Aesthetik Engineers Limited

Overview

| Logo Website 🔗 | |

| Business Activity | Construction |

| Division | Civil Engineering |

| Sub-class | Facade Systems |

| Location | Office: Kolkata, West Bengal Factory: Howrah, West Bengal |

| Establishment Year | 2003 |

Management

| Managing Director | Mr. Avinash Agarwal |

| Educational Qualifications | Bachelor of Commerce |

| Experience | Over 2 Decades |

| Annual Salary as % of Revenue | 0.99% |

| Total Number of Employees | 52 |

About

Aesthetik Engineers Limited (AEL) specializes in the design, engineering, fabrication, and installation of facade systems for buildings. The company offers a comprehensive range of products and services, encompassing building facades, aluminium doors and windows, railings, staircases etc.

Products and Services:

Aesthetik Engineers Limited specializes in the design, engineering, fabrication, and installation of various facade systems.

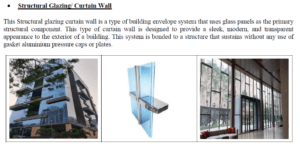

Structural Glazing/Curtain Wall: This system uses glass panels as the primary structural component, creating a sleek, modern, and transparent building exterior.

Aluminum Composite Panel (ACP) Cladding: This lightweight and versatile cladding option offers design flexibility and weather resistance.

Stone Cladding: AEL provides natural stone cladding, adding an elegant and durable finish to building exteriors.

Glass Fibre Reinforced Concrete (GFRC): This lightweight and moldable material allows for intricate designs and is used for various architectural elements

Solar EPC Projects: AEL has expanded its operations to include engineering, procurement, and construction (EPC) services for solar power systems. This includes supplying components like solar panels, lighting, earthing cables, and mounting structures.

Other Key Aspects:

The company’s factory, located in Howrah, spans 3,000 sqm and is central to its operations. AEL utilizes this facility for the fabrication and assembly of its products.

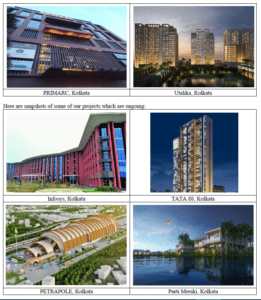

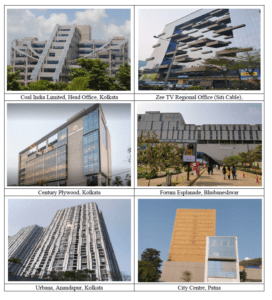

Aesthetik Engineers Limited has a proven track record, having completed projects for various clients across different industries, including commercial complexes, residential buildings, airports, and malls. Their geographical reach extends to states such as West Bengal, Bihar, Maharashtra, Assam, Odisha, and Gujarat.

For FY 2023-24, AEL’s top client was Infosys Ltd, generating 24.69% of the company’s revenue. Other major clients included S.E. Builders & Realtors Limited (13.50%), Larsen & Turbo Limited (8.55%), and Kolkata-One Excelton Pvt Ltd (7.92%).

For the FY 2023-24: Schueco India Pvt. Ltd. was the top supplier, accounting for 16.37% of the total cost of materials consumed. Other major suppliers include Calcutta Metal Corporation (17.46%), Marg Steel Private Limited (8.10%), and Shree Gayatri Trading Co. (11.65%).

Some of the notable completed projects include:

| Project Name | Installation Details | Value |

| Urbana (Residential Complex) | windows, railings, curtain wall glazing, ACP cladding, and GFRC cladding. | 34.18 Cr |

| Utalika (Residential Complex) | curtain wall glazing, windows, doors, GFRC, canopy, railing, ACP cladding, and Durock Board Cladding | 23.15 Cr |

| Siti Cable (Corporate Office) | Semi-unitized structural glazing, ACP cladding, stone cladding, and composite aluminium panel work | 7.33 Cr |

Other completed projects:

Century Plywood, Kolkata;

Forum Esplanade, Bhubaneshwar;

Primarc, Kolkata;

City Centre, Patna

Coal India Limited Head Office, Kolkata.

