Awfis Space Solutions Limited

Company

| Website 🔗 |  |

| Business Activity | Services |

| Division | Leasing |

| Sub-class | Flexible Workspace/ Office Space |

| Location | New Delhi, Delhi |

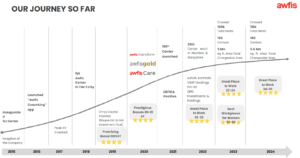

| Establishment Year | 2014 |

Management

| Managing Director | Amit Ramani |

| Educational Qualifications | Bachelor’s degree in architecture from the School of Planning and Architecture, New Delhi Master’s degree in architecture from Kansas State University, USA |

| Experience | Over 20 years of experience in real estate and workspace solutions. |

| Annual Salary | 705 Lakhs |

| Total Number of Employees | 3053 |

About

Business Model:

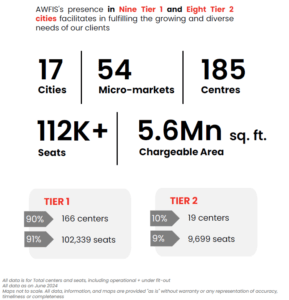

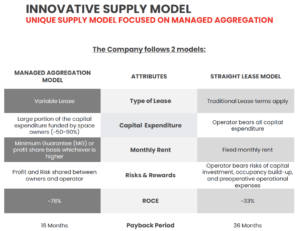

Awfis Space Solutions Limited is the largest flexible workspace solutions company in India as of December 31, 2023, based on the total number of centres. The company operates on an asset-light model, primarily through the Managed Aggregation (MA) model, where it partners with space owners. The MA model constituted 66.43% of Awfis’ total seats.

Supply Strategy:

Awfis utilizes two models for sourcing workspace:

The Straight Lease (SL) model and the Managed Aggregation (MA) model. The SL model involves traditional leases with fixed terms and conditions. In contrast, the MA model is asset-light and involves partnering with space owners who provide the space while Awfis manages and operates it.

Services:

Space Solutions: This includes flexible desks, private offices, meeting rooms, and customized office spaces for various durations and team sizes.

Enterprise Solutions: Provides end-to-end design, construction, and management services to create customized workspaces for larger businesses.

Awfis Transform: A dedicated vertical that delivers construction and fit-out services to clients seeking custom workspace designs.

Awfis Care: Offers property and facility management services for both Awfis centres and external clients. Services include engineering maintenance, security, housekeeping, and business support.

Allied Services: Includes amenities like high-speed internet, printing services, reception and administrative support, meeting room bookings, and access to a network of other professionals. It also features a mobile app for booking spaces, managing accounts, and accessing other Awfis services.

Workspace Formats:

Awfis: This format targets value-conscious clients, offering high-quality design and infrastructure in key micro-markets of Tier 1 and Tier 2 cities.

Awfis Gold: This premium offering caters to discerning clients seeking premium spaces in Grade A buildings in major Tier 1 cities.

Suppliers:

Awfis has a large and diversified vendor base of over 350 vendors across India. This network allows Awfis to access various products and services, ensuring cost-effectiveness and quality, and mitigating supply chain risks.

Clients:

To meet its clientele’s diverse needs, Awfis offers various workspace formats such as Awfis, Awfis Gold, and managed aggregation centres.

Awfis had 2,295 clients spanning various industries, including technology, banking and finance, and consulting.

Startups & Freelancers: Awfis caters to the needs of individuals and small teams seeking flexible and affordable workspace solutions.

SMEs: Small and medium-sized enterprises benefit from the scalable workspace options and comprehensive business support services provided by Awfis.

Large Corporations: Awfis offers enterprise-level workspace solutions, including custom-designed offices and managed workspaces, to meet the specific needs of large organizations.

Corporate Entities (Awfis Care): The facility management services under Awfis Care are designed for businesses with existing office or retail spaces looking for comprehensive facility maintenance solutions.

