OBSC Perfection Limited

Company

| Website 🔗 | |

| Business Activity | Manufacture |

| Division | Precision Metal Components |

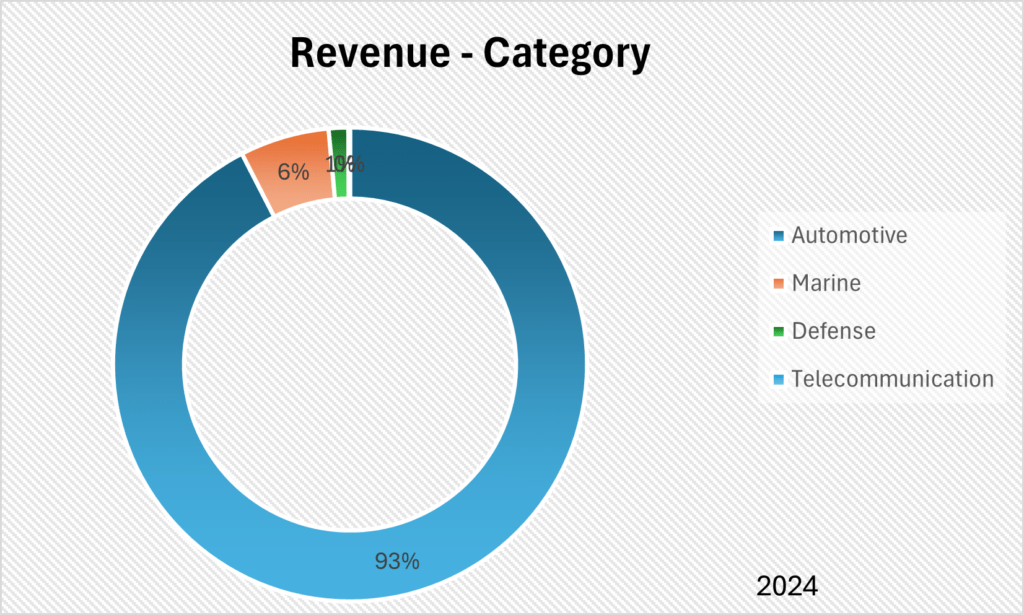

| Sub-class | Automotive, Defence, Marine, and Telecommunication Infrastructure |

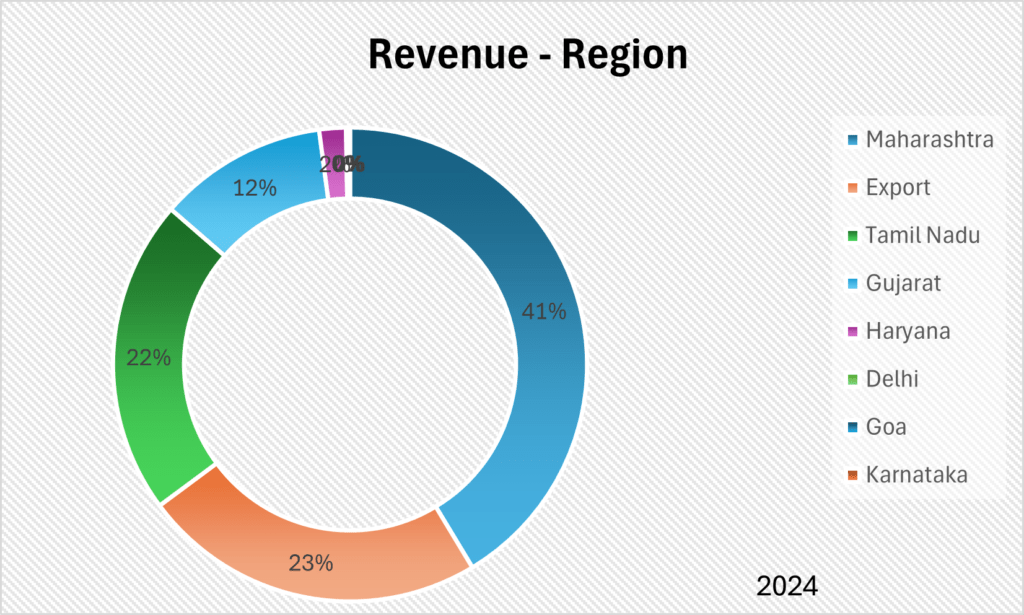

| Location | Pune, Maharashtra Thiruvallur, Tamil Nadu |

| Establishment Year | 2017 |

Management

| Managing Director | Saksham Leekha |

| Educational Qualifications | Bachelor of Technology (Computer Science and Engineering) from Guru Gobind Singh Indraprastha University |

| Experience | Over 7 years of experience in the precision engineering components industry |

| Annual Salary | ₹ 59 Lakhs |

| Total Number of Employees | 735 |

About

OBSC Perfection Limited is a precision metal component manufacturer that offers a wide range of high-quality engineered parts for different industries. The company primarily focuses on the automotive sector, specifically catering to Original Equipment Manufacturers (OEMs) who supply components to major automotive companies in India.

