Jay Bee Laminations Limited

Company

| Website 🔗 |  |

| Business Activity | Manufacture |

| Division | Electrical Components |

| Sub-class | Electrical Steel Cores for Transformers |

| Location | Noida, Uttar Pradesh |

| Establishment Year | 1988 |

Management

| Managing Director | Mudit Aggarwal |

| Educational Qualifications | Master of Science in Engineering Management Systems from Columbia University, New York City |

| Experience | Over 11 years of experience with Jay Bee Laminations Limited |

| Annual Salary | ₹ 30 Lakhs |

| Total Number of Employees | 310 |

About

Jay Bee Laminations Limited is a key player in the Indian power industry, specializing in the manufacturing and supply of electrical steel cores. These cores, crafted from Cold Rolled Grain Oriented (CRGO) steel and Cold Rolled Non-Grain Oriented (CRNGO) steel, find their applications in transformers, uninterruptible power supplies (UPS), and inverters.

Products and Services:

Electrical Laminations:

These are thin sheets of electrical steel used to construct the cores of transformers and other electrical machines.

Slit Coils:

These are coils of electrical steel that have been slit to specific widths, ready for further processing into laminations or stampings.

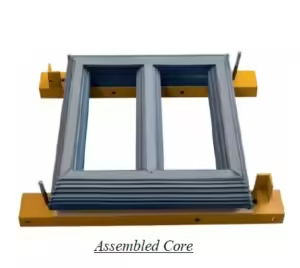

Assembled Cores:

These are pre-assembled stacks of laminations, that form the magnetic core of transformers.

E & I Stampings:

These are specific shapes cut from CRNGO steel and are used in motors, generators, UPS, and inverters.

Mother Coils:

These are the large, original coils of CRGO or CRNGO steel from which other products are derived.

Clients:

Transformer Manufacturers:

The company primarily caters to manufacturers producing transformers ranging from 11kV to 220 kV class, serving both power and distribution sectors.

Manufacturing Process:

Procurement of Raw Materials:

The journey begins with sourcing CRGO and CRNGO electrical steel mother coils from BIS-approved steel mills, both domestically and internationally.

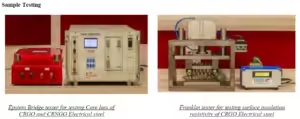

Sample Testing:

Stringent quality control is maintained through an in-house laboratory. Samples from each batch of coils are rigorously tested to ensure they meet the standards set by the Bureau of Indian Standards (BIS).

Slitting:

The mother coils are then slit into narrower widths using high-speed semi-automatic slitting machines, catering to customer-specific requirements.

Cutting:

Slit coils are further processed through cutting, either manually or using automatic CNC cut-to-length machines. This step involves shearing and punching sheets to create the desired shapes for the final products.

Assembly:

Cut laminations are stacked and clamped together with precision, forming assembled cores ready for transformer integration.

Quality Control & Final Testing:

The company adheres to ISO 9001:2015 standards, ensuring quality at every stage. Final products undergo meticulous testing before dispatch to guarantee compliance with customer specifications.

Packaging & Transportation:

Products are carefully packaged to prevent transit damage and are transported using third-party logistics or as per customer agreements.

Raw Materials:

CRGO Steel (Cold Rolled Grain Oriented Electrical Steel):

A specialized steel with directional magnetic properties is crucial for reducing energy losses in transformers.

CRNGO Steel (Cold Rolled Non-Grain Oriented Electrical Steel):

A steel with uniform magnetic properties in all directions is used in motors, generators, and other electrical equipment.

Suppliers:

BIS-Approved Steel Mills:

The company sources its CRGO and CRNGO steel mother coils from various BIS-approved mills, both domestically and internationally.

They also import from various countries, including China, Poland, the USA, UAE, Japan, Germany, and the Czech Republic.

Local Steel Suppliers:

Mild steel shapes and sections for in-house fabrication of channels are procured from local suppliers.

Other Key Aspects:

The company’s manufacturing units, located in Noida and Greater Noida, are equipped with in-house facilities for the entire production process, including slitting, cutting, assembling, and testing. They also have an in-house laboratory for quality control and a tooling division for maintaining their equipment.

The company is committed to environmental, health, and safety standards and holds ISO 14001:2015 and ISO 45001:2018 certifications.

