Exicom Tele-Systems Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Power Management |

| Sub-class | Telecom Power Systems, Electric Vehicle Chargers |

| Location | Solan, Himachal Pradesh Gurugram, Haryana. Maheshwaram, Telangana |

| Establishment Year | 1994 |

Management

| Managing Director | Anant Nahata |

| Educational Qualifications | Bachelor’s degree in Arts (Economics) from the University of Pennsylvania |

| Experience | Over 14 years in the power electronics industry. Previously associated with Credit Suisse and co-founded Koovs. |

| Annual Salary | ₹2 Crore, with additional perquisites (50% Base Salary) |

| Total Number of Employees | 1190 |

About

Overview:

Exicom Tele-Systems is a vertically integrated company with a strong presence in the power management solutions sector. It caters to the critical power needs of the telecom industry and is actively involved in the burgeoning EV charging infrastructure space in India.

Exicom has a strong presence in this market, holding a 16% market share in DC Power Systems and a 10% market share in Li-ion batteries for telecom applications in India.

Products and Services:

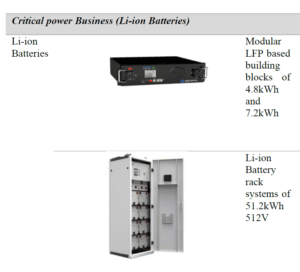

Critical Power Business:

DC Power Systems: Customized power solutions for telecom sites, central offices, and data centres.

Li-ion Batteries: Energy storage solutions for backup power and renewable energy integration.

EV Charger Business:

AC Chargers: Slow charging solutions for residential use.

DC Chargers: Fast charging solutions for commercial and public use.

Software Solutions: Charger management platforms (ChargeX) and mobile applications (SPIN Control) for enhanced user experience and network management.

Services:

The company offers a comprehensive range of services, including installation, commissioning, maintenance, spare parts support, and repair services. They have a dedicated service team and a pan-India service network.

Clients:

Critical Power Business: Telecom operators (Reliance Jio, BSNL, Maxis Telecom), tower companies (Indus Towers, American Tower Corporation), and data centres.

EV Charger Business: Automotive OEMs (Mahindra & Mahindra, MG Motors, JBM), CPOs (Jio-BP, Fortum), and fleet aggregators (BluSmart, Lithium).

Raw Materials:

Critical Power Business: Electronic components (semiconductors, ICs, diodes, resistors, capacitors), PCB assemblies, electrical and mechanical components (cable assemblies, switchgear components, plastic enclosures, metal parts, bus bars), and Li-ion battery packs and cells.

EV Charger Business: Similar to the Critical Power Business, focusing on EV charging technology components.

Exicom is recognized as an early entrant in the Indian EV charger manufacturing sector and holds a significant market share of 60% in the residential charging segment and 25% in the public charging segment.

Suppliers

Exicom sources its raw materials and key inputs from both global and domestic suppliers.

Global Suppliers: Located in China, Singapore, Hong Kong, South Korea, and other countries. They provide Li-ion cells and battery packs, semiconductors, rectifier modules, and other critical components.

Domestic Suppliers: They supply various electronic, electrical, and mechanical components.

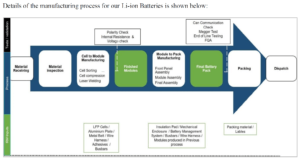

Manufacturing: Exicom has three manufacturing facilities in India, located in Solan and Gurugram. These facilities are equipped with advanced machinery and production lines for PCB assembly, power electronics production, and battery pack assembly.

Research and Development (R&D): The company has two dedicated R&D centres in Gurugram and Bengaluru, with a team of 145 engineers and specialists. They focus on power electronics design, firmware development, system engineering, EV charger advancements, and battery management systems

Work Flow Chart

Revenue – Category

Revenue – Region

Audit and Legal

Related Party Transactions:

Exicom Tele-Systems Limited does have related party transactions. For the six months ended September 30, 2023, these transactions amounted to ₹110.2 Crore. This represents 24.23% of the total revenue from operations for that period.

Material Uncertainty Related to Going Concern:

The auditors drew attention to the deficit in net assets of one subsidiary, Horizon Tele-Systems SDN BHD, at various reporting dates.

Standalone Financial Statements:

The auditors mentioned that they did not audit the standalone financial statements of certain subsidiaries and the company itself for specific periods. The audit reports for these entities were relied upon, which were audited by other auditors.

