Anya Polytech & Fertilizers Limited

Company

| Website 🔗 |  |

| Business Activity | Manufacture / Trade |

| Division | Packaging, Fertilizers |

| Sub-class | HDPE/PP Bags, Zinc Sulphate |

| Location | Shahjahanpur, Uttar Pradesh |

| Establishment Year | 2011 |

Management

| Managing Director | Yashpal Singh Yadav |

| Educational Qualifications | Bachelor of Engineering from Delhi University in 2008, Export Management program from Indian Institute of Management & Foreign Trade in 2009, Post-Graduation in Management from European School of Management in 2012. |

| Experience | Over 12 years of experience in the plastic packaging and fertilizer industries |

| Annual Salary | ₹ 27.70 Lakhs |

| Total Number of Employees | 114 |

About

Anya Polytech & Fertilizers Limited is an Indian manufacturer specializing in the production of high-density polyethylene (HDPE) and polypropylene (PP) bags, as well as zinc sulfate fertilizers. The company also trades in various other fertilizers and agricultural products.

Products and Services:

HDPE/PP Bags:

These bags are commonly used for the packaging of commodities such as food grains, sugar, urea, and cement. They are a cost-effective and efficient alternative to traditional jute bags, offering superior performance in terms of:

- Seepage loss prevention

- Moisture resistance

- Water, insect, and rodent resistance

- Food grain safety

Zinc Sulfate Fertilizers:

The company offers zinc sulfate fertilizers in two forms:

- Monohydrate: Used in the veterinary and poultry industries for various formulations.

- Heptahydrate: Used as a fertilizer to correct zinc deficiencies in soils, promoting plant growth and nutrient absorption.

Other Agricultural Products:

The company also manufactures and trades in other agricultural products, including:

- Anya Bhuposhak: A seaweed extract used as an organic fertilizer.

- Anya Super Dhan: A granulated organic super potash fertilizer.

- Anya Phospho King: A phosphate-rich organic manure.

Clients:

Agriculture:

Farmers and agricultural businesses use the company’s fertilizers and other agricultural products.

Packaging:

Companies involved in the packaging of commodities such as food grains, sugar, urea, and cement, utilizing the company’s HDPE and PP bags.

Veterinary and Poultry:

Businesses in these sectors use the company’s zinc sulfate monohydrate for various formulations.

Trading:

Companies involved in the trading of fertilizers and other agricultural products.

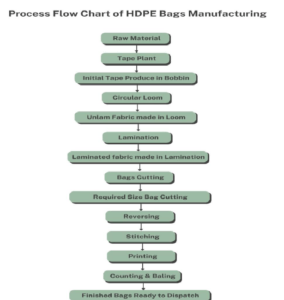

Manufacturing Process:

The company’s work process involves the following key stages:

- Order Placement: Receiving purchase orders from customers for specific products.

- Manufacturing: Producing the ordered products using the company’s manufacturing facilities and ensuring quality standards.

- Quality check: Quality testing to ensure adherence to specifications.

- Delivery: Delivering the finished products to customers in a timely manner.

- Feedback: Collecting feedback from customers to ensure satisfaction and identify areas for improvement.

Raw Materials:

The company’s primary raw materials include HDPE granules, PP granules, zinc ash, and sulfuric acid. These materials are sourced from various suppliers, both domestically and internationally.

Suppliers:

The company has a few key suppliers, with the top ten suppliers accounting for a significant portion of its purchases. It does not have long-term contracts with its suppliers and relies on quotes from various sources to determine raw material prices.

Other Key Aspects:

Manufacturing Facilities and Infrastructure:

The company’s manufacturing facility is located in Shahjahanpur, Uttar Pradesh, India. The facility is equipped with modern machinery and infrastructure to support the production of its various products.

Certifications:

The company is ISO 9001:2015 certified for its quality management system, demonstrating its commitment to producing high-quality products.

Achievements and Awards:

The company has received several awards and recognitions for its performance and contributions to the industry, including the “Best Video Film Award 2017” by The Fertiliser Association of India (FAI) and the “Platinum Business Award” by Dainik Jagran in 2022.