Manufacturing Process Flowchart

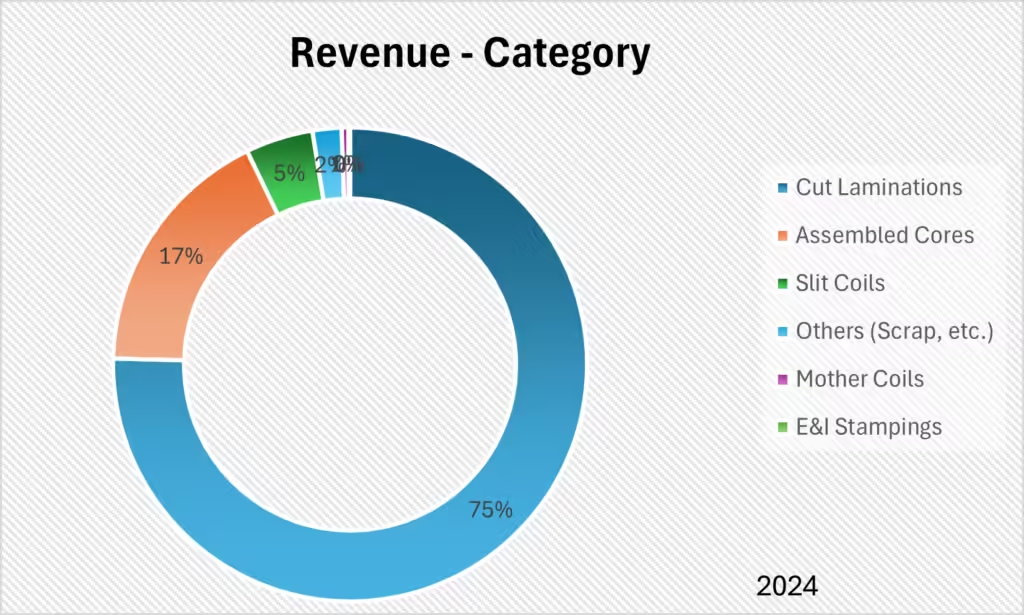

Revenue – Category

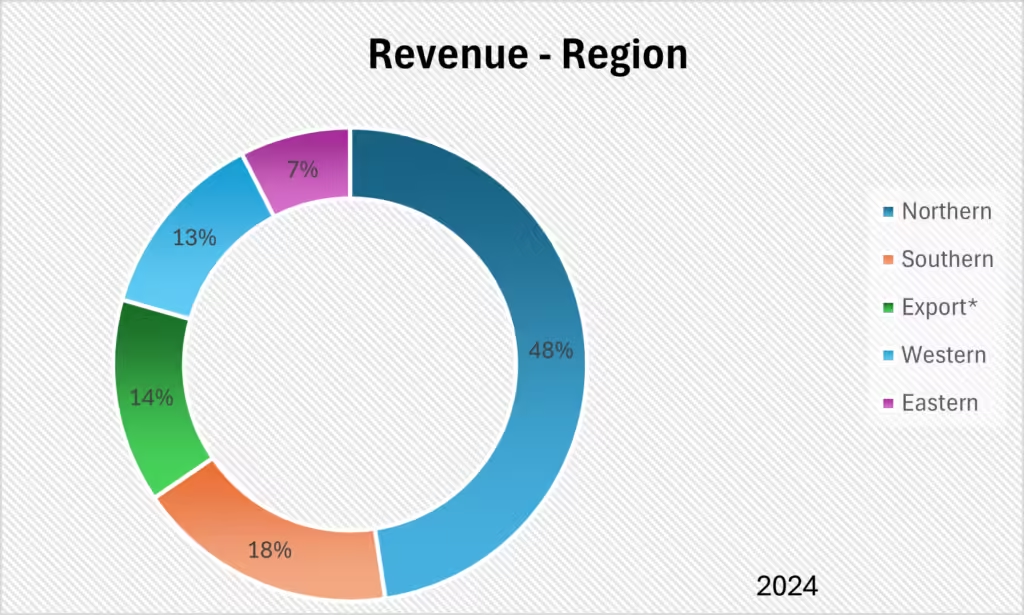

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors, explicitly stated in their report that there were no qualifications in the audit report for FY 2024, 2023, and 2022.

