% of its revenue in FY 2024.

Commission Income: The company also earns revenue through commissions from various service providers involved in the events, such as hotels, airlines, and transportation companies. This accounted for 0.27% of the revenue in FY 2024.

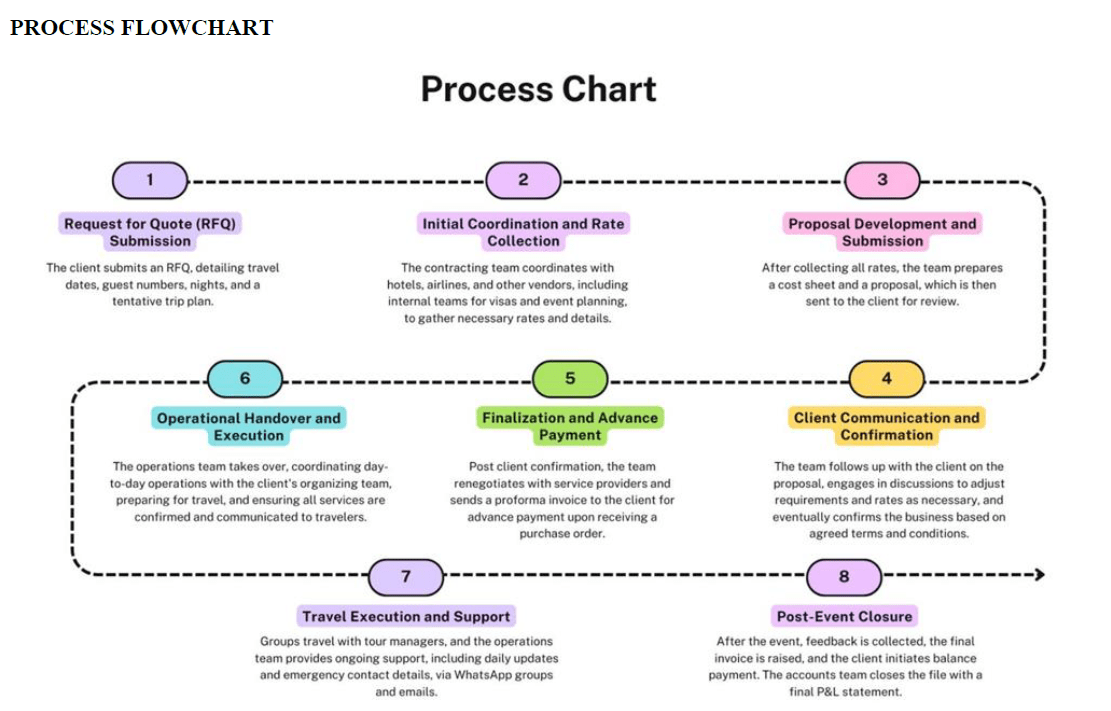

Business Flow Chart

Revenue – Category

Audit and Legal

Related Party Transactions:

Mach Conferences and Events Limited has related party transactions mostly related to loans received from key promoters for FY 2024.

Auditor’s Remarks:

The Statutory Auditors have issued an unqualified opinion.

Emphasis of Matter:

The auditors state that certain trade receivables, advances, and trade payables as of March 31, 2024, were subject to confirmation and reconciliation. The auditors noted that the financial statements did not include any adjustments that might arise from this process, but management believed there would be no significant impact.

Delayed Filings and Discrepancies in Statutory Records:

There have been instances of delays, incorrect filings, or non-filings of statutory forms with the Registrar of Companies (RoC)

Contingent Liabilities:

The company does not have any contingent liabilities on either a standalone or consolidated basis

Taxation Matters:

There are multiple taxation matters related to Income Tax (Outstanding Demand) (2.25 Crore) Income Tax (e-proceedings) and TDS Default cases.

GST (Outstanding Demand):

The company has 20 cases of outstanding GST demands, totalling ₹7.50 crores.

SWOT Analysis

Strengths

| Comprehensive Service Portfolio: MCEL offers a wide array of MICE and event management services, catering to diverse client needs and acting as a one-stop solution. |

| Established Network: The company has cultivated strong relationships with hospitality and event partners, ensuring priority access to quality services and venues. |

| Strong Financial Performance: The company has demonstrated robust revenue growth and positive operating cash flow in recent periods, indicating financial health and stability. |

Weaknesses

| Dependence on Key Clients: The company’s revenue is heavily concentrated among a few large clients, making it vulnerable to fluctuations in their demand and potential client losses. |

| Lack of Long-Term Contracts: The absence of formal long-term contracts with clients creates uncertainty in revenue streams and makes the company susceptible to market fluctuations. |

| Talent Acquisition and Retention Challenges: The company faces difficulties attracting and retaining skilled professionals in the competitive MICE industry, which could impact service quality and growth. |

Opportunities

| Growth of the MICE Industry: The MICE industry in India is projected to experience significant growth, providing ample opportunities for MCEL to expand its market share and revenue. |

| Expansion into B2C Market: The launch of the “BookMyYatra.com” portal could open up new revenue streams and leverage the company’s existing customer base and insights. |

| Diversification into Religious Tourism: This emerging segment offers potential for growth and aligns with India’s cultural and spiritual landscape. |

