Gala Precision Engineering Limited

Company

| Website 🔗 |  |

| Business Activity | Manufacture |

| Division | Precision Engineering – Metal Forming and Stamping |

| Sub-class | Technical Springs and Fasteners |

| Location | Palghar, Maharashtra Sriperumbudur, Tamil Nadu |

| Establishment Year | 2009 |

Management

| Managing Director | Kirit Vishanji Gala |

| Educational Qualifications | Bachelor’s degree in Engineering (Mechanical) from University of Bombay (1984) Master’s degree in Management Studies from University of Bombay (1986) |

| Experience | Over three decades of experience in engineering and manufacturing |

| Annual Salary | ₹ 94.4 Lakhs |

| Total Number of Employees | 684 |

About

Gala Precision Engineering Limited specializes in the design and manufacture of precision engineering components. It has become a key player in the Indian market, providing original equipment manufacturers (OEMs) and Tier 1 companies with diverse technical springs and fastening solutions.

Products and Services:

Disc springs and strip springs:

These are essential for various applications, including those in the renewable energy, automotive, and railway industries. They play a crucial role in parts such as transaxles, hydraulic motors, torque limiters, dual-clutch, and hydraulic attachments.

Wedge lock washers:

These specialized washers provide secure fastening solutions, particularly in high-vibration environments.

Coil and spiral springs:

These are used in various industries, including automotive, off-highway vehicles, and industrial infrastructure.

Special fastening solutions:

These include anchor bolts, studs, and nuts, catering to specific needs in different sectors.

Clients:

Renewable energy:

Companies involved in wind turbine and hydropower plants.

Industrial:

Companies in the electrical, off-highway equipment, infrastructure, and general engineering sectors.

Mobility:

Companies in the automotive and railway industries.

Raw Materials:

The company’s primary raw material is steel, which it procures in various forms, such as coils, bars, wires, and flat sheets.

Suppliers:

They have a rigorous supplier qualification process to ensure the quality and reliability of the materials. Some of their key suppliers include leading steel mills in Europe, China, and South Korea from which approximately 20% of raw materials are imported.

In addition to its global sourcing strategy, Gala Precision Engineering Limited has a strong domestic supplier network, with 79 suppliers contributing to its raw material requirements.

Distribution Network:

Direct Distribution:

Gala Precision Engineering Limited directly supplies its products and services to Indian and global OEMs and Tier 1 companies.

Indirect Distribution:

In addition to direct sales, the company also utilizes indirect distribution channels, including distributors, sales representatives, and agents. These intermediaries help the company reach a wider customer base, particularly in international markets where it may not have a direct presence.

Export Distribution:

Gala Precision Engineering Limited has a significant export business, serving customers in over 25 countries, including major markets such as Germany, Denmark, China, Italy, Brazil, USA, Sweden, and Switzerland. The company’s export distribution network involves freight forwarders, shipping lines, and airlines to ensure the timely and efficient delivery of its products to international clients.

