Ceigall India Limited

Company

Management

| Managing Director | Ramneek Sehgal |

| Educational Qualifications | Bachelor’s degree in Commerce from Osmania University |

| Experience | Over 20 years in the construction industry |

| Annual Salary as % of Revenue | 0.28% |

| Total Number of Employees | 2,256 |

About

- Ceigall India Limited is an infrastructure construction company specializing in projects such as elevated roads, flyovers, bridges, railway over-bridges, tunnels, highways, metros, expressways and runways.

- The company generates revenue through EPC (Engineering, Procurement, and Construction) projects, HAM (Hybrid Annuity Model) projects, and O&M (Operations & Maintenance) contracts. While the company recognizes revenue for EPC and O&M projects using the percentage completion method or item rate basis, revenue from HAM projects is generated differently.

- HAM projects involve the construction of assets through a public-private partnership model. In this model, the authority provides partial funding for construction, and upon completion, the company receives semi-annual annuity payments spread over a concession period. After the concession period, the asset is transferred back to the authority.

- The company’s work primarily revolves around the design and construction of various road and highway projects, including those involving specialized structures.

- Ceigall India Limited has completed over 34 projects, which include 16 EPC projects, one HAM project, five O&M projects, and 12 Item Rate projects. They have another 18 ongoing projects comprising 13 EPC projects and 5 HAM projects. Ceigall India Limited owns and rents construction equipment to carry out these projects.

- Book-to-Bill Ratio is calculated as the Order Book at a particular period divided by the Revenue from operations for that period. The book-to-bill ratio of the company as of Fiscals ended March 31, 2024, 2023 and 2022, is 3.05, 5.23 and 5.6 respectively. In absolute numbers, the order book for the same period has been ≈ ₹9,225.78, ₹10,809.04 and ₹6,346.13 respectively

- List of Clients:

- Ministry of Road Transport and Highways of India

- Uttar Pradesh Metro Rail Corporation of India

- National Highway Authority Of India

- Ircon International Limited

- Military Engineer Services

- Public Works Department (Building & Roads) Punjab

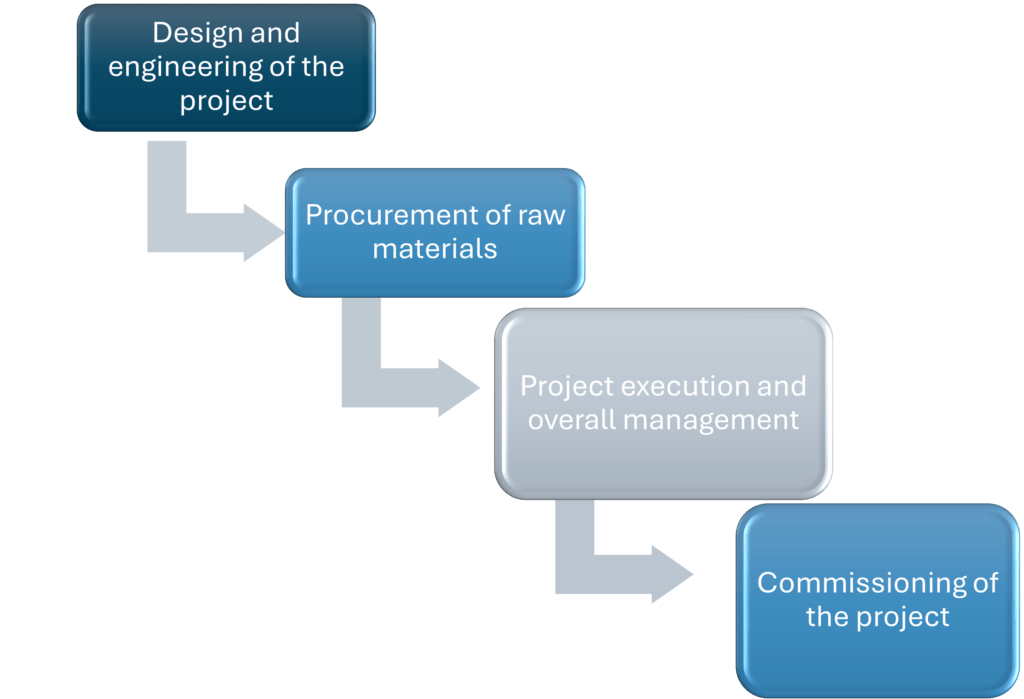

Work Flow Chart

Revenue – Category

Revenue – Location

Audit and Legal

- Ceigall India Limited had related party transactions amounting to 14.16% of the revenue for Fiscal 2024 with M/s R.K. Infra. But recently, the Company has acquired a 50% stake in M/s R.K. Infra to improve its project execution and to undertake projects with complex structures in future

- The auditor’s report on the adequacy and effectiveness of internal financial controls over financial reporting for certain subsidiaries and step-down subsidiaries for 2024 was based on the corresponding reports of the auditors of those companies

- An application was filed for a 132-day delay in appointing a woman director, resulting in a penalty.

- Applications for condonation of delay were filed for various form-filings, including MGT-14 for the appointment of the Managing Director, revision in remuneration, and conversion from a private to a public company. These delays were condoned upon payment of additional fees

- Ceigall India Limited faces multiple legal actions, with the most significant being 21 cases filed against the company. These cases primarily involve statutory or regulatory actions, with a smaller number related to tax proceedings and material civil litigation. The company has also been subject to show cause notices related to alleged violations of mining regulations.

- The company has not made certain regulatory filings with the RoC and has been in non-compliance with certain requirements under the Companies Act, 2013, and paid a penalty of ₹12.8 lakhs.

- Material Civil Litigation: The aggregate amount involved in the four material civil litigations against the company is ₹119.35 Cr.

- Tax Proceedings: The aggregate amount involved in tax proceedings against the company is ₹3.18 Cr.

SWOT Analysis

Strengths

| Strong financial performance: The company has demonstrated consistent growth in revenue and profitability in recent years |

| Experienced management team: The company is led by a team of experienced professionals with a proven track record in the industry. |

| Efficient business model: The company’s efficient business model has enabled it to maintain a strong financial position |

Weaknesses

| Dependence on government contracts: A significant portion of the company’s revenue is derived from government contracts, particularly in the infrastructure sector. |

| Limited geographical diversification: The company’s operations are primarily concentrated in a few states in India, which exposes it to regional economic downturns or policy changes. |

| Litigation and regulatory risks: The company is subject to various litigation and regulatory proceedings, which could result in financial penalties or reputational damage. |

Opportunities

| Growth in the Indian infrastructure sector: The Indian government’s focus on infrastructure development presents significant growth opportunities for companies operating in this sector. |

| Expansion into new geographical areas: The company can explore opportunities to expand its operations into new states or regions within India, reducing its dependence on a few key markets. |

| Diversification of service offerings: The company can explore opportunities to diversify its service offerings into related areas, such as operation and maintenance of infrastructure projects or renewable energy. |

Threats

| Competition in the infrastructure sector: The Indian infrastructure sector is highly competitive, with the presence of several large and established players. |

| Regulatory and policy risks: Changes in government regulations or policies, such as those related to land acquisition, environmental clearances, or taxation, could adversely impact the company’s operations and profitability. |

| Economic slowdown: A slowdown in the Indian economy could result in a decline in government spending on infrastructure projects, impacting the company’s revenue and profitability. |