Products and Services:

OBSC Perfection manufactures a diverse range of precision metal components, including:

- Cut blanks

- Shafts and spline shafts

- Torsion rods

- Piston rods

- Rack bars

- Pinions

- Driveshafts

- Gear shifters

- Cable end fittings

- Sensor bosses

- Sleeves

- Push plates

- Hubs

- Housings (brass and aluminium)

- Fork bolts

- Fasteners

- Connectors

- Ball pins and housings

- Flanges

- Rings

- Dozing adapters

Clients:

OBSC Perfection primarily serves OEMs in the automotive industry (Exhaust Systems, Braking Systems, Steering Systems, and Suspension Systems). The company also caters to manufacturers in the defence(Ammunition Fuzes), marine (Mechanical Cables and Steering Systems), and telecommunication infrastructure (Antenna) sectors.

Manufacturing Process:

The company has 4 manufacturing units in Pune (I, II and IV) and Chennai (III) and employs a variety of manufacturing processes to create its precision components. These processes include:

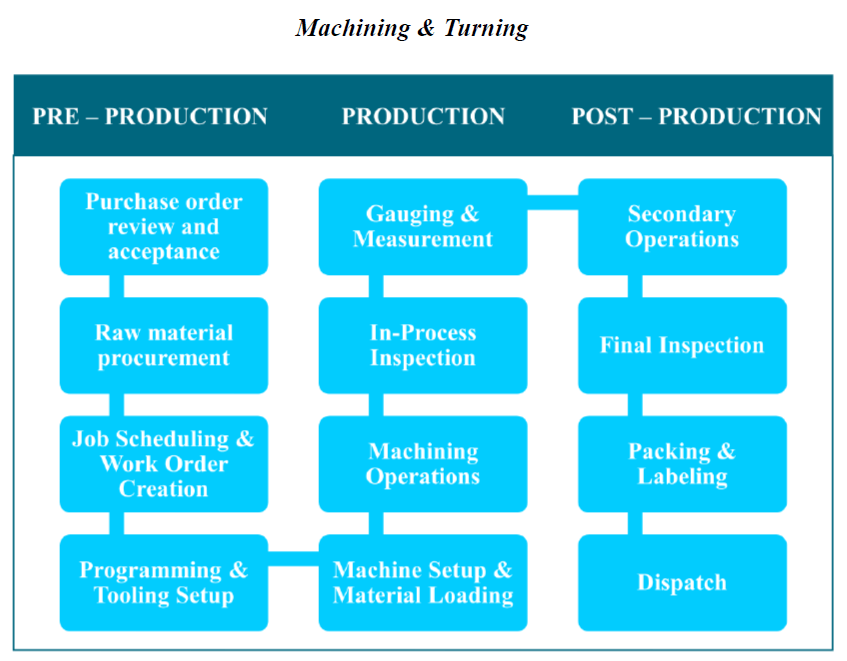

Machining and Turning:

Utilizing Computer Numerical Control (CNC) technology to cut and shape metal bars into precise components.

Investment Casting:

Creating complex and high-quality components by pouring molten metal into intricate moulds.

Forging:

Shaping metal using compressive forces to achieve desired forms.

Stamping:

Transforming flat metal sheets into specific shapes.

Fabrication:

Cutting, forming, and joining metal components.

Welding:

Joining metal parts with high accuracy to ensure structural integrity.

Phosphating and Chromate Conversion Coating:

Applying protective layers to improve corrosion resistance and paint adhesion.

Assembled Components:

Combining individual parts to create functional products.

Raw Materials:

The primary raw materials used by OBSC Perfection are:

- High/Low Carbon steel bright bars: Sourced primarily from Omega Bright Steel & Components Private Limited, a promoter group entity.

- Aluminium

- Stainless steel

- Brass

- Wax

Suppliers:

The company’s primary supplier of High/Low Carbon steel bright bars is Omega Bright Steel & Components Private Limited, a promoter group entity. Other raw materials are sourced from a network of suppliers, with the top 10 suppliers contributing approximately 82.15% of the total raw material purchases in Fiscal Year 2024. Sources and related content

Other Key Aspects:

OBSC Perfection is part of the Anglian Omega Group, which has diversified into various sectors, including electric mobility, high-tech auto components, infrastructure, supply chain management services, trading, and sports.

