Aimtron Electronics Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Electronics |

| Sub-class | Electronics System Design and Manufacturing |

| Location | Waghodia, Vadodara, Gujarat Whitefield, Bengaluru, Karnataka |

| Establishment Year | 2011 |

Management

| Chairman and Non-Executive Director | Mukesh Jeram Vasani |

| Educational Qualifications | Bachelor of Engineering (Civil), Sardar Patel University, Gujarat |

| Experience | 30 years in the production, marketing and manufacturing of engineering and electronic goods and services |

| Annual Salary | ₹ 24 Lakhs + upto 200% on performance. |

| Total Number of Employees | 132 |

About

Aimtron Electronics Limited(AEL) is primarily engaged in providing Electronics System Design and Manufacturing (ESDM) services, with a focus on high-value precision engineering products. The company offers end-to-end solutions, starting from printed circuit board (PCB) design and assembly to the manufacturing of complete electronic systems (Box Build).

Products and Services

AEL’s product and service offerings cater to diverse industries, including automotive, gaming, industrial, IoT/robotics, medical & healthcare equipment, and power sectors. The company’s offerings can be broadly categorized into:

PCBA (Printed Circuit Board Assembly): Designing and assembling PCBs, encompassing the entire value chain from concept to volume production.

Box Build Assembly: Assembling complete electronic systems, including enclosure fabrication, cabling, and component installation.

Design Solutions: Providing end-to-end services from conceptualization and design to prototyping and mass manufacturing.

Clients:

Aimtron Electronics Limited serves a diversified customer base across multiple industry verticals. The company has established long-term relationships with several clients, some spanning over five years. The key client segments along with their revenue share are industrial (68%), medical & healthcare equipment(5.5%), automotive(16%), gaming(4%), and drones & UAVs(5.5%). The company also generates a significant portion of its revenue from its group companies.

Raw Materials and Suppliers:

Direct Procurement from Overseas Manufacturers: The company procures electronic components like microcontrollers, ICs, resistors, capacitors, LEDs, PCBs, and semiconductors directly from overseas manufacturers, primarily located in countries like China, Hong Kong, and Singapore. The company may also source these components from authorized distributors of these manufacturers.

Procurement from Approved Vendors: The company sources other essential raw materials from a network of approved vendors, ensuring quality and reliability. These include:

Process Consumables: Obtained from various third-party manufacturers.

Wiring Harness: Procured from approved vendors, which is crucial for the long-term quality of products as they carry electrical loads.

Plastic Parts: Sourced from specialized plastic moulding companies.

Sheet Metal Parts: Procured from third-party suppliers based on the company’s drawings.

Manufacturing Process:

The company’s core manufacturing processes include:

Surface Mount Technology (SMT): An automated process involving machines that execute tasks based on pre-set programs. The key stages in SMT include screen printing (applying solder paste), component placement, reflow soldering (forming electrical connections), and inspection using AOI and X-ray machines.

Through-Hole Component Insertion (THT): A manual or semi-automated process for inserting components with leads through holes on the PCB. This process involves manual soldering, wave soldering, or dip soldering, followed by inspection.

Other Key Aspects

AEL positions itself as a “One-Stop Shop” for ESDM services, offering integrated solutions to meet diverse customer needs.