Revenue – Category

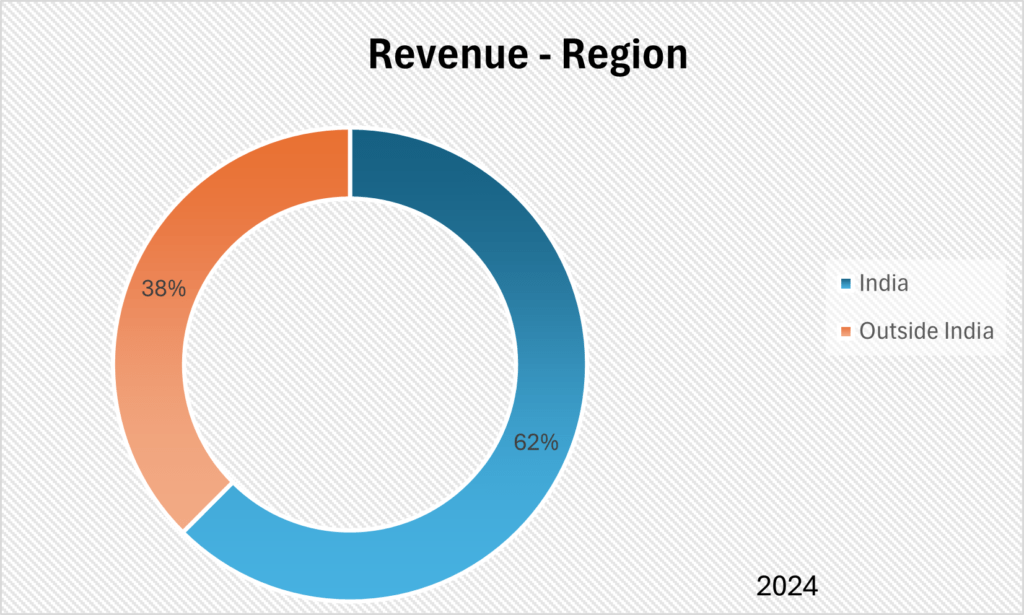

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors have issued an unqualified opinion on the company’s financial statements

Non-Compliances and Other Issues:

Delay in Payments:

There have been certain instances of delays in the payment of ESIC, PF, LWF and other statutory dues in the past by the company.

Contingent Liabilities:

As of March 31, 2024, Gala Precision Engineering Limited has reported the following contingent liabilities of ₹ 98.38 million in its financial statements:

| Particulars (in ₹ million) | As of March 31, 2024 |

| Disputed Income Tax Demands | 32.97 |

| Patent | 20 |

| Bank Guarantees | 7.96 |

| Letters of Credit | 37.45 |

| Total | 98.38 |

Legal Cases:

Cases Filed Against the Company

Patent Infringement Suit by Nord-Lock AB:

Gala Precision Engineering Limited is involved in a material civil litigation regarding a patent infringement suit which was filed against Gala Precision Engineering Private Limited and Gala Fasteners Private Limited by Nord-Lock AB and Nord-Lock (India) Private Limited before the High Court of Delhi on December 14, 2023. The Plaintiffs allege this infringement as a direct consequence of the Company’s manufacture, sale and advertisement of its washers under the brand name “Gallock Washers“.

Cases Filed by the Company

Tax Proceedings against the Company:

Nature of case: Direct Tax

Number of cases: 07

Amount Involved (in ₹ million ): 28.12

SWOT Analysis

Strengths

| Established Player with a Diverse Portfolio: Gala Precision Engineering Limited is a well-established player in the precision engineering components market, offering a diverse product portfolio that caters to a wide range of industries. |

| Strong Customer Relationships: The company boasts long-standing relationships with both Indian and global OEMs and Tier 1 companies. These relationships, some of which span over 15 years, highlight the company’s commitment to quality, reliability, and customer satisfaction. |

| Well-equipped manufacturing facilities with in-house design and production capabilities, offering scale, flexibility, and comprehensive solutions: The company’s manufacturing facilities are equipped with advanced machinery and technology, enabling it to produce high-quality precision components efficiently. |

| Consistent track record of financial growth and operational efficiency: The company has a proven track record of financial growth and profitability. Its ability to generate positive operating cash flows and maintain healthy profit margins indicates its financial strength and ability to fund its growth plans. |

Weaknesses

| Dependence on a few key customers and suppliers: While the company serves a diverse customer base, a significant portion of its revenue is still generated from a few key customers. Similarly, the company relies on a concentrated supplier base for its raw materials. |

| Relatively smaller scale compared to some large global competitors: Compared to some of its larger global competitors, Gala Precision Engineering Limited has a relatively smaller scale and geographical reach. This could limit the company’s ability to compete on price and volume, particularly in international markets where larger players may have greater economies of scale and resources. |

Opportunities

| Capitalize on the growth in key sectors, such as renewable energy, automotive, and railways: The industries that Gala Precision Engineering Limited serves are poised for significant growth in the coming years. |

| Expand into new product categories and geographical markets: The company can further diversify its product portfolio and expand into new geographical markets to reduce its reliance on existing products and markets. |

| Leverage technological advancements to enhance production processes and product offerings: The company can leverage technological advancements, such as automation and advanced manufacturing techniques, to enhance its production processes and product offerings. This can improve efficiency, reduce costs, and increase competitiveness. |