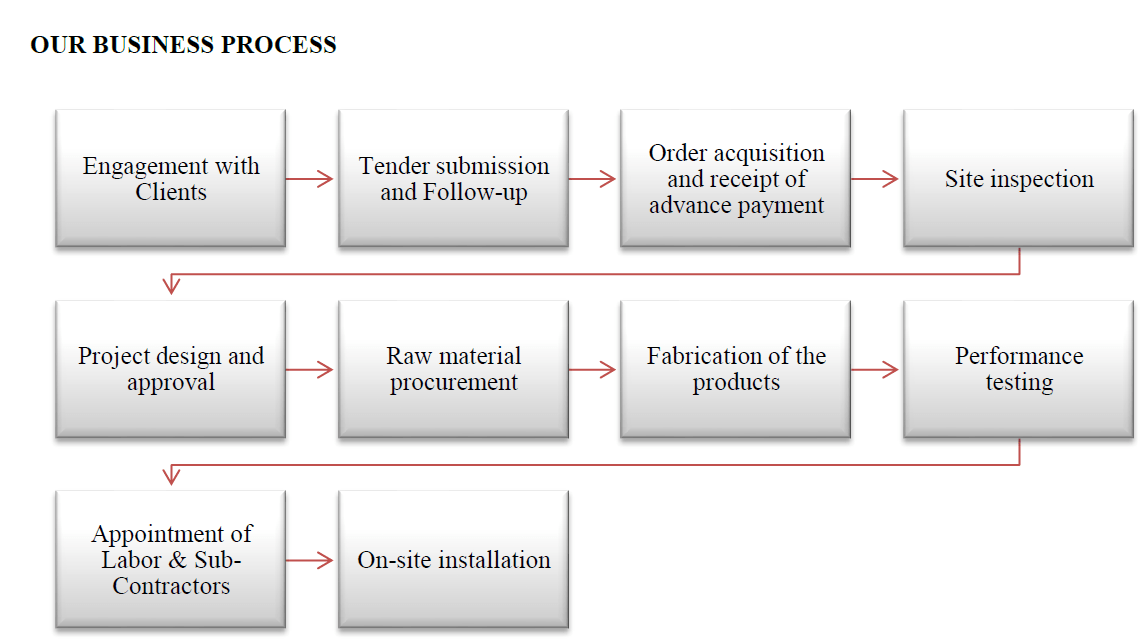

Work Flow Chart

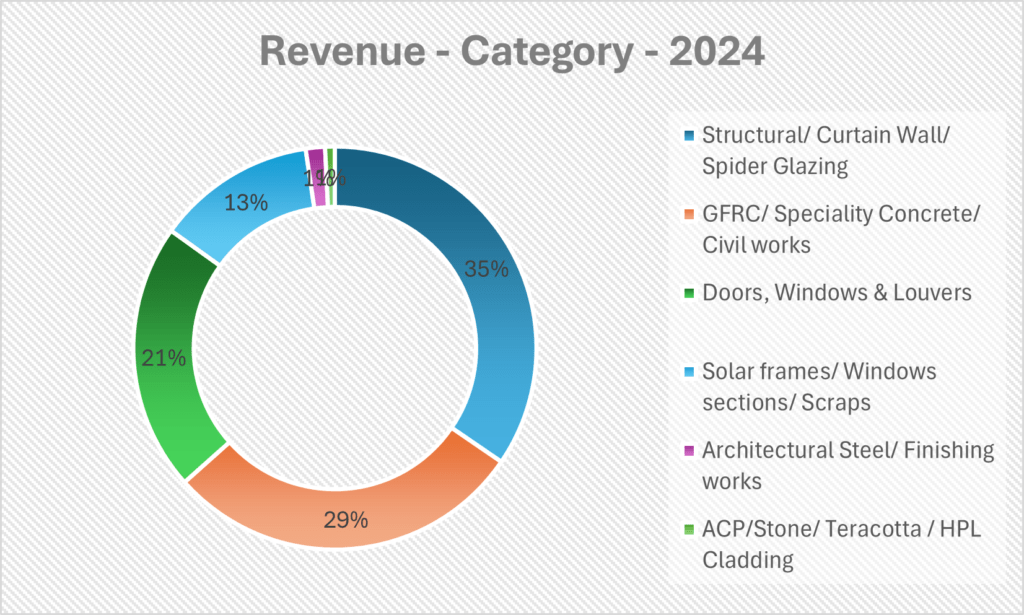

Revenue – Category

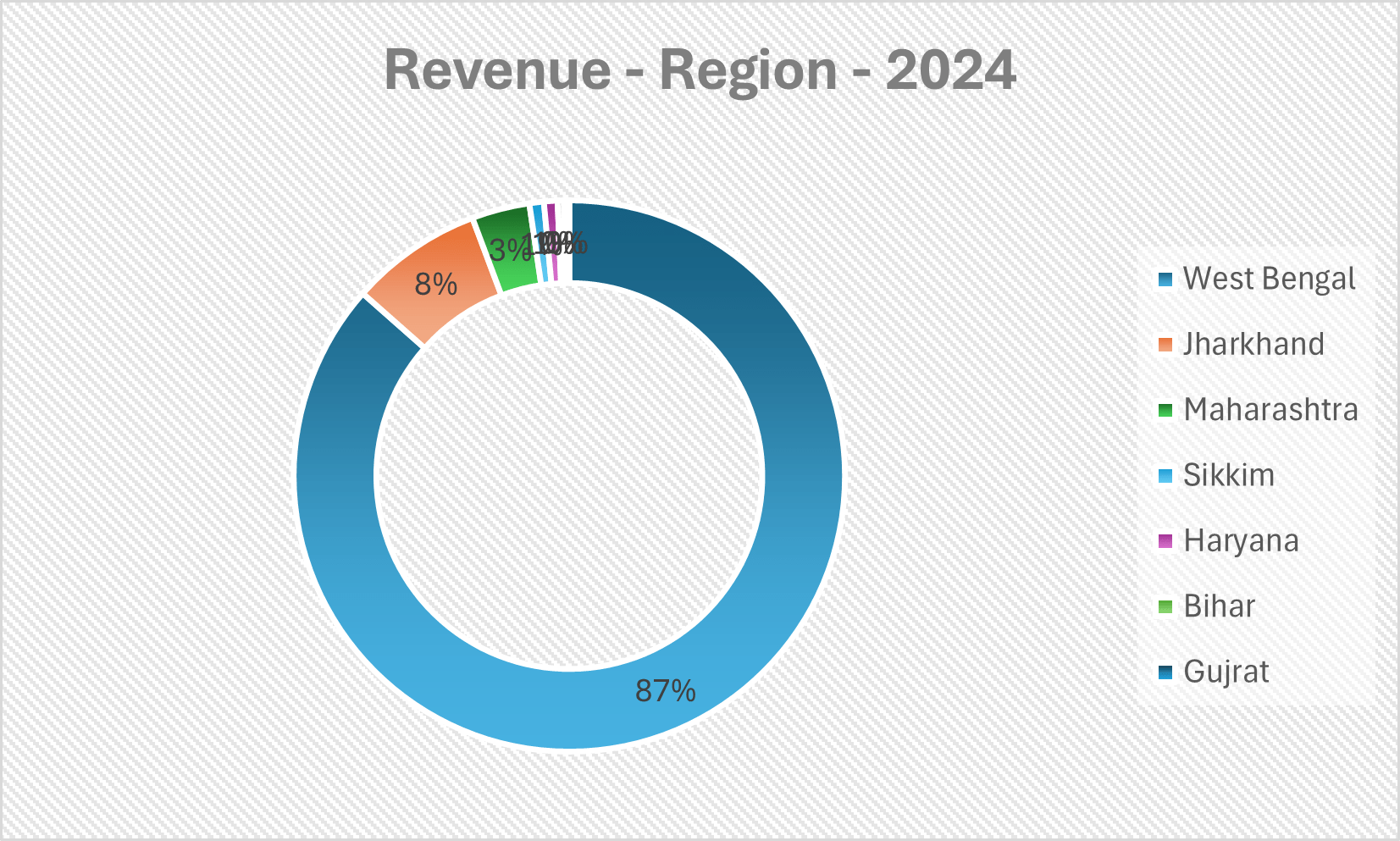

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The Independent Auditor’s Examination Report on the Restated Consolidated Financial Information states that the auditors did not audit the financial information of one associate company, Solysis Solar Pvt Ltd, included in the consolidated annual financial statements for the year ended March 31, 2024.

Non-Compliances and Other Issues:

The Commissioner of Service Tax in Kolkata issued an order in 2015 imposing a penalty of Rs. 82 lakhs against Aesthetik Engineering for the fiscal years 2008-09 to 2012-13. While the company has appealed the demand and deposited Rs. 83 lakhs the outcome of this case is pending.