Manufacturing Infrastructure

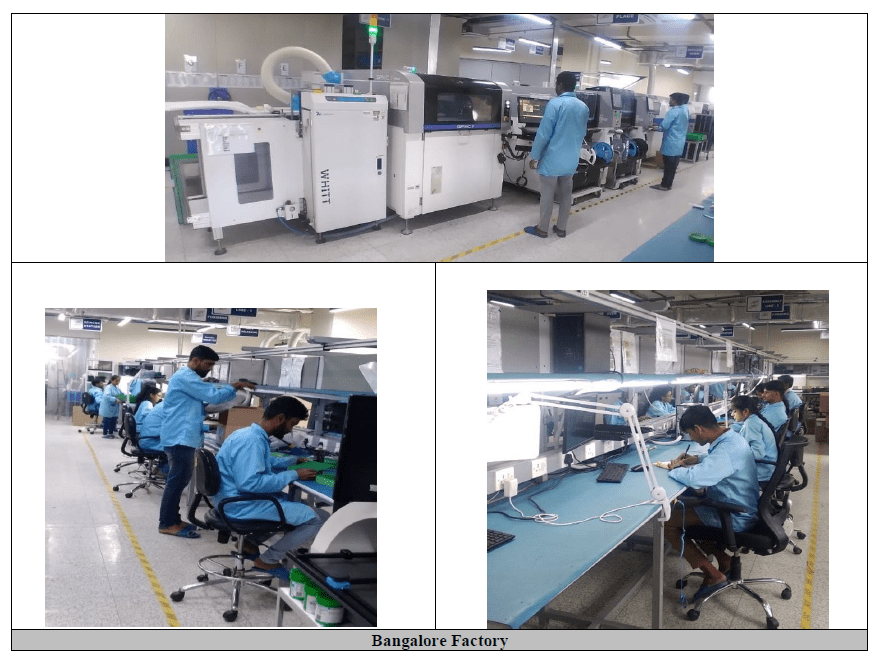

The company’s headquarters, which also houses its Factory Unit I, is located in Waghodia, Gujarat. The second production unit, Factory Unit II, is situated in Whitefield, Bengaluru, Karnataka.

The facilities are designed with engineered layouts, process controls, and automation to ensure quality and productivity.

The company’s manufacturing capabilities cover micro-electronic components to large box build assemblies.

AEL’s facilities are equipped with advanced machinery, including SMT lines, THT lines, and box-build assembly lines.

The company holds certifications such as ISO 13485:2016, ISO 14001:2015, and EN ISO 9001:2015, demonstrating its commitment to quality and environmental management.

Manufacturing Flowchart

Revenue – Category

Revenue – Region

Audit and Legal

Related Party Transactions:

During the period ending on December 31, 2023, and the FY 2023, AEL derived 51.74% and 60.73% of its revenue from operations, respectively, from its group companies.

Non-Compliances and Other Issues:

Non-compliance with FEMA Regulations: The company failed to report certain share allotments to the RBI within the prescribed period. While the share issuance itself was valid, this non-compliance could lead to regulatory actions and penalties.

Discrepancies in Corporate Records: The company identified minor discrepancies in its corporate records, such as errors in the regularization of additional directors and the inability to locate a historical share transfer deed.

Non-compliance with EPCG License Obligations: The company benefits from EPCG licenses, which require it to export goods of a specified value. Failure to meet these export obligations could result in the company having to pay duties and interest proportionate to the unfulfilled obligations. The company’s pending obligation against the EPCG license as of December 31, 2023, is ₹18.3 Crores.

Lack of Fire NOC for Bengaluru Facility: The company’s manufacturing facility in Bengaluru currently lacks a Fire NOC (No Objection Certificate).

Auditor’s Remarks:

There were no audit qualifications or observations

Contingent Liabilities:

As of December 31, 2023, Aimtron Electronics Limited has contingent liabilities totaling ₹2.4 Crores. The primary contributors to these liabilities are:

Bank Guarantee for EPCG License: The largest portion, at ₹2.3 Crores, is related to a bank guarantee provided for an EPCG (Export Promotion Capital Goods) license. This indicates a potential liability if the company fails to meet its export obligations under the license.

Legal Cases:

Direct Tax Case: The company has one outstanding case related to direct taxes, with the amount in dispute being ₹2.88 Lakhs. This case pertains to TDS (Tax Deducted at Source) defaults.

Indirect Tax (GST) Cases: The company is involved in two cases related to indirect taxes (specifically GST), with a total disputed amount of ₹147.63 Lakhs.