Threats

| Intense competition from domestic and international players: The precision engineering components market is highly competitive, with both domestic and international players vying for market share. |

| Fluctuations in raw material prices and exchange rates: The company is exposed to fluctuations in raw material prices, particularly steel, and exchange rates, which could impact its profitability. |

| Changes in technology and customer preferences: The precision engineering components industry is subject to rapid technological advancements and changing customer preferences. The company needs to adapt to these changes and continuously innovate to remain competitive. |

| Potential legal challenges and contingent liabilities: The company is involved in a patent infringement suit and has other contingent liabilities, which could result in financial losses or operational disruptions if the outcomes are unfavourable. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The precision engineering industry requires significant capital investment and technical expertise, presenting a barrier to entry. However, the potential for high returns could attract new players. |

| Bargaining Power of Suppliers | LOW |

| The company has a diversified supplier base and strong relationships with leading steel mills, reducing its reliance on any single supplier. |

| Bargaining Power of Buyers | MODERATE |

| The company serves a diverse customer base across various industries, reducing reliance on any single buyer. However, some large OEM customers may have greater bargaining power due to their size and influence. |

| Threat of Substitute Products or Services | LOW |

| Precision engineering components, such as technical springs and fasteners, are essential for the functionality of various systems and equipment, limiting the threat of direct substitutes. |

| Rivalry Among Existing Competitors | HIGH |

| The company faces intense competition from domestic and international players in the precision engineering components market. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers for FY 2024 is as follows:

| Particulars | Gala Precision Engineering Limited | Harsha Engineers International Limited | SKF India Limited | Sundram Fasteners Limited | Rolex Rings Limited | Sterling Tools Limited | Ratnaveer Precision Engineering Limited |

| Total Income (₹ in million) | 2043.77 | 14,217.90 | 46,641.40 | 57,204.70 | 12,368.19 | 9,385.11 | 6,024.00 |

| EBITDA margins (%) | 19.86 | 14.13 | 17.4 | 16.45 | 22.4 | 12.18 | 9.46 |

| PAT margin (%) | 11.89 | 7.84 | 11.83 | 9.19 | 12.62 | 5.9 | 5.15 |

| Return on Net Worth (%) | 23.27 | 9.48 | 20.57 | 15.37 | 17.37 | 12.38 | 12.32 |

Green Box

Research and Development:

Diversification of product portfolio:

The company has successfully expanded its product offerings from disc springs and strip springs to include coil and spiral springs in 2015 and special fastening solutions in 2018.

New product development:

The company has a dedicated product development team that has developed over 200 products for different technical springs and high-tensile fasteners in the past five years.

Positive Operating Cash Flow:

Gala Precision Engineering Limited has maintained a positive operating cash flow in the last three FY 2024, 2023 and 2022.

Market Position and Reputation:

Gala Precision Engineering Limited is a key player in the Indian market for precision engineering components. The company has a significant presence in the Indian disc spring market, particularly in the renewable energy industry, where it holds a dominant share.

IPO Funds:

Setting up a new manufacturing facility in Sriperumbudur, Tamil Nadu:

This expansion will allow the company to increase its production capacity, particularly for special fastening solutions, and better serve its customers in southern India. The new facility’s proximity to the port will also streamline export operations, reducing transportation costs and ensuring smoother deliveries to international clients.

Funding capital expenditure requirements for the existing facility in Wada, Maharashtra:

This investment will enhance the company’s capabilities in manufacturing hex bolts, improve operational efficiency, and upgrade its IT setup and quality control infrastructure. These improvements will strengthen the company’s core business and support its efforts to move up the value chain from niche markets to larger addressable markets.

Repayment/prepayment of certain borrowings:

Reducing the company’s debt burden will improve its financial position and enable it to utilize its accruals for further investments in business growth and expansion. This will also enhance the company’s leverage capacity, providing greater financial flexibility to pursue future business development opportunities.

Industry Outlook:

The precision component manufacturing industry is expected to grow at a CAGR of 6.1% during CY 2023-26. This growth is primarily attributed to the expansion of various end-user industries, including renewable energy, automotive, off-highway vehicles, and railways.

Amber Box

Legal Challenges:

The company is involved in a patent infringement suit, which could result in financial liabilities or disruptions to its operations if the outcome is unfavourable.

Exchange Rate Fluctuations:

The company’s export business exposes it to foreign exchange risks, as fluctuations in exchange rates could affect its profitability.

Capacity Utilization:

As of March 31, 2024, the capacity utilisation rate of Gala Precision Engineering Limited is as follows:

- Disc springs and strip springs facility: 84.84%

- Coil and spiral springs facility: 77.88%

- Special fastening solutions facility: 69.64%

Red Box

Competition:

The company faces intense competition from domestic and international players in the precision engineering components market, which could pressure profit margins and market share.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).