Strong Emphasis on Quality:

The company maintains stringent quality control measures and has obtained ISO 9001:2015 and IATF 16949:2016 certifications for its quality management systems.

Manufacturing Process Flowchart

Revenue – Category

Revenue – Region

Audit and Legal

Auditor’s Remarks:

The auditors have issued an unqualified opinion on the company’s financial statements

Non-Compliances and Other Issues:

Delays in filing statutory forms such as ADT-1, MGT-14, MSME-1, MGT-7, CHG-1, MR-1, and DIR-12, which were later filed with additional fees.

Omission of certain dates of board meetings in e-form MGT-7 and Boards’ Report in specific reporting periods.

Failure to have a whole-time company secretary on the payroll for a period when it was required.

Related Party Transactions:

The company heavily relies on its promoter group entity, Omega Bright Steel & Components Private Limited, for its raw material supply. While this arrangement has benefits, it also presents a potential conflict of interest. For FY 2024, raw materials supplied by the group company amounted to 35.85% of total purchases.

Non-Compete Agreements:

The company has not entered into non-compete agreements with its promoters or promoter group entities. This could lead to competition between the company and these entities in the future.

Contingent Liabilities:

OBSC Perfection Limited does not have any contingent liabilities as of FY 2024.

Legal Cases:

Cases Filed Against the Company

Case Type: Employees’ compensation claim

Claim Amount: ₹ 10.75 lakhs

Case Details: The complainant, Seema Vishwamber Rathod, filed a case under Section 4 of the Employees’ Compensation Act, 1923, after suffering a severe injury while working at the company’s facility.

Cases Filed by the Company

Nil

Tax Proceedings against the Company:

Nil

SWOT Analysis

Strengths

| Strategic Location: The company’s manufacturing facilities are located in key automotive hubs in India, allowing for proximity to customers, efficient logistics, and access to a skilled workforce. |

| Supply Chain Advantage: The co-location of a manufacturing facility with a key raw material supplier (a promoter group entity) provides cost advantages, quality control, and timely procurement. |

| Strong Financial Performance: The company has demonstrated consistent growth in revenue and profitability, indicating operational efficiency and effective management. |

Weaknesses

| Customer Concentration: A significant portion of the company’s revenue is derived from a few major customers, posing a risk if these relationships are disrupted. |

| Dependence on the Automotive Industry: The company’s business is heavily reliant on the automotive sector, making it vulnerable to industry downturns. |

| Lack of Long-Term Contracts: The absence of long-term agreements with suppliers and contract workers exposes the company to price volatility and potential disruptions. |

Opportunities

| Industry Growth: The Indian automotive industry and other sectors served by the company are experiencing rapid growth, presenting opportunities for expansion and increased revenue. |

| Expansion Plans: The company’s plans to expand its manufacturing facilities and enter new product categories can further enhance its capabilities and market reach. |

| Export Market: The company has the opportunity to increase its presence in the international market, leveraging its expertise and competitive pricing. |

| Electric Vehicle Market: The global shift towards electric vehicles presents new opportunities for the company to supply components for this growing market. |

Threats

| Competition: The company faces intense competition from both organized and unorganized players in the industry, which could pressure margins and market share. |

| Economic Slowdown: A potential downturn in the domestic or global economy could adversely affect demand for the company’s products. |

| Raw Material Prices: Volatility in raw material prices, particularly steel, could impact the company’s profitability and financial performance. |

Porter’s Five Forces1

| Threat of New Entrants | MODERATE |

| Relatively low barriers to entry in the precision metal components manufacturing industry could attract new players, potentially increasing competition. However, the company’s strategic location, supply chain advantage, and established customer relationships provide some barriers to entry. |

| Bargaining Power of Suppliers | MODERATE |

| The company’s reliance on a few key suppliers, especially for high/low carbon steel bright bars, gives suppliers moderate bargaining power. |

| Bargaining Power of Buyers | MODERATE |

| The company’s customer base is concentrated among a few large OEMs, giving buyers significant bargaining power. These buyers can demand lower prices and more favourable terms, potentially impacting the company’s profitability. |

| Threat of Substitute Products or Services | LOW |

| The threat of substitute products is relatively low, as precision metal components are essential for various industries, including automotive, defence, and marine. |

| Rivalry Among Existing Competitors | HIGH |

| The precision metal components manufacturing industry is highly competitive, with both organized and unorganized players. The company faces competition based on price, quality, and product range. |