SWOT Analysis

Strengths

| Diversified Product Portfolio: AEL offers a wide range of products and services, catering to various industries, and reducing dependence on a single market segment. |

| End-to-End Solutions: AEL’s ability to provide comprehensive solutions, from design to manufacturing, gives it a competitive advantage and fosters customer loyalty. |

| Strong Manufacturing Capabilities: AEL’s manufacturing facilities are equipped with advanced machinery and adhere to international quality standards, enabling it to deliver high-quality products. |

| Diversified Product Portfolio: AEL offers a wide range of products and services, catering to various industries, and reducing dependence on a single market segment. |

Weaknesses

| Customer Concentration: The company relies heavily on a few key customers, including its group companies, for a significant portion of its revenue. |

| Dependence on Exports: A significant portion of AEL’s revenue comes from exports, exposing it to risks associated with international trade and currency fluctuations. |

| Working Capital Intensity: AEL’s business is working capital intensive, with a significant portion of its current assets tied up in inventories and trade receivables. |

| Past Losses: The company has a history of net losses. |

Opportunities

| Growth in ESDM Industry: The ESDM industry in India is projected to grow significantly, presenting opportunities for AEL to expand its market share and revenue. |

| Government Initiatives: The Indian government’s focus on promoting domestic electronics manufacturing through initiatives like the PLI scheme creates a favourable environment for AEL’s growth. |

| Expansion into New Markets: AEL has the potential to expand its geographical reach and tap into new markets, particularly in Europe and Australia. |

| Backward Integration: The company’s plans for backward integration could lead to greater control over the manufacturing process, cost efficiencies, and improved margins. |

Threats

| Intense Competition: The ESDM industry is highly competitive, with domestic and international players vying for market share. |

| Raw Material Price Volatility and Supply Chain Disruptions: Fluctuations in raw material prices and potential supply chain disruptions could impact AEL’s profitability and operations. |

| Regulatory Risks: The company faces regulatory risks related to compliance with various laws and regulations, including FEMA, EPCG, and environmental laws. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| The ESDM industry in India has a low barrier to entry due to the fragmented nature of the market and the presence of numerous small players. The government’s initiatives to promote domestic manufacturing further encourage new entrants. However, establishing a strong reputation, securing long-term contracts with OEMs, and achieving economies of scale can be challenging for new players. |

| Bargaining Power of Suppliers | MODERATE |

| While AEL sources raw materials and components from a diverse network of domestic and international suppliers, certain components may have limited suppliers or face supply chain disruptions. The company’s reliance on imports for a significant portion of its raw materials also exposes it to potential supply risks and price volatility. |

| Bargaining Power of Buyers | MODERATE – HIGH |

| The bargaining power of buyers (OEMs) is likely to be high due to the availability of multiple EMS providers in the market. Large OEMs, in particular, can exert significant pressure on pricing and demand favourable terms. However, AEL’s focus on high-value precision engineering products and its ability to provide end-to-end solutions could mitigate this power to some extent. |

| Threat of Substitute Products or Services | LOW |

| The threat of substitute products or services is relatively low in the ESDM industry. While there is always a risk of technological advancements leading to the obsolescence of certain products or processes, the core value proposition of EMS providers, including AEL, remains relevant across various industries. |

| Rivalry Among Existing Competitors | HIGH |

| The intensity of competitive rivalry in the ESDM industry is high due to the presence of numerous players, including both domestic and international companies. The industry is characterized by price competition, technological advancements, and the need to constantly innovate to meet evolving customer demands. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers can be observed in the following table, which presents the Key Performance Indicators (KPIs) for Aimtron Electronics Limited and its selected peer group for FY, 2024

Revenue and Profitability: AEL’s revenue from operations is significantly lower than its listed peers, indicating a smaller scale of operations. However, the company exhibits higher Operating Profit margins compared to most of its peers, suggesting better operational efficiency and profitability.