Threats

| Intense Competition: The MICE industry in India is highly competitive, with aggressive pricing and the emergence of new players, including digital event platforms. |

| Economic Downturns: Economic slowdowns in India or globally could impact business travel and corporate spending on events, affecting MCEL’s revenue and profitability. |

| Geopolitical Uncertainties and Pandemics: Unforeseen events like geopolitical tensions, natural disasters, or public health crises could disrupt the company’s operations and lead to financial losses. |

Porter’s Five Forces1

| Threat of New Entrants | HIGH |

| The industry has low entry barriers. The primary resources needed are skilled personnel and a network of vendors, which are relatively easy to acquire. |

| Bargaining Power of Suppliers | MODERATE |

| The company relies on a network of suppliers, including hotels, airlines, and transportation providers. MCEL has established strong relationships with these suppliers, enabling it to procure priority and quality services |

| Bargaining Power of Buyers | HIGH |

| The company’s client base is highly concentrated, with the top 10 customers contributing to 91.80% of sales in FY 2024. The absence of long-term contracts further strengthens the bargaining power of buyers. |

| Threat of Substitute Products or Services | MODERATE |

| The rise of virtual and hybrid events has introduced substitute services to traditional in-person events. Digital event platforms and streaming services now offer alternative ways for companies to conduct meetings, conferences, and exhibitions. |

| Rivalry Among Existing Competitors | HIGH |

| The MICE industry in India is highly competitive, with aggressive pricing being a common practice. The company faces competition from both established players and new entrants. |

Peer Comparison

Comparison of Mach Conferences and Events Limited’s (MCEL) key performance indicators (KPIs) with two of its listed peers, Exhicon Events Media Solutions Ltd and Touchwood Entertainment Limited. The comparison is for FY 2024 and is presented on a standalone basis. The following table summarizes this comparison:

| Particulars (Standalone) | Mach Conferences and Events Limited | Exhicon Events Media Solutions Ltd | Touchwood Entertainment Limited |

| Revenue from Operations (₹ in Lakhs) | 23,725.89 | 4,118.22 | 3,271.73 |

| Growth in Revenue from Operations (YoY %) | 67.92% | 10.69% | -9.26% |

| EBITDA Margin (%) | 14.56% | 20.24% | 13.97% |

| PAT Margin (%) | 11.04% | 15.32% | 11.07% |

| RoE (%) | 72.78% | 15.31% | 11.46% |

| RoCE (%) | 57.57% | 19.07% | 12.80% |

| Operating Cash Flows (₹ in Lakhs) | 1,772.14 | -3,308.43 | -55.32 |

Revenue:

MCEL significantly outperforms its peers in terms of revenue from operations, demonstrating its larger scale and market presence.

Efficiency and Returns:

MCEL exhibits superior efficiency and returns compared to its peers. Its RoE and RoCE are substantially higher, indicating that it generates more profit from its equity and capital employed.

Cash Flows:

MCEL has positive operating cash flows, while both of its peers have negative operating cash flows. This indicates that MCEL is generating cash from its core operations, which is a positive sign for its financial health.

Green Box

End-to-End Solutions:

MCEL offers a comprehensive suite of services, ranging from venue booking and travel arrangements to event planning and execution. This one-stop-shop approach simplifies the event planning process for clients and differentiates MCEL from competitors who may offer a more limited range of services.

Proven Track Record and Experience:

The company has been operating in the MICE industry for over two decades. This extensive experience, combined with the expertise of its promoters and management team, provides MCEL with a competitive edge in terms of industry knowledge and the ability to handle complex events.

Established Network:

MCEL has built strong relationships with various hospitality and event partners, allowing it to secure priority access to venues, accommodations, and other essential services. This can enhance the quality of events and provide a seamless experience for clients.

Bid for Higher Value Events:

The company aims to raise a significant portion of the IPO proceeds (₹33.26 crores) to meet its working capital needs. This infusion of capital will allow MCEL to participate in bidding for larger and more prestigious events, which can enhance its brand recognition and value.

Industry Outlook:

The MICE (Meetings, Incentives, Conferences, and Exhibitions) industry in India is poised for a substantial growth rate (CAGR) of 18% during the period from 2023 to 2030.

Amber Box

Negative Cash Flows from Operating Activities:

The company experienced negative cash flows from its operating activities in FY 2022 (-6.62 Crores) and FY 2023, (-3.30 Crores) while this has turned positive in FY 2024 (₹17.72 Crores).

Debt-to-Equity Ratio: 0.25

Lack of Long-Term Contracts:

The company operates primarily on a contract or order basis, without long-term agreements with its clients. This creates uncertainty in revenue streams and makes the company vulnerable to fluctuations in demand and potential client attrition.

Talent acquisition and retention:

The company faces challenges in attracting and retaining skilled professionals, which could impact its service quality and growth potential.

Red Box

Exposure to Aggressive Pricing:

The MICE industry in India is characterized by intense competition and aggressive pricing strategies. This could put pressure on MCEL’s profit margins and force it to accept less favourable terms to secure projects.

Customer Concentration:

The company’s revenue is heavily reliant on a small number of clients. The top 10 customers contributed to 91.80% of sales in FY 2023-24

Images

- For Porter’s Five Forces, the force value of “LOW” is considered good. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).