Archit Nuwood Industries Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Wood based Panels |

| Sub-class | MDF, HDF boards Pre laminated sheets |

| Location | Tohana, Haryana |

| Establishment Year | 2017 |

Management

| Managing Director | Vinod Kumar Singla |

| Educational Qualifications | Bachelor of Arts |

| Experience | 12+ years |

| Annual Salary | 12 Lakhs |

| Total Number of Employees | 149 |

About

Overview:

Archit Nuwood Industries Limited is primarily engaged in the manufacturing and marketing of Medium-Density Fiberboards (MDF) and High-Density Fiberboards (HDF). The company also offers pre–laminated MDF and HDF boards, adding value to its core products.

Products and Services:

Medium-Density Fiberboards (MDF): These are versatile wood-based panels used in various applications, including furniture, cabinetry, and interior decoration.

High-Density Fiberboards (HDF): These are denser and stronger than MDF boards, making them suitable for applications requiring higher strength and durability, such as flooring and wall panelling.

Pre-laminated MDF and HDF boards: These are value-added products that come with a decorative laminate layer, offering enhanced aesthetics and protection.

Raw Materials Used:

Wood: This is the primary raw material used to produce fibres for MDF and HDF boards.

Agro-based residues: These include agricultural waste products like rice husk, sugarcane bagasse, and cotton stalks, which serve as alternative sources of fibre.

Resins: These are used as binders to hold the fibres together in the panels.

Additives: These include chemicals like wax, hardeners, and fire retardants, which are added to improve the properties of the panels.

Suppliers:

The company sources its raw materials from a network of suppliers, including Wood suppliers and Agro-residue suppliers from a network of suppliers located close to its manufacturing unit and Chemical suppliers.

Clients:

Furniture manufacturers (primary consumers of MDF and HDF boards), Interior designers and decorators, Construction companies, Retailers and Distributors.

