Innomet Advanced Materials Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Metals and Alloys |

| Sub-class | Powder Metallurgy |

| Location | Hyderabad, Telangana |

| Establishment Year | 1984 |

Management

| Managing Director | Vinay Choudary Chilakapati |

| Educational Qualifications | Mechanical Engineer |

| Experience | Over 15 years of experience in the Powder Metal industry |

| Annual Salary | ₹ 50 Lakhs |

| Total Number of Employees | 56 |

About

Innomet Advanced Materials Limited is a leading manufacturer of specialized metal products such as Metal Powders and Tungsten Heavy Alloys (THA).

Products and Services:

Metal Powders:

The company provides various metal powders, including ferrous and non-ferrous metals and their alloys. These powders are used in multiple industries, such as diamond tools, welding, brazing, surface coatings, and powder metallurgy components.

Tungsten Heavy Alloys:

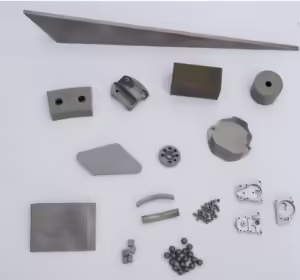

Innomet manufactures tungsten heavy alloys in various forms, including bars, plates, cubes, spheres, and custom components as per customer drawings. These alloys find applications in defence, aerospace, radiation shielding, and engineering industries. Innotung is the brand name for “The Tungsten Heavy Alloy series” manufactured through Powder

Metallurgy process by the Company.

Diamond Tools:

The company also manufactures diamond tools, which are used in various industrial applications.

Clients:

Domestic Clients:

The company caters to a wide range of clients in India, including defence organizations, research and development institutions, and private companies.

International Clients:

Innomet also exports its products to various countries, including the US, UK, Germany, Netherlands, Japan, Italy, New Zealand, Lebanon, Brunei, and many others.

Defence:

The company supplies tungsten heavy alloy (THA) products to defence organizations such as the Ordnance Factories, BDL, and various R&D organizations like DMRL, PGAD, TBRL, ARDE, and NSTL. These products are used in various defence applications, including missiles, ammunition, and armour plating.

Aerospace:

Innomet also caters to the aerospace industry, supplying THA components to organizations like HAL, RCI, and DRDL. These components are used in aircraft, missiles, and helicopters for various purposes, including balancing weights, adjusting spares, and radiation shielding.

Radiation Shielding:

The company’s THA products are also used in radiation shielding applications by organizations such as BRIT, EBC, and BARC. These products are used to manufacture radiation shielding containers, syringe shields, and other components for medical, engineering, and industrial applications.

Other Industries:

Innomet’s metal powders and diamond tools are used in various other industries, including construction, engineering, automotive, and electronics. These products are used in applications such as diamond tools for cutting and processing stone and concrete, surface coatings for improving wear and corrosion resistance, and bulk drugs for faster reactions or as catalysts.