Non-Compliances and Other Issues:

Customs Authority Penalty:

The Office of the Commissioner of Customs (Import) imposed a penalty of ₹33.05 lakhs on the company and promoters for allegedly importing lower-quality CRGO steel and claiming an exemption on customs duty. The company, along with its Promoter Directors, has filed an appeal against this penalty.

Late Filing Fees and Interest:

The company has incurred penalties in the past for delayed filing of GST and EPF returns. These penalties included late filing fees and interest on the delayed deposit of taxes and statutory dues.

Non-Compliance with Section 260 of the Companies Act, 1956:

There was an instance where Mr Mudit Aggarwal’s position as a director was not regularized on time, leading to a potential violation of the Companies Act, 1956.

Untraceable Corporate Records and Non-Compliances:

The company acknowledges that certain corporate records and filings are not traceable or contain errors and non-compliances.

Contingent Liabilities:

As of March 31, 2024, Jay Bee Laminations Limited reported the following contingent liabilities:

- Related to Direct Tax Matters: ₹54.51 lakhs

- Related to Indirect Tax Matters: ₹2.29 lakhs

- Estimated Value of Contracts Remaining to be Executed (Net of Advances): ₹777.66 lakhs

Legal Cases:

Cases Filed Against the Company

Cases Filed by the Company

There are multiple criminal cases filed by the company on other customers and companies concerning dishonoured cheques under the Negotiable Instruments Act.

There are multiple civil cases filed by the company on other companies with the National Company Law Tribunal (NCLT) and Micro and Small Enterprise Facilitation Council (MSEFC) to recover outstanding amounts.

Tax Proceedings against the Company:

Direct Tax: 6 cases involving ₹1.42 crores

Indirect Tax: 3 cases involving ₹1.63 crores

SWOT Analysis

Strengths

| Established Brand and Market Presence: The company has a 35-year history in the industry, allowing it to build a strong brand and establish a wide network of customers and suppliers. This recognition and market presence provides a solid foundation for future growth. |

| Strong Operational and Financial Performance: The company has demonstrated consistent growth in revenue and profitability, showcasing its operational efficiency and effective financial management. |

| Focus on Quality: The company’s commitment to quality is evident in its ISO certifications and rigorous testing procedures. This focus translates to high customer satisfaction, low rejection rates, and a strong reputation for reliability. |

| In-house Capabilities: The company’s vertically integrated operations, with in-house facilities for slitting, cutting, assembling, and testing, provide greater control over the production process, ensuring quality and efficiency. |

Weaknesses

| Dependence on Key Suppliers: The company relies on a limited number of suppliers for its critical raw materials. This dependence creates vulnerability to supply chain disruptions, price fluctuations, and potential quality issues. |

| Lack of Long-Term Contracts: The company operates primarily on short-term purchase orders, lacking long-term agreements with both customers and suppliers. This creates uncertainty in demand and supply, potentially affecting production planning and revenue stability. |

| Working Capital Intensity: The company’s operations require significant working capital, which could strain cash flow and limit financial flexibility, especially during economic downturns or market volatility. |

Opportunities

| Favorable Industry Outlook: The power and distribution transformer industry in India is projected to experience substantial growth, driven by economic expansion, rising electricity demand, and government initiatives. This presents a significant opportunity for the company to expand its market share and revenue. |

| Capacity Expansion: The company’s planned capacity expansion at its Unit-II facility will enable it to tap into new customer segments, explore new markets, and introduce new product lines, further fueling its growth potential. |

| Focus on High-Value Products: The company’s strategic shift towards higher-value products, particularly in the export market, could lead to improved profit margins and enhanced financial performance. |