Legal Cases:

A supplier, Kinlong Hardware India Private Ltd, filed a suit against Aesthetik Engineering for non-payment of dues amounting to Rs. 34.50 lakhs. The case is pending in commercial court.

SWOT Analysis

Strengths

| Experienced Management team, strong customer relationships, and quality assurance and control procedures |

| Strong track record of designing and executing complex projects |

Weaknesses

| The company has incurred losses in the past (2022) and has a limited track record of profitability. |

| The company is highly dependent on a small number of customers. |

Opportunities

| The company has several opportunities for growth, including the fact that India’s construction industry is experiencing substantial growth. |

| The demand for sustainable and energy-efficient construction is rising, and the company can capitalize on this trend by developing new and innovative facade systems |

Threats

| The company operates in a cyclical industry that is sensitive to changes in economic conditions. |

| The company also faces competition from other companies in the construction industry, both in India and internationally. |

Porter’s Five Forces1

| Threat of New Entrants | HIGH |

| The entry barriers are very weak for any new company to enter into this field of products and services. |

| Bargaining Power of Suppliers | LOW |

| Company seems to have long standing relationships with the suppliers and the raw materials that company require have multiple suppliers in the market |

| Bargaining Power of Buyers | MODERATE |

| AEL has a large number of competitors in its field of work. |

| Threat of Substitute Products or Services | MODERATE – HIGH |

| Changing preference for styles and designs by customers can result in new products being used for facade systems |

| Rivalry Among Existing Competitors | HIGH |

| AEL has large number of competitors in its field of work. |

Peer Comparison

Aesthetik Engineers Limited recognizes Innovators Facade System Limited as its peer and here is a broad comparison of the two companies

| Particulars (Amount in Crores)(FY2024) | Aesthetik Engineers Limited | Innovators facade System Limited |

| Revenue from Operations | 60.72 | 215.11 |

| Growth in Revenue from Operations | 51.76% | 18.86% |

| EBITDA (%) | 7.7 | 28.44 |

| EBITDA Margin (%) | 12.69% | 13.22% |

| PAT (%) | 5.03 | 15.16 |

| PAT Margin (%) | 8.28% | 7.05% |

Green Box

The total value of ongoing projects at present is 67.36 Cr

Aesthetik Engineers Limited plans to expand its existing manufacturing facility at an estimated cost of ₹ 6.61 Cr, buy new machinery worth 3.87 Cr and also install a Solar roof for 0.63 Cr

Indian Facades Market:

The Indian facades market is projected to exhibit a CAGR of 7.18% between 2024 and 2032. The factors contributing to this growth include a surge in construction activities across the country, an increasing number of commercial spaces, and a rising trend of remodelling and upgrading existing structures.

Responding to Industry Trends:

The company acknowledges the importance of identifying and adapting to industry trends, particularly in the rapidly evolving facade industry. The sources mention the company’s use of market research, networking events, and industry conferences to stay informed about industry developments

Debt-to-Equity Ratio (0.59→0.57)and Debt Service Coverage Ratio (0.4 → 0.92) have improved in the last year

Amber Box

The company had negative operating cash flow (OCF) for FY 2024, arising largely from an increased inventory. But the company had positive OCF for the previous years FY 2023 and 2022

Expand geographical network:

Aesthetik Engineers Limited is presently concentrated in specific states in India, but it plans to expand its reach to cater to a broader customer base and meet increasing demand from existing clients. The company intends to establish a stronger niche customer base, particularly among institutional clients such as government institutions, builders, and developers of residential and commercial projects.

Exposure to Economic Fluctuations and Industry Risks:

The company acknowledges its susceptibility to various economic and industry-specific risks. The demand for its products is inherently linked to the health of the Indian economy and fluctuations in the construction and infrastructure sectors.

Red Box

Dependence on a Few Major Customers:

A significant portion of the company’s revenue is concentrated among a relatively small number of customers. This dependence poses a risk as the loss of one or more of these clients could adversely affect cash flows and liquidity.

Industry Challenges:

The Indian facade and window industry faces challenges such as cheap imports, non-standard pricing, heavy import duties, and competition from Chinese products. These external factors could impact Aesthetik Engineers Limited’s profitability and market share.

Images

- For Porter’s Five Forces, the force value of “LOW” is considered good. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).