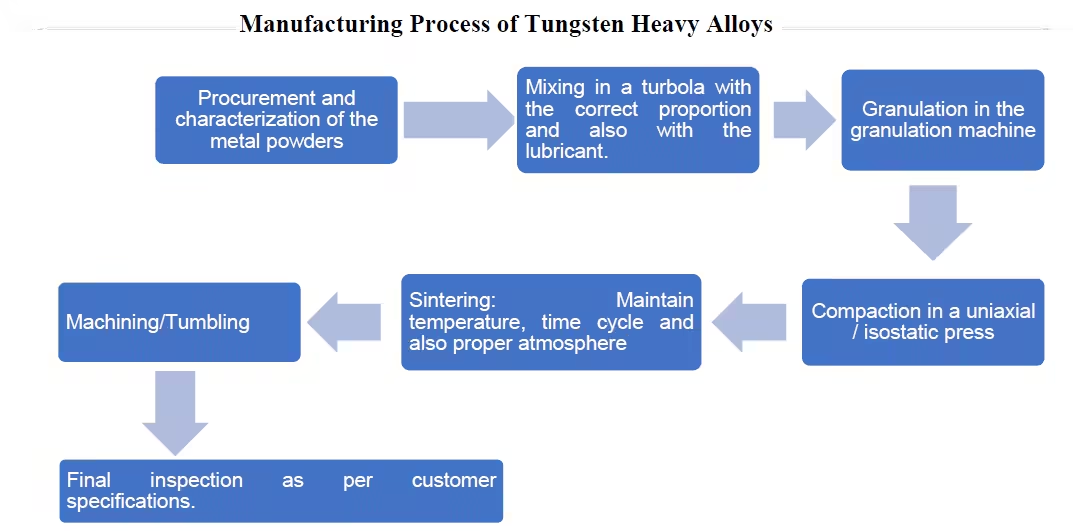

Manufacturing Process:

Atomization:

This process involves the conversion of molten metal into fine droplets, which solidify into powder form. Innomet utilizes both water and air atomization techniques to produce a wide range of metal powders.

Powder Metallurgy:

This process involves the production of metal parts or components by blending fine metal powders, compacting them into the desired shape, and then sintering them to achieve the required properties.

Raw Materials:

Metals:

The company utilizes various metals, including copper, bronze, brass, nickel, tin, stainless steel, tungsten, and their alloys, as the primary raw materials for its manufacturing processes.

Other Materials:

In addition to metals, Innomet also utilizes other materials, such as binders and solvents, in its powder metallurgy processes.

Suppliers:

Domestic Suppliers:

The company primarily sources its raw materials from domestic suppliers in India. For instance, the company sources tungsten from Swasteek Chemicals & Rare Metals in Maharashtra and Avis in Gujarat. Tungsten powder is sourced from Maharashtra and Gujarat states.

International Suppliers:

Innomet also sources some of its raw materials from international suppliers, particularly for specialized materials like tungsten.

Other Key Aspects:

The company collaborates with Indian research laboratories, such as those under the Defence Research and Development Organisation (DRDO) and the Council of Scientific and Industrial Research (CSIR), to develop and enhance its manufacturing processes and technologies. Sources and related content.

Industry Collaboration:

The company actively collaborates with leading scientists and research organizations in India. They have an MoU with IIT Madras for the development of ODS alloys and an agreement with ARCI Hyderabad to co-develop self-disinfecting paint.

New Product Development:

Innomet has a dedicated R&D unit for developing new products and improving existing ones. They work on creating customized grades of metal/alloy powders and have introduced over 20 products, including various Copper, Bronze, Brass, Nickel, Tin, and Stainless Steel powders.

