Interarch Building Products Limited

Company

| Website 🔗 |  |

| Business Activity | Construction |

| Division | Civil Engineering |

| Sub-class | PEB (Pre Engineered Buildings) |

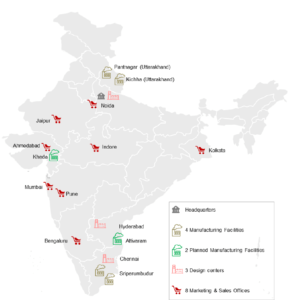

| Location | Office: New Delhi Units: Kichha, Pantnagar, Uttarakhand Sriperumbudur, Tamilnadu |

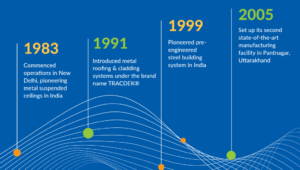

| Establishment Year | 1983 |

Management

| Managing Director | Arvind Nanda |

| Educational Qualifications | Bachelor’s degree in commerce (honors) from the University of Delhi. |

| Experience | Nearly 30 years of experience in the pre-engineered steel buildings industry with Interarch Building Products Limited |

| Annual Salary | 73.2 lakhs (Income + House Rent) |

| Total Number of Employees | 2114 |

About

Interarch Building Products Limited is a leading provider of turnkey pre-engineered steel construction solutions in India. The company, has a long history in the industry, operating under the brands “TRAC®” and “TRACDEK®”. Interarch distinguishes itself by offering end-to-end solutions, with integrated facilities for design, engineering, manufacturing, and on-site project management.

As of 2024, Interarch holds the third position in terms of operating revenue within the integrated PEB sector in India, boasting an aggregate installed capacity of 141,000 MTPA and a market share of 6.5%.

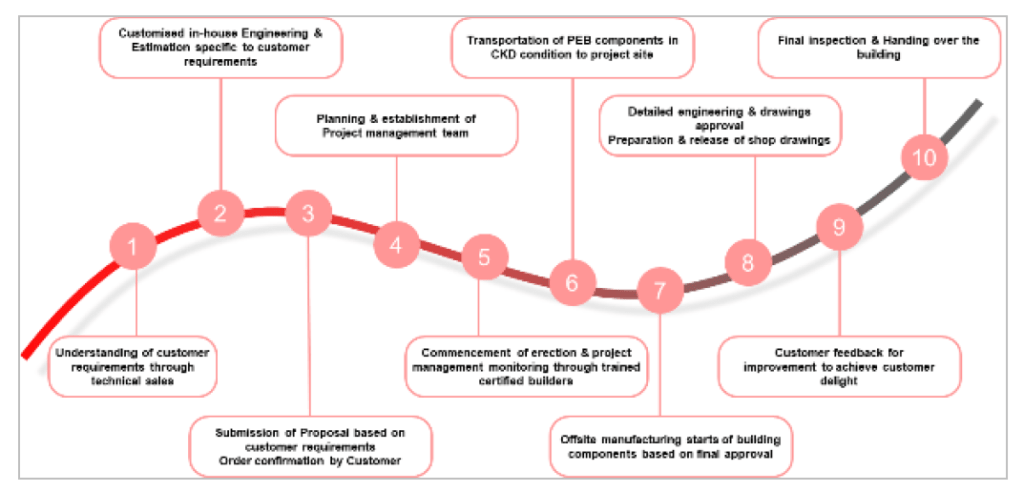

Work Process:

Design and Engineering: Interarch operates three dedicated design and engineering centres in Noida, Chennai, and Hyderabad, allowing for customized PEB designs tailored to customer needs.

Manufacturing: The company primarily manufactures its products in-house at four manufacturing facilities located in Uttarakhand and Tamilnadu.

On-Site Project Management: Interarch provides comprehensive on-site project management for the installation and erection of their PEBs, ensuring smooth and efficient project execution.

Products and Services:

PEB Contracts: Interarch provides complete PEBs on a turnkey basis, handling everything from design and engineering to manufacturing, delivery, and installation.

PEB Sales: The company also sells individual PEB components, including metal ceilings, corrugated roofing (“TRACDEK®” brand), and PEB steel structures.

Infrastructure Steel Solutions: This includes structural steel used in the construction of industrial platforms, mezzanine floors, and walkways.

Job Work: A small portion of PEB production is outsourced to third-party manufacturers.

Raw Materials:

Steel is the primary raw material used by Interarch, procured in various forms such as hot-rolled steel plates, galvanized steel coil sheets, and standard hot-rolled sections.