Manufacturing Process Flowchart

Revenue – Category

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors have issued an unqualified opinion on the company’s financial statements

Non-Compliances and Other Issues:

The company has experienced delays in filing certain statutory forms with the Registrar of Companies (RoC), resulting in additional fees. Additionally, there have been slight delays in filing GSTR-3B and EPF returns. The company has also faced objections to its trademark applications under Class 17 and Class 6 of the Trademark Act.

Contingent Liabilities:

The company has contingent liabilities amounting to ₹ 16.67 Lakhs as of March 31, 2024, primarily related to tax demands and bank guarantees.

Legal Cases:

Cases Filed Against the Company

Criminal case numbering COMA/73/2020 in Court of Chief Judicial Magistrate, Panchkula:

This case was filed by the State of Haryana against a fertilizer proprietor and others, including Anya, for failure to meet the specifications of a fertilizer sample taken under Section 7 of the Essential Commodities Act 1955

A money suit filed by a supplier for non-payment of dues.

Cases Filed by the Company

A case filed by the company against a supplier for inadequacies in project implementation.

Tax Proceedings against the Company:

SWOT Analysis

Strengths

| Diverse product portfolio catering to various sectors. |

| ISO 9001:2015 certification for quality management systems. |

Weaknesses

| Dependence on a few key customers for a significant portion of revenue. |

| Lack of long-term contracts with suppliers, leading to potential price volatility and supply chain disruptions. |

| Dependence on the agricultural sector, which is susceptible to weather patterns and other external factors. |

Opportunities

| Expansion into new geographical markets and product segments to diversify revenue streams. |

| Strengthening relationships with suppliers and securing long-term contracts to mitigate supply chain risks. |

| Investing in research and development to innovate and introduce new products and services. |

Threats

| Intense competition from both domestic and international players in the packaging and fertilizer industries. |

| Economic downturns or instability in the agricultural sector, impact demand for the company’s products. |

| Fluctuations in raw material prices and availability, affect profitability and production costs. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

Moderate capital investment is required for entry into the packaging and fertilizer industries. Existing players have established brand recognition and customer relationships. Technological advancements and innovation can create opportunities for new entrants.

| Bargaining Power of Suppliers | LOW |

| The availability of numerous suppliers for raw materials reduces the bargaining power of individual suppliers. The company’s ability to source raw materials internationally provides flexibility and reduces dependence on specific suppliers. |

| Bargaining Power of Buyers | MODERATE |

| The presence of multiple players in the packaging and fertilizer industries provides buyers with alternatives. Building strong customer relationships and offering differentiated products can reduce buyer bargaining power. |

| Threat of Substitute Products or Services | LOW |

| Limited substitutes for HDPE and PP bags in the packaging of commodities. Zinc sulfate fertilizers have specific applications with limited direct substitutes. |

| Rivalry Among Existing Competitors | HIGH |

| The packaging and fertilizer industries are highly competitive, with the presence of several large and established players. Competition is based on factors such as price, quality, product differentiation, and customer service. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers is as follows:

| Metric | Anya Polytech & Fertilizers Limited | Commercial Syn Bag Limited |

| Revenue | ₹ 12,341.77 Lakhs | ₹ 28,843.47 Lakhs |

| EBITDA Margin | 13.36% | 9.27% |

| PAT Margin | 7.76% | 2.72% |

| ROE | 28.25% | 6.30% |

| ROCE | 16.47% | 7.46% |

Green Box

IPO Funds:

- Fund capital expenditure for the purchase of plant and machinery to expand production capacity.

- Meet working capital requirements to support business growth and expansion.

- Invest in a new project under a subsidiary company to diversify operations and enter the renewable energy sector.

Industry Outlook:

The plastic packaging and fertilizer industries in India are expected to experience significant growth in the coming years, driven by factors such as rising demand for packaged goods, increasing agricultural output, and government initiatives to promote the use of fertilizers.

Amber Box

Capacity Utilization: As of FY 2024

- HDPE Bags: 88.82%

- Zinc Sulfate: 55.81%

- PP Bags: 24.50%

- SSP Fertilizers: 15.00%

Negative Operating Cash Flow:

The company has maintained a positive operating cash flow in the last two financial years. However, it experienced negative cash flow from operating activities in the financial year 2021-22.

Dependence on the agricultural sector, which is susceptible to weather patterns and other external factors.

Red Box

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).