Auditors’ Report Statement on certain matters:

The quarterly returns/statements filed with banks were not in agreement with the unaudited books of accounts for the Financial for FY2022, 2023 as reported under the Companies (Auditor’s Report) Order, 2020.

Delayed Filings:

The company has a history of delays in submitting filings to the Registrar of Companies (RoC).

Untraceable Corporate Records:

The company is unable to locate share transfer forms related to the transfer of equity shares to its corporate promoter in the past.

Independent Directors lack experience in listed companies:

Except for one, none of the Independent Directors have prior experience serving on the board of a listed company. This could potentially limit their ability to provide effective oversight and guidance on compliance and governance matters specific to listed entities.

Contingent Liabilities:

Bank Guarantees: The company has bank guarantees issued on its behalf, totalling ₹38.5 Crores.

Sales Tax Disputes: The company faces potential liabilities of ₹2.65 Crore due to ongoing disputes with sales tax authorities in various states.

Show Cause Notice and Notice for Vacating Land:

District Industries Centre, Solan issued show cause notices in 2018 alleging that Exicom had constructed structures on additional land without permission and had encroached on the land. Despite Exicom’s responses and an earnest money deposit for the additional land, the General Manager issued a notice in 2019 to vacate the encroached land. The matter is currently pending for allotment of the additional land.

SWOT Analysis

Strengths

| Established Player in EV Charger Market: The company has an early-mover advantage and a strong market share in the rapidly growing Indian EV charger industry. |

| Strong R&D Capabilities: Exicom has two dedicated R&D centres and a focus on innovation, allowing it to develop new products and stay ahead of the curve. |

| Vertically Integrated Operations: The company controls the entire product development and manufacturing process, enabling cost efficiency and quality control. |

| Strong R&D Capabilities: Exicom has two dedicated R&D centers and a focus on innovation, allowing it to develop new products and stay ahead of the curve. |

| Established Customer Base: The company has long-standing relationships with key customers in the telecom and EV sectors. |

Weaknesses

| Dependence on Key Customers: A significant portion of revenue comes from a few major customers, posing a risk if these relationships are disrupted. |

| Dependence on Global Suppliers: The company relies on imports for certain raw materials and components, exposing it to supply chain disruptions and currency fluctuations. |

| Working Capital Requirements: The business is working capital intensive, requiring significant funds to manage inventory. |

Opportunities

| Data Centre Growth: The proliferation of data centres in India creates a growing market for Exicom’s energy storage solutions. |

| Expansion into New Markets: The company is actively exploring opportunities in Southeast Asia and Europe, which could fuel further growth. |

| Increasing Demand for Telecom Power Solutions: The growing demand for data services and 5G networks is driving the need for reliable power solutions, benefiting Exicom’s Critical Power Business. |

| Data Center Growth: The proliferation of data centers in India creates a growing market for Exicom’s energy storage solutions. |

| Government Initiatives: Favorable government policies and incentives for EVs and renewable energy could further boost demand for the company’s products |

Threats

| Regulatory Risks: The company operates in highly regulated industries, and any adverse changes in regulations could impact its operations and profitability. |

| Intense Competition: The power electronics and EV charger industries are highly competitive, with established players and new entrants vying for market share. |

| Technological Changes: Rapid technological advancements could render existing products obsolete or require significant investments in R&D to stay competitive. |

| Supply Chain Disruptions: Global events or disruptions in the supply chain could impact the availability and cost of raw materials and components. |

Porter’s Five Forces1

| Threat of New Entrants | LOW |

| The EV charger and telecom power solutions industries have high entry barriers due to the need for technological expertise, regulatory compliance, and established partnerships. |

| Bargaining Power of Suppliers | MODERATE |

| Exicom depends on global suppliers for critical components and raw materials, particularly Li-ion cells and battery packs. |

| Bargaining Power of Buyers | MODERATE |

| The company’s Critical Power Business relies heavily on a few major customers, including government entities and PSUs. In the EV Charger Business, the company caters to OEMs, CPOs, and fleet aggregators. |

| Threat of Substitute Products or Services | MODERATE |

| In the Critical Power Business, alternative energy storage technologies and power solutions could emerge as substitutes. In the EV Charger Business, advancements in battery technology or alternative charging methods could pose a threat. |

| Rivalry Among Existing Competitors | HIGH |

| The power electronics and EV charger industries are highly competitive, with established players and new entrants. Delta Electronics is a key competitor across both of Exicom’s business segments. |