Porter’s Five Forces

| Threat of New Entrants | HIGH |

| The Indian infrastructure sector is experiencing significant growth, attracting new players. However, high capital requirements and the need for specialized expertise can act as barriers to entry. |

| Bargaining Power of Suppliers | MODERATE |

| The company relies on suppliers for construction materials, equipment, and labor. The availability and pricing of these inputs can impact profitability. However, the company can mitigate supplier power by diversifying its supplier base and building strategic relationships. |

| Bargaining Power of Buyers | MODERATE |

| The company’s primary buyers are government entities, which typically have significant bargaining power due to their size and influence. However, the specialized nature of infrastructure projects and the limited number of qualified bidders can provide some leverage to the company |

| Threat of Substitute Products or Services | LOW – MODERATE |

| Depending on the specific project, there may be limited substitutes for infrastructure development, such as road construction. However, alternative transportation solutions or project delays due to funding constraints can pose a threat. |

| Rivalry Among Existing Competitors | HIGH |

| The Indian infrastructure sector is highly competitive, with the presence of several large and established players vying for government contracts. The company’s ability to compete effectively depends on its pricing strategies, project execution capabilities, and relationships with key stakeholders. |

Peer Comparison

- Ceigall India Limited achieved a compound annual growth rate (CAGR) of 50.13%, while the peer average was 21.99%

- The company has secured a strong order book, reaching ₹ 9225.78 Cr in fiscal year 2024. This surpasses the order book values of several competitors, including KNR Constructions Limited, H.G. Infra Engineering Limited, and J. Kumar Infraprojects Limited during the same period.

- The company’s operating profit margin in fiscal year 2024 was 14.84%, which is lower than the margins recorded by its peers by about 2.5%.

- In fiscal year 2024, Ceigall India Limited recorded an ROCE of 31.98% and an ROE of 33.57%, compared to the peer group average of 20.57% and 21.94%, respectively.

- The company’s debt-to-equity ratio was 1.17, in comparison, the average debt-to-equity ratio among the company’s peers was 0.22 for 2024.

Green Box

- Ceigall India Limited is also looking to diversify its portfolio by exploring opportunities in HAM projects. The company plans to bid for HAM projects in states with stable growth and with central or multilateral funding.

- The compound annual growth rate (CAGR) for investments in the road sector is projected to be around 10-12% between fiscal years 2025 and 2028. This signifies a consistent upward trend in the sector.

- Ceigall boasts a history of completing over 34 projects across ten states in India and currently has an order book of ₹ 9,470.84 Cr as of June 30, 2024. This strong order book, primarily driven by projects awarded by the National Highways Authority of India (NHAI), provides significant revenue visibility in the short to medium term.

Amber Box

- Ceigall India Limited has been operating profitably, but it has bid for projects on lower margins than its competitors

- Industry-Specific Regulations: Operating within the highways sector in India subjects Ceigall to a complex web of regulations. Key legislations governing the sector include the National Highways Authority of India Act, 1988, the National Highways Act, 1956, and various state-level regulations. Ceigall must remain informed and compliant with these regulations, as any changes or non-compliance could disrupt operations.

- While technical expertise and experience are important, price often plays a decisive role in securing contracts. This pressure could potentially impact the company’s profit margins and ability to secure projects with desirable returns

Red Box

- Dependence on Governmental Contracts: The company’s business heavily relies on contracts from governmental authorities, especially the National Highways Authority of India (NHAI). Any adverse changes in central, state, or local government policies could lead to contract foreclosures, terminations, or renegotiations, significantly impacting Ceigall’s business operations and profitability

- The company has sustained negative cash flow from operating activities for the past three fiscal years Fiscal 2022, 2023, and 2024 at (134.59), (72.7) and (210.8) in crores respectively which raise concerns about the company’s ability to generate sufficient cash flow in the future to meet its financial obligations

- Contingent liabilities as of March 31, 2024, are 939 (in ₹ Cr) with the following breakup.

- Demands raised by Income Tax Authorities 0.68 Cr

- Demands raised by Indirect Tax Authorities 2.5 Cr

- Guarantees issued by the bank on the group’s behalf of 749.9 Cr

- Corporate guarantees issued by our Company on behalf of Subsidiary 186 Cr

Images

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, there might be manual/ human or other errors, authors are not responsible for any decision arising out of an inadvertent mistake. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).