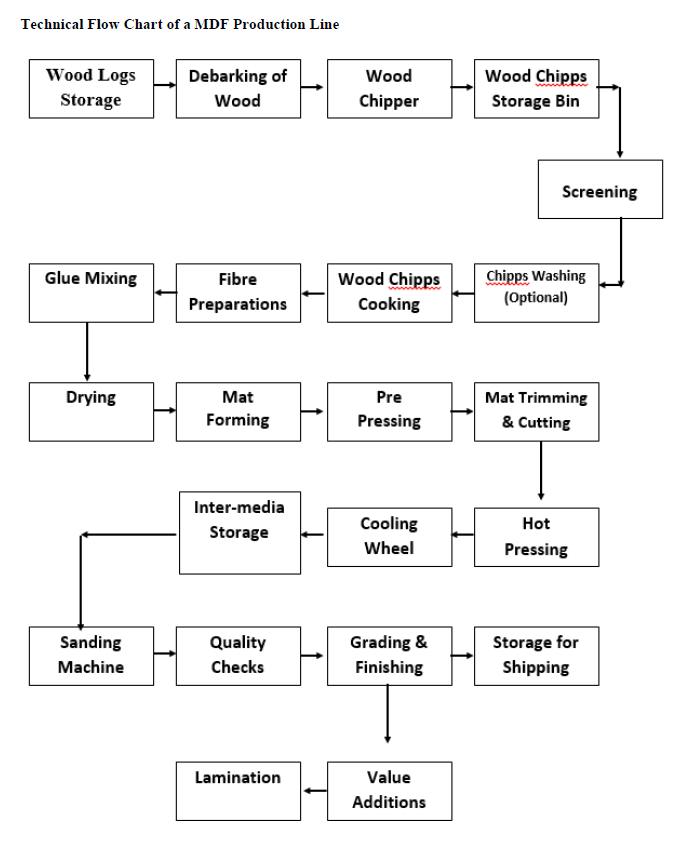

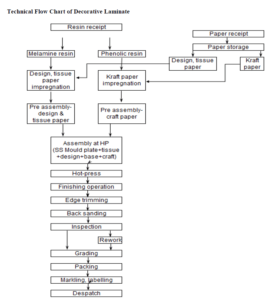

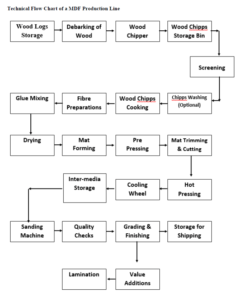

Work Flow Chart

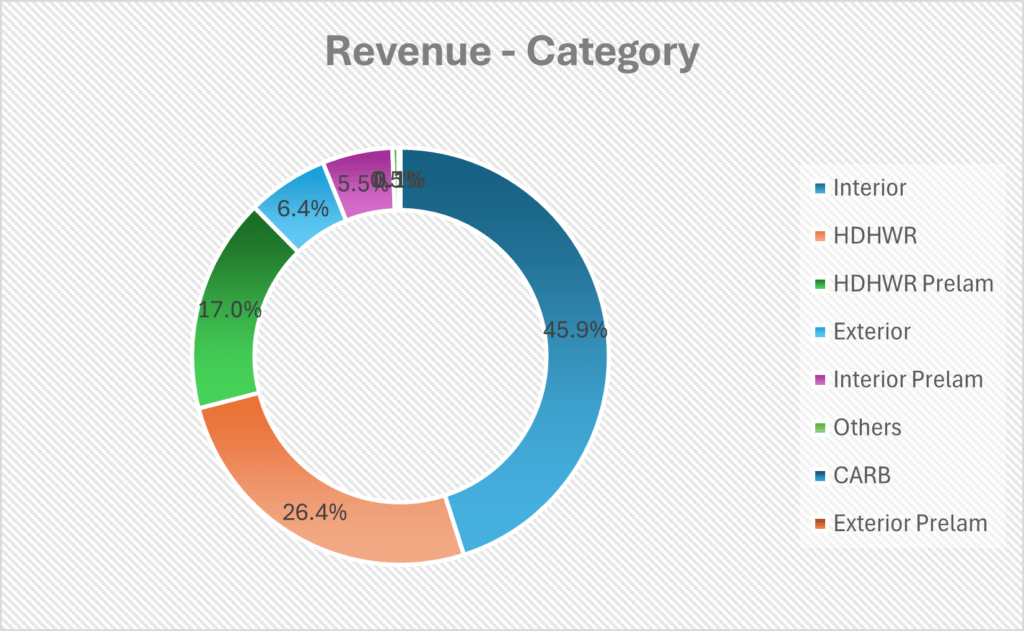

Revenue – Category

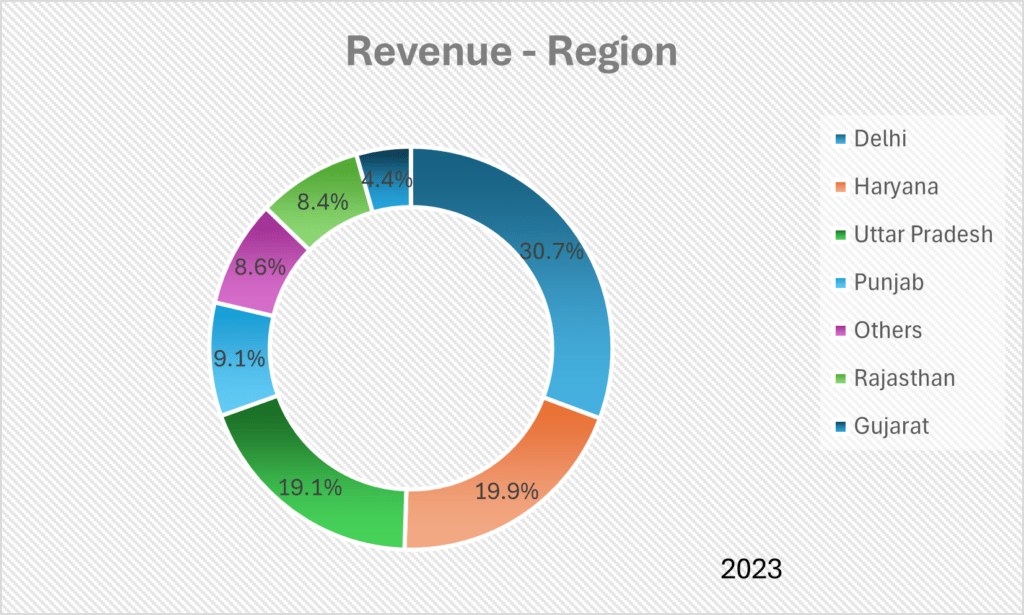

Revenue – Region

Audit and Legal

Related Party Transactions:

The company has engaged in related party transactions, primarily involving loans from directors and job work expenses paid to its wholly-owned subsidiary, Archit Panels Private Limited, these transactions represent approximately 9.65% of the total revenue.

Auditor’s Remarks:

Auditors found the financial information to be fairly presented in accordance with the applicable accounting standards.

Contingent Liabilities:

As per the restated financial statements, the company does not have any contingent liabilities.

Legal Proceeding:

One of the promoters, Mr. Vinod Kumar Singla, is involved in a legal proceeding regarding a GST penalty imposed by the authorities. He has filed a civil writ petition seeking a refund of ₹10 Crore, allegedly wrongly recovered from him.

SWOT Analysis

Strengths

| Strategic Location of Production Facilities: The company’s manufacturing unit is situated near the source of raw materials, reducing transportation costs and ensuring a consistent supply. |

| High-Quality Products: The company focuses on producing MDF and HDF boards that meet stringent quality standards, enhancing its brand reputation and customer loyalty. |

| Diverse Product Range: The company offers a variety of MDF and HDF boards, including pre-laminated options, catering to different customer segments and market needs. |

| Strong Customer Base: The company has established relationships with a large number of dealers and clients, ensuring a steady demand for its products. |

Weaknesses

| Lack of Pricing Power: As MDF and HDF boards are commodity products, the company may have limited control over pricing, impacting its profitability in a competitive market. |

| Dependence on a Few Suppliers: The company relies on a limited number of suppliers for its raw material needs, making it vulnerable to supply disruptions and price fluctuations. |

Opportunities

| Industry Growth Potential: The Indian MDF and HDF industry is expected to grow significantly in the coming years, driven by increasing demand from various sectors. |