Manufacturing Process Flowchart

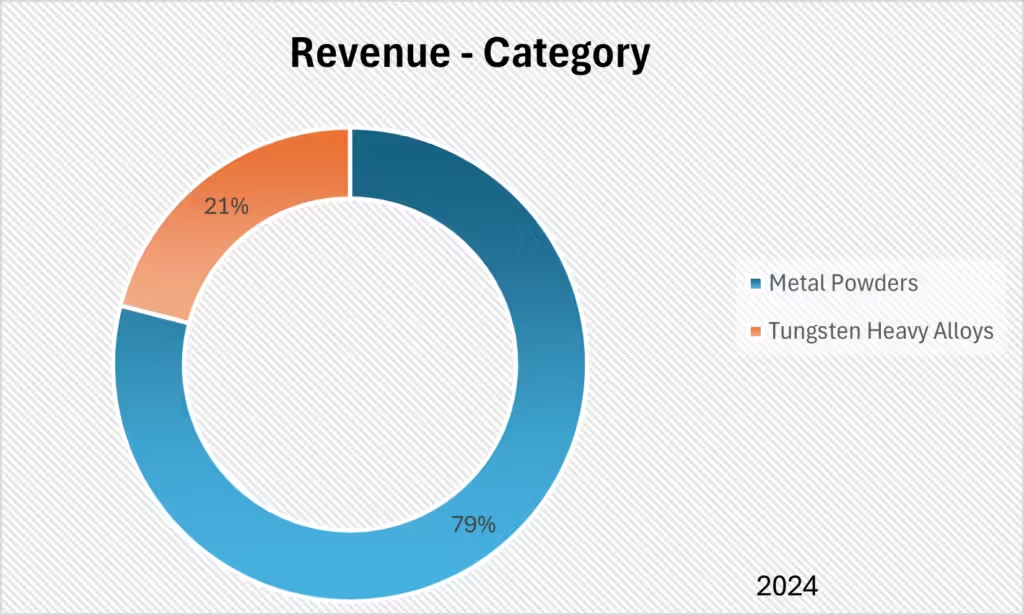

Revenue – Category

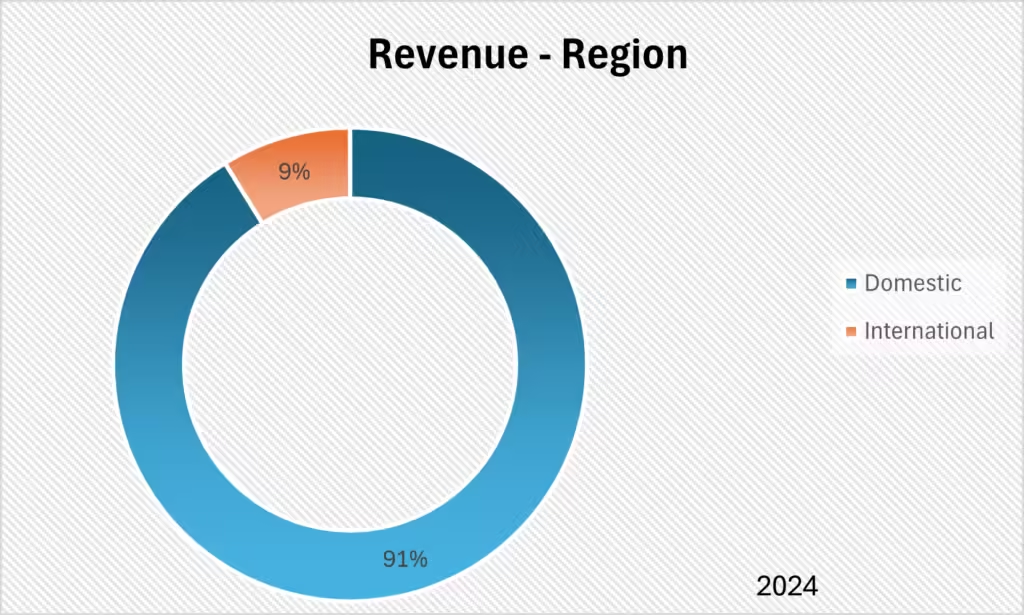

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors have issued an unqualified opinion on the company’s financial statements

Non-Compliances and Other Issues:

Delay in filing GST forms and EPF returns: The company has delayed filing certain GST forms and EPF returns in the past.

Non-compliance with Section 62(1)(a): The company wrongly allotted shares in terms of Section 62(1)(a) instead of Section 62(3) of the Companies Act, 2013.

Contingent Liabilities:

Innomet Advanced Materials Limited does not have any contingent liabilities as of March 31, 2024.

Legal Cases:

Cases Filed Against the Company

Cases Filed by the Company

Tax Proceedings against the Company:

Tax Demand Notice for A.Y. 2023-24:

The Income Tax Department issued a demand notice to Innomet Advanced Materials Limited on May 3, 2024, for the assessment year (A.Y.) 2023-24 demanding a payment of ₹1.06 Crore. This demand is currently pending payment by the company.

