Danish Power Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Electrical Equipment |

| Sub-class | Transformers |

| Location | Jaipur, Rajasthan |

| Establishment Year | 1985 |

Management

| Managing Director | Shivam Talwar |

| Educational Qualifications | Bachelor of Engineering with Honours in Electrical & Electronic Engineering |

| Experience | Over 17 years of experience in the transformer manufacturing industry |

| Annual Salary | ₹ 355.7 Lakhs |

| Total Number of Employees | 346 |

About

Danish Power Limited is an Indian manufacturer specializing in producing a wide range of transformers, including inverter duty transformers, distribution transformers, and power transformers, catering to various sectors in the power industry.

Products and Services:

Inverter Duty Transformers (multi-winding) up to 20 MVA 33 kV Class for Solar Power Plants & WTG Duty Transformers for Wind Power Plants:

These transformers, ranging from 500 kVA to 18,000 kVA with voltages up to 33 kV, are designed to step up voltage levels after the solar inverter or wind turbine generator.

Distribution Transformers up to 5 MVA 33 kV Class:

These transformers, ranging from 50 kVA to 5,000 kVA with voltages up to 33 kV, are designed to step down voltage levels for distribution networks, ensuring a smooth electricity supply to end-users. They are widely used in various settings, including commercial buildings, residential colonies, and factories. The company offers both mineral oil and ester fluid-filled distribution transformers, catering to diverse customer needs and environmental considerations.

Dry Type Cast Resin Transformers up to 5 MVA 33 kV Class:

These transformers, ranging from 100 kVA to 5,000 kVA with voltages up to 33 kV, are designed for oil-free operation, making them suitable for indoor installations and populated areas such as airports, malls, railway stations, and high-rise buildings. Their dry-type construction enhances safety and reduces environmental concerns associated with oil spills or leaks.

Power Transformers up to 63 MVA 132 kV Class:

These transformers, ranging from 5 MVA with 33 kV to 63 MVA with 132 kV, are designed for high-voltage applications, stepping up or down voltage levels at HV substations. They are used in power substations at various stages of power generation and transmission-distribution.

Control Relay Panels (CRP) up to 400 kV Class:

These panels, also known as protection panels, are installed in high-voltage (HV) and extra-high-voltage (EHV) substations to detect faults and protect critical substation equipment like transformers and feeders. They are designed for substations with voltages ranging from 11 kV to 400 kV, ensuring the safety and reliability of power infrastructure.

Substation Automation System (SCADA):

This system provides centralized monitoring and control of substations and power equipment. It comprises automation panels with relays, computers, networked data communications, and graphical user interfaces, enabling real-time data acquisition, analysis, and control for efficient power management.

Clients:

Renewable Power EPC Projects:

- Solar power plants and wind power farms.

- EPC contractors specializing in renewable energy projects.

Power Generation Plants:

- Conventional power plants using coal, gas, or other energy sources.

- Power generation companies and utilities.

Power Transmission and Distribution:

- Power transmission companies and utilities.

- Electricity substations and distribution networks.

Other Industries:

- Large industrial consumers of electricity.

- Manufacturing plants, data centres, and other commercial facilities.

Raw Materials:

CRGO Electrical Steel:

Used for making core assemblies in transformers, and creating a magnetic circuit.

Copper and Aluminum Wire/Strip/Sheet:

Used for making windings in transformers to conduct electrical current.

Mild Steel:

Used for making transformer tanks, radiators, and panel enclosures.

Transformer Oil:

Used as an insulating and cooling fluid in transformers.

Relays:

Used to provide protection features in control relay panels.

Suppliers:

The company sources its raw materials from various suppliers, both domestic and international.

Distribution Network:

The company has a pan-India presence, serving customers across various states. It has established a strong network of distributors and channel partners to reach its diverse customer base. The company also exports its products to several countries, further expanding its market reach.

Other Key Aspects:

Certifications:

ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 for quality, environmental, and occupational health and safety management systems.

Accreditation:

NABL accreditation for the company’s testing laboratory, ensuring accurate and reliable testing capabilities.

Awards:

EEPC National Award for Export Excellence in the product group of transformers for three consecutive years.