| Backward and Forward Integration: The company can consider integrating its operations backward into raw material procurement and forward into finished product manufacturing to enhance its control over the supply chain and increase its profit margins. |

Threats

| Intense Competition: The MDF and HDF industry is highly competitive, with the presence of both organized and unorganized players, leading to price pressures and margin erosion. |

| Entry of New Players: The low entry barriers in the industry may attract new entrants, further intensifying competition and impacting the company’s market share. |

| Fluctuating Raw Material Prices: The prices of wood and other raw materials are subject to fluctuations, impacting the company’s production costs and profitability. |

| Climatic Conditions: Adverse weather conditions can disrupt the supply of raw materials and impact the company’s production and delivery schedules. |

Porter’s Five Forces1

| Threat of New Entrants | HIGH |

| The low entry barriers in the industry, coupled with the relatively low capital requirements for setting up manufacturing units, make it susceptible to new entrants, increasing competition and potentially impacting the company’s market share and profitability. |

| Bargaining Power of Suppliers | MODERATE |

| The company relies on a limited number of suppliers for its raw material needs, giving them some bargaining power. However, the availability of alternative suppliers and the company’s long-term relationships with its existing suppliers mitigate this risk to some extent. |

| Bargaining Power of Buyers | HIGH |

| The buyers in the MDF and HDF industry, particularly large furniture manufacturers and construction companies have significant bargaining power due to the availability of alternative suppliers of the products. |

| Threat of Substitute Products or Services | MODERATE |

| While there are substitute products available in the market, such as plywood and particle board, MDF and HDF boards offer distinct advantages in terms of versatility, affordability, and ease of use, limiting the threat of substitutes to some extent. |

| Rivalry Among Existing Competitors | HIGH |

| The MDF and HDF industry is highly competitive, with the presence of numerous players, both organized and unorganized. This leads to intense price competition, margin pressures, and the need for continuous innovation and differentiation to maintain market share. |

Peer Comparison

Revenue: Archit Nuwood’s revenue is significantly smaller than its peers, indicating a considerably smaller market presence.