SWOT Analysis

Strengths

| Strong market position: Innomet is one of the few companies in India that manufactures metal powders, diamond tools, and tungsten heavy alloys. This gives the company a strong position in the market. |

| Wide range of products: The company offers a wide range of products, including ferrous and non-ferrous metal powders, tungsten heavy alloys, and diamond tools. This allows the company to cater to the needs of a variety of industries. |

| Focus on innovation: The company is committed to innovation and has a track record of developing new products and processes. This helps the company to stay ahead of the competition. |

Weaknesses

| Limited financial resources: The company has limited financial resources, which could restrict its ability to expand its operations and invest in new technologies. |

| Dependence on a few key customers: The company is dependent on a few key customers for a significant portion of its revenue. |

| Employee safety concerns: The company’s manufacturing process involves potentially dangerous circumstances for labourers. This could lead to legal and reputational issues for the company. |

Opportunities

| Growth in the Indian manufacturing industry: The Indian manufacturing industry is expected to grow significantly in the coming years. |

| Increasing adoption of powder metallurgy: Powder metallurgy is being increasingly adopted in various industries due to its advantages over traditional manufacturing processes. |

| Expansion into new markets: The company could expand its operations into new markets, both domestically and internationally. |

Threats

| Competition from domestic and international players: The company faces competition from both domestic and international players. This competition could put pressure on the company’s margins. |

| Fluctuations in raw material prices: The prices of raw materials, such as metals, could fluctuate significantly. This could impact the company’s profitability. |

| Economic slowdown: An economic slowdown in India or globally could impact the demand for the company’s products. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The industry requires significant capital investment and technical expertise, which can act as barriers to entry. However, the potential for high growth and profitability could attract new players. |

| Bargaining Power of Suppliers | LOW – MODERATE |

| The company sources raw materials from both domestic and international suppliers, reducing dependence on a single source. However, the specialized nature of some raw materials, such as tungsten, could give certain suppliers some leverage. |

| Bargaining Power of Buyers | MODERATE |

| The company serves a diverse customer base across various industries, reducing reliance on a single buyer. However, some customers, particularly in the defence and aerospace sectors, may have significant bargaining power due to the specialized nature of the products. |

| Threat of Substitute Products or Services | LOW – MODERATE |

| The company’s products, particularly tungsten and heavy alloys, have unique properties that make them difficult to substitute in certain applications. However, alternative materials and manufacturing processes could pose a threat in some sectors. |

| Rivalry Among Existing Competitors | MODERATE |

| The company faces competition from both domestic and international players. However, the specialized nature of the company’s products and its focus on innovation could help it maintain a competitive edge. |

Peer Comparison

There are no listed peers for Innomet Advanced Materials Limited to compare with.

Green Box

Specialized Products:

Innomet focuses on niche products like metal powders and tungsten heavy alloys, which require specialized expertise and have limited competition.

Import Substitution:

The company has a strong track record of developing import substitute products, catering to the growing demand for domestically sourced materials.

IPO Funds:

Working Capital:

To increase the company’s working capital to support its growing operations and expansion plans.

Capital Expenditure:

To invest in new machinery and equipment to increase production capacity and efficiency.

- Water Atomised Powders: The company intends to increase its installed capacity from 600 to 1400 Tonnes Per Annum (TPA).

- Gas Atomised Powders: The company plans to increase its installed capacity from 20 to 150 TPA.

Industry Outlook:

The global powder metallurgy market, which is the industry Innomet Advanced Materials Limited operates within, is expected to grow at a compound annual growth rate (CAGR) of 12.9% from 2023 to 2030. Sources and related content

Amber Box

Lack of Long-Term Contracts:

The absence of long-term agreements with suppliers and customers could lead to instability in sourcing raw materials or securing orders.

Capacity Utilization:

The current capacity utilization rate of the company varies across its product categories:

- Water Atomized Powders: 33.60%

- Air Atomized Powders: 1.07%

- Gas Atomized Powders: 0.10%

- Tungsten Heavy Alloys: 48.84%

The company expects to increase its capacity utilization significantly after the IPO by investing in raw materials, expanding marketing efforts, enhancing quality control, implementing ERP systems, expanding its team, and investing in lean manufacturing systems.

Debt-to-Equity Ratio: 0.90

Negative Operating Cash Flow:

The company has experienced negative cash flows from operating activities in FY 2022.

Red Box

Dependence on Key Customers:

A significant portion of Innomet’s revenue comes from a few key customers, particularly in the defence and aerospace sectors. This dependence makes the company vulnerable to changes in demand or policies of these major clients.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).