One Star Export House Status:

Awarded by the Government of India, recognizing the company’s export capabilities.

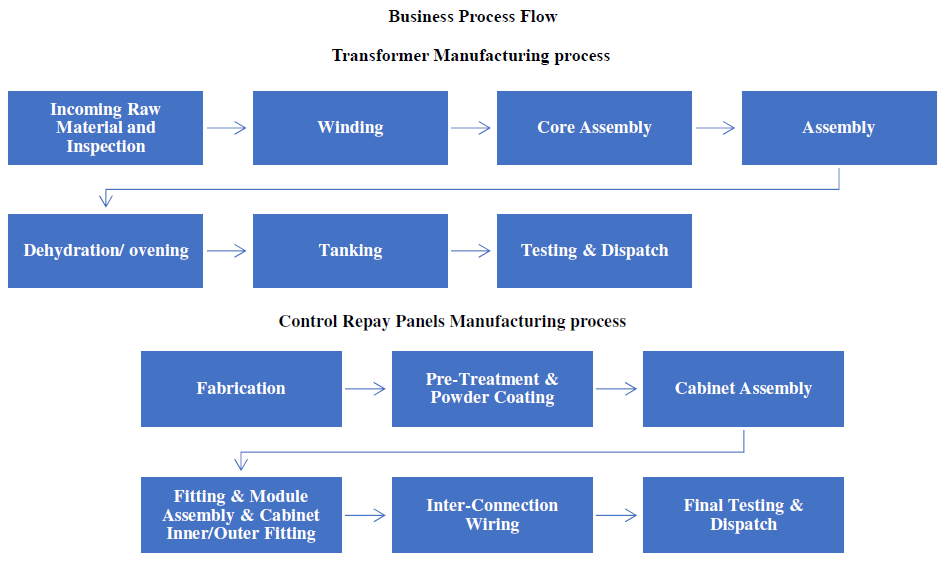

Manufacturing Process Flowchart

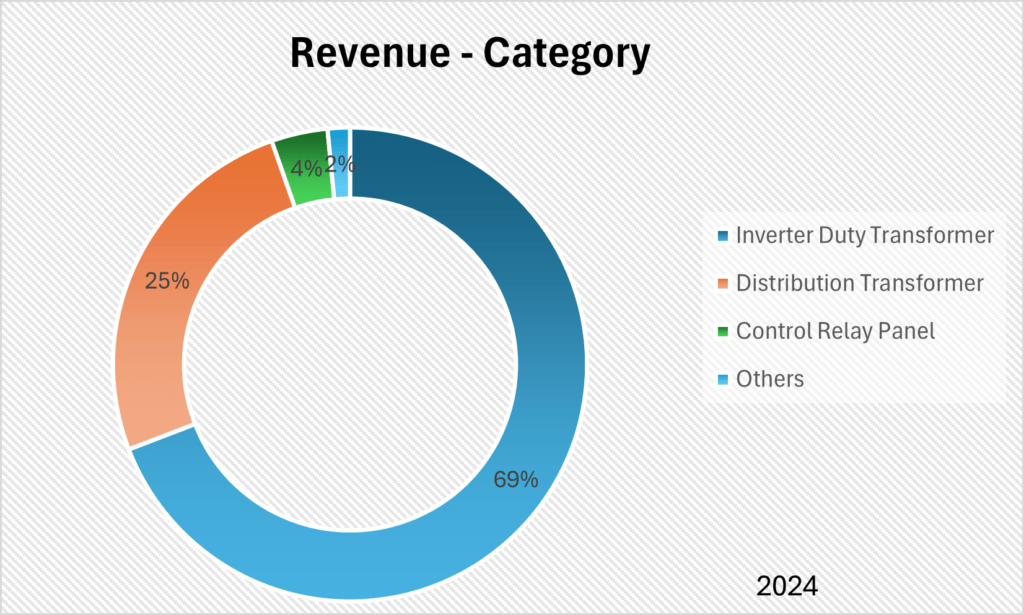

Revenue – Category

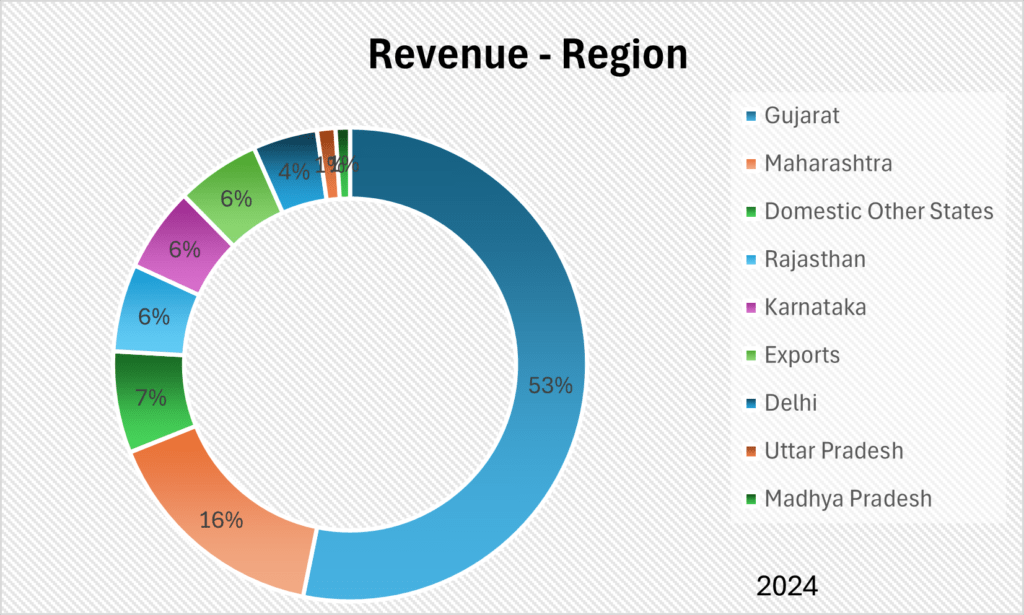

Revenue – Region

Audit and Legal

Auditor’s Remarks:

There are no auditor’s remarks or qualifications in the company’s latest financial statements.

Non-Compliances and Other Issues:

Failure to Submit Cost Audit Report on Time:

A show cause notice was issued on August 28, 2023, for the failure to submit the cost audit report for the financial year ending March 31, 2020, on time.

Incorrect Share Transfer List in Annual Return:

In the annual return for the year 2022-2023, the company incorrectly filed the share transfer list of shareholders, but this error has been corrected.

Contingent Liabilities:

The company has contingent liabilities of Rs. 5585.61 lakhs as of June 30, 2024, mostly comprising bank guarantees.

Legal Cases:

Cases Filed Against the Company

Cases Filed by the Company

Cases related to the MSMED Act:

Danish Power Limited has filed multiple cases against various government power transmission companies including Jaipur Vidyut Vitran Nigam Limited (JVVNL) and Ajmer Vidyut Vitran Nigam Limited (AVVNL) for delayed payments before the Micro & Small Enterprises Facilitation Council under Section 18 of the Micro, Small and Medium Enterprises Development Act, 2006 (“MSMED Act”) claiming an interest amount of Rs. 2 Crores approximately.

Tax Proceedings against the Company:

Tax Proceedings:

The company is involved in tax proceedings related to the disallowance of expenditure under the Income Tax Act, 1961.

Direct Tax:

Nature of Proceedings: TDS Defaults

No. of cases: 6

Amount involved (Rs. in lakhs): 52.82

SWOT Analysis

Strengths

| Established manufacturing facilities with modern equipment and a skilled workforce. |

| Strong focus on quality assurance and customer satisfaction. |

| Diversified product portfolio catering to various sectors in the power industry. |