Threats

| Intense Competition: The company faces competition from both domestic and international players in the electrical steel core manufacturing industry. It needs to continuously innovate and improve its operational efficiency to maintain its competitive edge. |

| Raw Material Price Volatility: Fluctuations in the prices of raw materials, especially CRGO and CRNGO steel, could impact the company’s profitability if it cannot pass on the increased costs to its customers. |

| Technological Advancements: The emergence of new technologies or substitute materials could render the company’s products obsolete or less competitive, impacting its market share and growth prospects. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The industry requires specialized knowledge and significant investment in machinery and testing facilities, creating barriers to entry. However, the potential for high profits could attract new players, especially with government initiatives promoting manufacturing. |

| Bargaining Power of Suppliers | MODERATE – HIGH |

| The company relies on a limited number of suppliers for CRGO and CRNGO steel, and there is no assurance of continued supply or favourable terms. Fluctuations in raw material prices and potential disruptions in the supply chain could significantly impact the company’s operations and profitability. |

| Bargaining Power of Buyers | MODERATE |

| The company’s customers are primarily transformer manufacturers who require high-quality CRGO steel cores. While there are alternative suppliers, the company’s focus on quality and long-standing relationships with customers provide some leverage. However, the absence of long-term contracts could increase buyer power. |

| Threat of Substitute Products or Services | LOW |

| While there are alternative materials for transformer cores, such as amorphous metal, CRGO steel remains the preferred choice due to its superior magnetic properties and efficiency. |

| Rivalry Among Existing Competitors | MODERATE |

| The CRGO steel core manufacturing industry in India has consolidated since the introduction of BIS quality control orders. While there are several organized players, the company’s focus on quality, in-house capabilities, and long-standing customer relationships provide a competitive advantage. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers for FY 2024 is as follows:

| Metric | Jay Bee Laminations Limited | Vilas Transcore Limited |

| Revenue from Operations (₹ in Crores) | 303 | 310 |

| Operating Profit Margin (%) | 11 | 10 |

| Return on Equity (ROE) (%) | 36.4 | 15.1 |

| Return on Capital Employed (ROCE) (%) | 39.6 | 20.8 |

| Debt to Equity Ratio | 0.38 | 0.00 |

Green Box

IPO Funds:

Funding Working Capital Requirements:

The company aims to raise a substantial portion of the net proceeds to bolster its working capital.

Strong Operational and Financial Performance:

The company has demonstrated consistent growth in revenue and profitability over the past three financial years.

Diversify into new customer segments:

The company aims to tap into the market for higher voltage class transformers (400 kV and 765 kV) and cater to customers seeking amorphous metal cores for 11 kV transformers.

Introduce a new product line:

The company plans to diversify its product portfolio by adding amorphous metal cores to its offerings.

In-house Laboratory:

The company has an in-house laboratory for testing raw materials and finished goods, ensuring strict adherence to quality standards and enabling them to address customer complaints effectively.

Low Rejection Rates:

The company’s stringent quality control measures have resulted in remarkably low rejection rates among its customers, further solidifying its reputation for reliability and product excellence.

In-house Transportation:

The company utilizes its own commercial vehicles for local deliveries to customers in nearby areas. This allows for greater control over the transportation process and potentially faster delivery times for certain orders.

Positive Operating Cash Flow:

Jay Bee Laminations Limited has maintained a positive operating cash flow over the past few years (FY 2022, 2023 and 2024).

Industry Outlook:

Government Initiatives:

The Indian government has undertaken several initiatives to strengthen the power sector, including reforms aimed at improving the financial health of DISCOMs (electricity distribution companies) and promoting renewable energy adoption.

Robust Economic Growth:

India’s economy is projected to experience strong growth, leading to increased demand for electricity and power infrastructure.

Amber Box

Capacity Utilization:

As of March 31, 2024, Jay Bee Laminations Limited has an overall capacity utilization rate of 83.00% across its two manufacturing units. Sources and related content

Dependence on Key Suppliers:

The company’s reliance on a limited number of suppliers for its crucial raw materials, CRGO and CRNGO steel, poses a significant risk. Any disruption in the supply chain, price volatility, or quality issues from these suppliers could adversely impact the company’s production and profitability.

Red Box

Concentration of Revenue:

A significant portion of the company’s revenue is generated from a few key customers and specific geographical regions. The top 5 customers contributed 42% of total revenue and the top 5 suppliers contributed 75% of total purchases. Any adverse developments affecting these customers or regions could have a disproportionate impact on the company’s financial performance.

Working Capital Intensity:

The company’s operations are working capital intensive, requiring significant investments in inventory and receivables. This could strain cash flow and limit the company’s financial flexibility, particularly during periods of economic downturn or market volatility.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).