Return on Equity (RoE): AEL’s RoE is notably higher than all its listed peers, demonstrating its superior ability to generate profits from its shareholders’ investments.

| Key Financial Performance | Aimtron Electronics Limited | Kaynes Technology India Limited | Vinyas Innovative Technologies Limited | Avalon Technologies Limited | Syrma SGS Technology Limited |

| Revenue (INR Crores) | 93 | 1,805 | 317 | 867 | 3,154 |

| Operating Profit Margin (%) | 25.4 | 14 | 10.3 | 7 | 6 |

| Return on Equity (%) | 43.6 | 10.5 | 33.7 | 4.75 | 6.81 |

| RoCE (%) | 39.4 | 14.5 | 25.9 | 6.22 | 9.84 |

| Debt-to-Equity Ratio | 0.28 | 0.13 | 0.75 | 0.38 | 0.39 |

Green Box

IPO Funds:

Repayment of Outstanding Borrowings:

Aimtron Electronics Limited plans to allocate a significant portion of the proceeds, ₹15 Crores, to repay some or all of its existing debts. This strategic move is intended to reduce the company’s interest burden and enhance its financial flexibility

Funding Capital Expenditure:

The company has earmarked ₹18.63 Crores for capital expenditure, primarily for installing additional plant and machinery. This investment is aimed at expanding the company’s production capacity and upgrading its technological capabilities to meet growing demand and enhance operational efficiency.

Backward Integration at the Vadodara Facility:

The company aims to enhance its operational efficiency and reduce reliance on external suppliers by bringing certain manufacturing processes in-house. Specifically, they plan to establish an integrated cable assembly line and have already procured the necessary machinery for this purpose.

Capacity Expansion at the Vadodara Facility:

The company intends to increase its production capacity by implementing an additional SMT (Surface Mount Technology) line. This expansion will be supported by an inline 3D AOI (Automated Optical Inspection) system for manufacturing high-tech multilayer PCB assemblies. The new SMT line is expected to enable the company to handle smaller components with higher precision, leading to improved operational efficiency and faster production.

The ESDM market in India is projected to grow at a CAGR of 16.1% between 2019 and 2025. This growth is attributed to robust demand, supportive government policies, and the increasing trend of digitalization across various sectors.

For the stub period ending on December 31, 2023, the capacity utilization of the manufacturing facility at Vadodara was 77.90%, and the capacity utilization of the manufacturing facility at Bengaluru was 61.50%.

Strong Manufacturing Capabilities:

AEL’s manufacturing facilities are equipped with advanced machinery and adhere to international quality standards. This allows the company to deliver high-quality products, ensuring customer satisfaction and repeat business.

AEL’s commitment to quality is evident in its certifications (ISO 13485:2016, ISO 14001:2015, EN ISO 9001:2015) and stringent quality control processes.

End-to-End Design Solutions:

The company offers end-to-end design solutions, which include conceptualization, engineering, and product prototype development. This suggests that AEL has the capability to design and develop new products based on customer specifications or market needs.

Focus on High-Value Precision Engineering:

AEL emphasizes its expertise in manufacturing complex and precise electronic components and systems. This focus on high-value products could differentiate the company from competitors who may cater to more general or lower-value segments of the market.

Amber Box

The company had negative Operating Cash Flow in FY 2023. However, it did have positive Operating Cash Flows for FY 2024, 2022 and 2021.

Red Box

Group Companies as Customers:

Aimtron Electronics Limited’s revenue is heavily reliant on a small number of key customers, including its group companies and related party transactions with group companies amounting to more than 50% of its revenue, it will always be a concern if the transactions are being made at arm’s length.

Dependence on Exports:

A substantial portion of AEL’s revenue is generated from exports, exposing the company to risks associated with fluctuations in foreign exchange rates and potential disruptions in international trade, such as tariffs, geopolitical tensions, or global economic downturns.

Regulatory and Compliance Risks:

AEL faces various regulatory risks, including potential penalties for past non-compliance with FEMA regulations and the need to obtain and maintain various licenses and approvals.

The company relies heavily on export revenues and benefits from EPCG (Export Promotion Capital Goods) licenses. These licenses come with obligations to export goods of a certain value. Any failure to meet these obligations could lead to financial penalties

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).