Clients:

Interarch primarily operates on a business-to-business (B2B) model, serving a diverse clientele across various sectors. The company’s major customers come from the infrastructure, industrial, and power sectors.

Notably, repeat orders constitute a significant portion of the company’s revenue, highlighting strong customer relationships and satisfaction.

Work Flow Chart

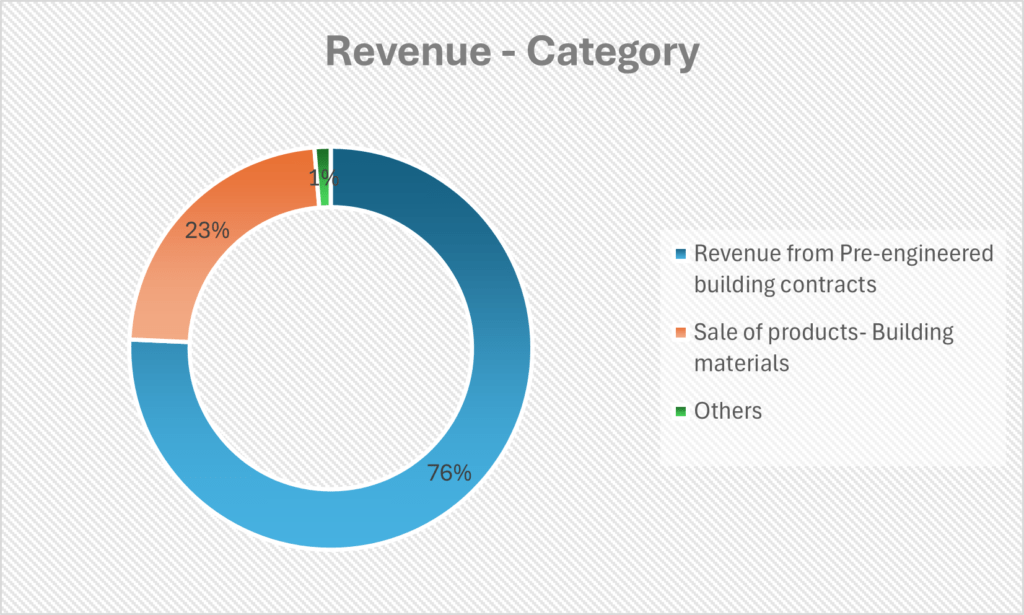

Revenue – Category

Audit and Legal

Related party transactions, categorized as advertisement expenses, corporate social responsibility, lease rent payments and loans surpassed 10% of the total transactions within their respective categories for the FYs 2022, 2023, and 2024.

The audit report for the FY 2024, included a modification regarding audit trail requirements. The report noted that the software used for maintaining the company’s accounting records lacked an enabled audit trail (edit log) feature, which is crucial for tracking changes made to financial data.

Missing Historical Records: Certain corporate records are untraceable, including documentation related to preference share redemption and filings associated with equity share allotments. It underscores potential weaknesses in the company’s record-keeping practices.

Contingent Liabilities: The company has a total of 113 Cr contingent liabilities

Pantagar Manufacturing Facility Lockout: The company faced legal challenges due to a lockout it imposed at its Pantnagar Manufacturing Facility in 2022, following disputes with the labour union. The Uttarakhand Government Labour Division deemed the lockout illegal, and the company faced a demand for ₹1.85 Cr in unpaid wages for the lockout period.

Multiple Show Cause Notices and Demands: The company received a show cause notice in 2014, from the Employees’ Provident Fund Organization in Haldwani, alleging failure to produce payment documents for contract work. This resulted in an order to pay ₹3.41 million in PF contributions. Additionally, the company received 34 demand notices from the Sriperumbudur Panchayat Union in Tamil Nadu for unpaid taxes and license fees.

SWOT Analysis

Strengths

| Established Market Position and Strong Brand Presence: Ranked third in operating revenue from the PEB business in FY 2024 among integrated PEB players in India. |

| Integrated Business Model: Provides turn-key PEB solutions, including design, engineering, manufacturing, and on-site project management for installation. |

| Experienced Management Team: Led by industry professionals with a proven track record. |

Weaknesses

| Missing Historical Records: Absence of certain original corporate records, potentially indicating weaknesses in record-keeping practices. |

| Dependence on Repeat Orders: The company heavily relies on repeat orders from a limited number of customer groups. In the FYs 2022, 2023, and 2024, revenue from these repeat customer groups constituted a substantial portion of their total operational revenue (58.62%, 80.42%, and 81.39% respectively). This reliance makes them vulnerable to fluctuations in demand from these specific groups. |