Weaknesses

| Dependence on a few key customers for a significant portion of revenue. |

| Lack of long-term contracts with suppliers and customers, leading to potential instability. |

| Vulnerability to fluctuations in raw material prices and exchange rates. |

Opportunities

| Expanding geographical reach and market share in the growing power sector. |

| Capitalizing on the increasing demand for renewable energy products and solutions. |

| Developing new and innovative products to cater to evolving industry needs. |

Threats

| Intense competition from domestic and international players in the transformer industry. |

| An economic slowdown or recession impacts the demand for the company’s products. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The transformer industry requires significant capital investment, technical expertise, and compliance with stringent quality and safety standards, creating barriers for new entrants. |

| Bargaining Power of Suppliers | LOW – MODERATE |

| The company has a diversified supplier base, reducing the bargaining power of individual suppliers. However, the supply and prices of key raw materials like CRGO steel and copper can be volatile, impacting the company’s profitability. |

| Bargaining Power of Buyers | MODERATE |

| The company serves a mix of large and small customers, with varying degrees of bargaining power. Large customers, such as power generation companies and EPC contractors, may have greater negotiating leverage due to their order volumes. |

| Threat of Substitute Products or Services | LOW |

| There are limited direct substitutes for transformers in power generation, transmission, and distribution applications. |

| Rivalry Among Existing Competitors | HIGH |

| The transformer industry is highly competitive, with the presence of several large and established players, both domestically and internationally. Companies compete on factors such as price, quality, delivery time, and customer service. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers for FY 2024 is as follows:

| Metric | Danish Power Limited | Indo Tech Transformers Limited | Shilchar Technologies Limited | Voltamp Transformers Limited |

| Revenue from Operations (₹ Lakhs) | 33,247 | 50,361 | 39,687 | 1,61,622 |

| EBITDA (₹ Lakhs) | 5371 | 5959 | 11,309 | 32,234 |

| EBITDA Margin (%) | 16.16% | 11.83% | 28.49% | 19.94% |

| Profit After Tax (PAT) (₹ Lakhs) | 3807 | 4686 | 9,188 | 30,736 |

| PAT Margin (%) | 11.45% | 9.30% | 23.15% | 18.02% |

| ROE (%) | 60.35% | 24.15% | 55.52% | 24.98% |

| ROCE (%) | 56.98% | 30.64% | 74.51% | 29.35% |

Green Box

Positive Operating Cash Flow:

The company has maintained a positive operating cash flow in recent years, indicating its ability to generate cash from its core business operations.

Focus on Quality and Customer Satisfaction:

Danish Power Limited places a strong emphasis on quality assurance and customer satisfaction. The company has implemented stringent quality control measures throughout its production process, ensuring that its products meet the highest quality standards.

Commitment to Innovation:

The company is committed to innovation and technology adoption, ensuring its competitiveness in the industry. It has successfully introduced ester fluid-filled transformers, which are more environmentally friendly and energy-efficient. The company also focuses on making its products more energy-efficient, as demonstrated by its achievement of the 2 Star rating for distribution transformers under the Bureau of Energy Efficiency (BEE) program.

IPO Funds:

Funding capital expenditure for the expansion of manufacturing facilities. Meeting working capital requirements to support business growth. Repayment of certain borrowings to reduce debt and improve financial flexibility.

| Particulars | Amount (Rs. in Lacs) |

| Funding capital expenditure towards the expansion of the manufacturing facility of the Company by building of factory shed and installation of additional plant and machinery therein | 3699.47 |

| To meet working capital requirements | 8500.00 |

| Repayment of certain borrowing availed by the company, in part or full | 2,000.00 |

Industry Outlook:

The electrical equipment industry in India is expected to grow at a robust CAGR of 11.68% from 2022 to 2027

Amber Box

Dependence on Key Customers:

The company derives a significant portion of its revenue from a few key customers. In the year ended June 30, 2024, the company’s top ten customers accounted for 88.04% of its revenue from operations. This dependence on a few key customers poses a risk to the company’s financial performance if these relationships are disrupted or if these customers reduce their order volumes.

Capacity Utilization:

The company’s current capacity utilization rate is approximately 81% for transformers and 72% for control relay panels.

Red Box

Vulnerability to Fluctuations:

The company is vulnerable to fluctuations in raw material prices and exchange rates. The prices of key raw materials, such as CRGO steel and copper, can be volatile, impacting the company’s profitability. Additionally, the company’s export business is exposed to fluctuations in foreign currency exchange rates, which can affect its export margins and overall profitability.

Smaller scale and capital base compared to some larger international competitors, potentially limiting its ability to compete on price or undertake large-scale projects.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).