Efficiency (ROE & ROCE): Archit Nuwood outperforms its peers in terms of generating returns on equity and capital employed, highlighting efficient resource utilization.

Peer Comparison – Financial Metrics (INR Crores)

| Metric | Archit Nuwood | Rushil Decor | Century Plyboards |

| Revenue from Operations | 152.33 | 839.77 | 3665.78 |

| EBITDA Margin (%) | 20.84% | 17.82% | 14.64% |

| PAT Margin (%) | 13.97% | 9.26% | 10.01% |

| RoE (%) | 82.07% | 21.37% | 18.98% |

| RoCE (%) | 79.14% | 19.50% | 23.57% |

Green Box

Investment in Subsidiary: The company plans to infuse a substantial portion of the net proceeds, into its wholly-owned subsidiary, Archit Panels Private Limited (APPL), to establish a new manufacturing unit for MDF and HDF boards.

Capacity utilization:

The company’s existing MDF manufacturing unit in Tohana, Haryana, is operating at its maximum production capacity, suggesting strong demand for its products and efficient utilization of its existing resources.

The MDF and HDF industry in India is poised for significant growth in the coming years. The market is projected to expand at a CAGR of 15-20%.

Rising Demand from End-Use Sectors: The increasing demand for MDF and HDF boards from various sectors, such as furniture, construction, and interior decoration, is a key driver of industry growth.

Shift from Plywood to MDF: The gradual shift in consumer preference from plywood to MDF, due to its versatility, affordability, and eco-friendliness, is expected to contribute significantly to market expansion. The MDF to plywood consumption ratio in India, currently skewed at 20:80, is anticipated to improve, creating ample room for MDF growth in the future.

The consolidated statement of cash flows reveals a positive net cash generated from operating activities for recent years.

Distribution Network:

Archit Nuwood Industries Limited has established a robust distribution network comprising a large number of dealers spread across various regions in India. The company’s strategic focus on expanding its distribution network, particularly in smaller towns and rural areas, is aimed at increasing its market penetration and reaching a wider customer base.

Amber Box

Environmental Regulations: The company’s manufacturing processes involve the use of wood and other raw materials, which could be subject to stringent environmental regulations.

Labour Laws: The company employs a significant workforce, both directly and through contractors. Any changes in labour laws, such as minimum wage revisions, regulations on working conditions, or unionization, could increase the company’s labour costs and affect its profitability.

Debt-to-Equity Ratio: The company’s debt-to-equity ratio as of October 31, 2023, was 0.70. This suggests a moderate level of leverage, which could be manageable if the company maintains healthy profitability and cash flows.

Cyclical Nature of the Industry: The demand for MDF and HDF boards is influenced by the performance of the real estate and construction sectors, which are cyclical. Any downturn in these sectors could adversely affect the company’s sales and profitability.

Red Box

Limited Operating History: The company has a relatively short operating history, having commenced commercial production in 2019. This limited track record may make it challenging to assess its long-term sustainability and growth potential, particularly in a competitive and dynamic market.

Working Capital Intensive: The company’s operations require significant working capital, primarily for inventory and receivables management. Any inefficiencies in managing working capital could lead to liquidity constraints and impact the company’s financial health.

Factory License: The company’s subsidiary is awaiting a Factory License, and any delays or complications in obtaining this license could pose regulatory challenges and disrupt the company’s expansion plans.

Competition: The MDF and HDF industry is highly competitive, with the presence of numerous players, both organized and unorganized. This intense competition could lead to price pressures, margin erosion, and challenges in maintaining market share.

Images

- For Porter’s Five Forces, the force value of “LOW” is considered good. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).