Opportunities

| Growth of the PEB Industry: The Indian PEB industry is expected to grow significantly in the coming years at a CAGR of 11-12% |

| Government Initiatives: Favorable government policies and infrastructure development plans are expected to drive demand for PEBs. |

| Technological Advancements: Adopting new technologies and innovations in PEB design, manufacturing, and installation processes. |

Threats

| Competition: Intense competition from existing players in the Indian PEB market. |

| Economic Slowdown: A slowdown in the Indian economy will have a large negative effect on demand for PEBs. |

| Raw Material Price Volatility: Fluctuations in the prices of raw materials such as steel could impact profitability. |

Porter’s Five Forces

| Threat of New Entrants | HIGH |

| The threat of new entrants is high due to moderate capital requirements and the fragmented nature of the industry, with many small players. |

| Bargaining Power of Suppliers | LOW – MODERATE |

| Steel, the primary raw material, is available from multiple sources. However, price fluctuations in steel can impact the industry. |

| Bargaining Power of Buyers | MODERATE |

| Buyers have moderate bargaining power. While buyers can switch suppliers, large PEB players like Interarch Building Products Limited benefit from established relationships and reputations. |

| Threat of Substitute Products or Services | LOW – MODERATE |

| Substitute products, such as conventional steel buildings, exist but might not offer the same cost and time advantages as PEBs. The threat from substitutes is higher in projects where design flexibility is critical. |

| Rivalry Among Existing Competitors | HIGH |

| The PEB industry is highly competitive, with competition based on pricing, project execution capabilities, and brand reputation. The organized sector within the PEB industry in India is consolidated, with six key players accounting for a significant market share. |

Peer Comparison

Strong Revenue Growth: The company has demonstrated a robust revenue growth rate of 24.5% CAGR (compound annual growth rate) between FY 2022 and 2024. This surpasses the growth rates of most of its listed peers, including Everest Industries Limited (14.8%) and Pennar Industries Limited (23.1%) during the same period.

Improving Profitability: Interarch Building Products Limited displays a substantial improvement in its profitability. Its profit after tax (PAT) CAGR from FY 2022 to 2024 is 124.4%, significantly exceeding the profitability growth of its peers. This highlights the company’s success in enhancing its operational efficiency and cost management.

Interarch Building Products Limited’s ROCE (Return on Capital Employed) at 26.9% in Fiscal Year 2024, though higher than in previous years, remains lower than companies like Kirby Building Systems & Structures India Pvt Ltd (75.8%)

Green Box

Revenue from the top five Customer Groups is just 25%

Total Order Book stands at 1153.3 Cr at the end of FY 2024

Financing capacity expansion: The company plans to use a significant portion of the proceeds from the IPO to finance capital expenditure for Phase 2 of a new PEB manufacturing unit at the Planned Andhra Pradesh Manufacturing Facility. This facility is being set up in two phases. Phase 1, already underway, involves setting up a PEB manufacturing unit on 15,470 sq. mtrs of land. The company has received and installed almost all plant and machinery for this phase, with an estimated capacity of 20,000 MTPA. Phase 2, aims to further expand the facility.

Planned Gujarat Manufacturing Facility: The company also plans to establish a manufacturing facility in Kheda, Gujarat, indicating its intention to expand its geographical footprint.

Upgrading existing facilities: The company will also upgrade its existing manufacturing facilities: Kichha Manufacturing Facility, Tamil Nadu Manufacturing Facility I and II, and Pantnagar Manufacturing Facility.

The company’s total capacity utilization across its manufacturing facilities as of March 31, 2024, was 60.64%. However, focusing on the key indicator of capacity utilization for the company, BU (Built-Up sections) components production, the capacity utilization for the same period was 80.49%.

The Indian PEB industry has experienced steady growth. Between FY 2019 and 2024, it expanded at a CAGR of ~8.0%, reaching a value of ₹195 billion in FY 2024. The industry is projected to maintain a strong growth trajectory, estimated at 11.0-12.0% CAGR from Fiscal Year 2024 to 2029.

Interarch Building Products Limited has had a positive cash flow from operating activities for the past few years. In FY 2024, cash generated from operations was ₹111.86 Cr

Debt-to-Equity Ratio is negligible at 0.03 for the company

Amber Box

Revenue from Customer’s repeat orders is 81.3% of total revenue.

Red Box

Labour disputes: The company got involved in multiple major labour disputes with labourers protesting against the management in the past and such situations can adversely impact the operations of the company.

Dependence on Raw Material Prices and Availability: The company’s profitability heavily relies on the availability and cost of raw materials, primarily steel. Volatility in steel prices or supply chain disruptions could significantly impact the company’s margins.

Images

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).