Peer Comparison

The company’s performance on various financial and operational metrics compared to its peers is as follows:

| Metric | OBSC Perfection Limited | RACL Geartech Limited | Talbros Automotive Components Limited |

| Revenue from Operations (₹ in Crores) | 115 | 410 | 778 |

| Operating Profit Margin (%) | 18 | 23 | 15 |

| Return on Equity (ROE) (%) | 51.0 | 21.2 | 17.2 |

| Return on Capital Employed (ROCE) (%) | 31.1 | 17.8 | 21.4 |

| Debt to Equity Ratio | 1.38 | 1.41 | 0.18 |

Green Box

Positive Operating Cash Flow:

The company has maintained positive operating cash flows for the past few years (FY 2024,2023 and 2022).

Strategic Location:

The company’s manufacturing facilities are strategically located in key automotive hubs in India, namely Pune and Chennai. This proximity to major automotive manufacturers offers several advantages, including streamlined logistics, reduced transportation costs, faster response times, and improved collaboration with clients.

Focus on Innovation:

The company continuously upgrades its manufacturing processes and invests in advanced CNC machines with multi-axis capabilities, ensuring higher precision, faster production times, and the ability to handle intricate designs. This focus on innovation and technology enables the company to maintain a competitive edge and cater to the evolving needs of its customers.

IPO Funds:

The company plans to use a portion of the proceeds to fund capital expenditure requirements as mentioned below:

The company plans to expand its production capacity through several initiatives:

- Proposed Expansion at Unit III:

- The company will invest in new machinery which will include CNC Lathe machines, CNC Vertical Machining Centers, CNC Turnmill Centers, and CNC Centreless Grinding Machines for its existing manufacturing facility in Chennai (Unit III).

- This expansion is estimated to cost ₹1,542.00 lakhs and will be funded from the IPO’s net proceeds.

- The expansion is expected to increase the unit’s production capacity by 35,00,000 units, bringing the total capacity to 53,16,000 units.

- Proposed Expansion at Unit IV:

- The new machinery will include Citizen Sliding Head Stock CNC Lathes, CNC Vertical Machining Centers, Flat Bed CNC Chuckers, Circular Sawing Machines, CNC Cylindrical Grinding Machines, and 3D CNC CMMs.

- This expansion is estimated to cost ₹1,517.00 lakhs and will be funded from the IPO’s net proceeds.

- The expansion is expected to increase the unit’s production capacity by 25,00,000 units.

- Expansion into Precision Clamping Solutions:

- The company has recently ventured into manufacturing precision clamping solutions, including speciality collets and guide bushes, under the brand “AlphaSeiki.”

- These products will be manufactured in-house and distributed globally through a network of dealers.

- Proposed Manufacturing Facility in Sanand, Gujarat:

- The company plans to establish a new manufacturing facility in Sanand, Gujarat, another prominent automotive hub in India.

- This expansion is driven by a nomination letter from a leading automotive OEM, indicating potential future business.

- The new facility will complement the company’s existing operations in Pune and Chennai, further strengthening its presence in the Indian automotive industry.

Another portion of the proceeds will be used to fund the company’s working capital requirements.

Industry Outlook:

The Indian automobile industry is projected to reach a turnover of US$300 billion by 2026, growing at a CAGR of 15%.

The Indian auto components industry is expected to grow to US$ 200 billion by FY26. This growth will be backed by strong export demand which is expected to rise at an annual rate of 23.9% to reach US$ 80 billion by 2026 due to the high development prospects in all vehicle industry segments.

Amber Box

Capacity Utilization:

Capacity Utilization of many of its Units is below 50%, operating significantly below full potential indicating room for growth.

Electric Vehicle Market:

The global shift towards electric vehicles presents a significant opportunity for the company. By supplying components for electric vehicles, the company can tap into this rapidly growing market, potentially leading to substantial revenue growth and value appreciation.

Labour-Related Risks:

The company’s operations are labour-intensive, exposing it to risks related to labour costs, availability of skilled workers, and potential labour unrest.

Red Box

Expansion Risks:

The company’s expansion plans, while promising, are subject to risks such as cost overruns, delays, and uncertainties related to market demand and competition.

Related Party Transactions:

The company procures a significant portion of raw materials from group companies and it is important that the transactions are fair and transparent and are not unfavourable to the company.

Images

- The force value of “LOW” is considered good Click Porter’s Five Forces article for more information. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).