Peer Comparison

Exicom considers Delta Electronics India as its key competitor across its revenue segments, while other companies in comparison are also in similar fields.

| Companies/ Particulars | Operati ng income (Rs million) | Operating EBITDA margin (%) | PAT margi n (%) | ROCE (%) | ROE (%) | Invent ory (days) | Debtor s (days) | Creditor s (days) |

| Delta Electronics India | 23,227 | 6.90% | 2.60% | 4.60% | 3.70% | 137 | 82 | 147 |

| Exicom Tele-Systems Limited | 7,154 | 8.30% | 4.30% | 17.70% | 15.50% | 71 | 166 | 199 |

| Vertiv Energy | 28,198 | 11.50% | 7.70% | 61.40% | 42.90% | 47 | 71 | 144 |

| Vrinda Nano Technologies | 36902 | 4.00% | 3.00% | 40.80% | 59.90% | 78 | 67 | 146 |

| Aptiv Power | 36,972 | 17.00% | 10.00% | 49.90% | 34.60% | 35 | 75 | 112 |

| HBL Power Systems Limited | 13,718 | 11.90% | 7.10% | 14.40% | 11.30% | 104 | 80 | 43 |

| Servotech Power Systems | 2,785 | 6.80% | 3.90% | 17.80% | 17.30% | 29 | 118 | 37 |

Green Box

Capacity Expansion:

The company’s primary capacity expansion is through the establishment of the Planned Telangana Facility of 74,475.40 sq. mts. The facility will house production/assembly lines for both Critical Power and EV Charger businesses, as well as a dedicated Prismatic production/assembly line for Li-ion Batteries.

Industry Outlook from 2023-28:

The DC power systems market is projected to expand at a CAGR of 8.5%. The energy storage solutions market, particularly for Li-ion batteries, is anticipated to witness a projected CAGR of 13.5% from 2023 to 2028.

Electric Vehicle (EV) Charging Infrastructure Market: The EV charging market in India is experiencing rapid expansion due to the increasing adoption of electric vehicles. The market is projected to grow at a CAGR of 55-60% between 2023 and 2028

R&D Expenditure:

Exicom has consistently invested in R&D, with expenses ranging from 1.80% to 2.85% of total revenue from operations in the past three fiscal years.

Product Development and Commercialization: The company has a track record of successful product development, having developed and commercialized 16 products in the past three financial years. This demonstrates the effectiveness of its R&D efforts in translating research into marketable products.

Growing Demand for Telecom Power Solutions:

The increasing demand for data services and the rollout of 5G networks are expected to drive the need for reliable and efficient power solutions for telecom infrastructure.

Data Centre Expansion:

The rapid proliferation of data centres in India creates a growing market for energy storage solutions. Exicom’s Li-ion batteries, customized for data centre applications, can cater to this increasing demand and contribute to the company’s growth.

Diversified Product Portfolio:

Exicom offers a wide range of AC and DC chargers, catering to diverse customer needs across residential, commercial, and public charging segments. This diversified portfolio allows the company to tap into various market opportunities and expand its customer base.

Vertically Integrated Operations:

Exicom’s control over the entire product development and manufacturing process allows for cost efficiency, quality control, and faster response to market changes.

Channel Partners and Distributors:

Exicom has established partnerships with third-party distributors and value-add resellers in foreign markets. These partners help market and sell the company’s EV chargers, particularly in Southeast Asia.

International Sales Teams:

The company has sales teams located in key international locations, including Manchester (UK), Amsterdam (Netherlands), Singapore, Kuala Lumpur (Malaysia), Jakarta (Indonesia), Dubai (UAE), Lagos (Nigeria), and Dar es Salaam (Tanzania).

Amber Box

Operating Cash Flow:

While there have been instances of negative operating cash flow, the company has demonstrated a positive trend in recent periods.

Environmental Regulations:

The company’s manufacturing processes involve the use of hazardous materials, making it subject to various environmental laws and regulations. Non-compliance with these regulations could lead to penalties, legal action, or even the shutdown of manufacturing facilities.

The net debt to equity ratio (0.11) and total borrowings to total equity ratio (0.23) are both relatively low, suggesting that the company is not heavily reliant on debt financing and has a healthy capital structure.

Red Box

Key Negatives:

1. Customer Concentration

2. Dependence on Global Suppliers

3. Working Capital Intensity

4. Competition

Images

- For Porter’s Five Forces, the force value of “LOW” is considered good. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).