Design and Build: Awfis has a team of designers and project managers who collaborate with clients to design and build customized workspaces. The design process considers factors such as space efficiency, employee well-being, and brand aesthetics.

Growth Strategy:

Expanding the network of centres in existing and new cities across India.

Enhancing the technological infrastructure to improve the client experience and operational efficiency.

Strengthening its position in the enterprise solutions market by offering customized solutions and catering to the evolving needs of large corporations.

Expanding the reach of Awfis Transform and Awfis Care, offering design, build, and facility management services to a broader client base.

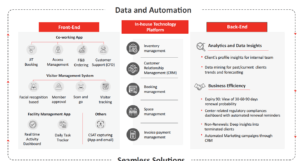

Work Flow Chart

Revenue – Category

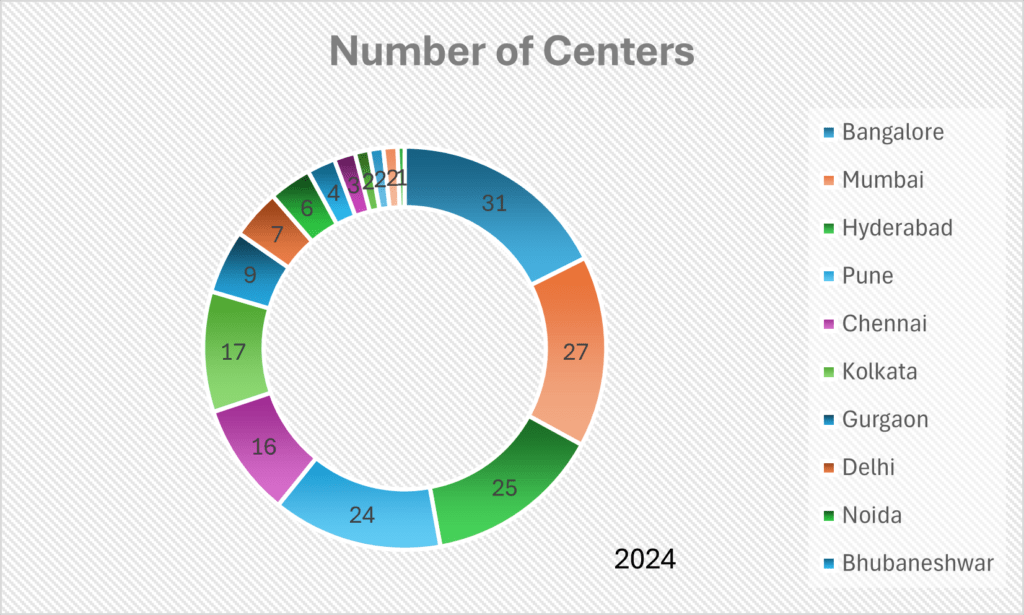

Number of Centers – Region

Audit and Legal

Auditor’s Remarks or Qualifications:

The Statutory Auditors include no qualifications in their audit reports on the Restated Consolidated Financial Statements.

Statutory Dues and Approvals: The company has a history of delayed payments for statutory dues like employee insurance, provident fund contributions, and taxes

Alleged Escaped Income (Assessment Year 2019-2020):

The Assistant Commissioner of Income Tax issued a notice alleging Awfis Space Solutions Limited failed to declare ₹75.8 Crore as taxable income, potentially linked to share capital raised during that year.

Excess Input Tax Credit (Financial Year 2022-2023)

The Deputy Commissioner of State Tax in Mumbai alleged that Awfis had an excess Integrated Goods and Service Tax (IGST) credit of ₹4.83 Crore.

Allegations of Turnover Underreporting (FY 2019-2020 to 2022-2023)

The Deputy Commissioner of Commercial Taxes in Bangalore issued a notice demanding Awfis Space Solutions Limited pay ₹18.19 Crore in GST liabilities.

The demand covers several alleged violations, including underreporting turnover, wrongfully claiming input tax credit, and failing to maintain proper books of accounts. Awfis Space Solutions Limited has responded to these allegations, and the matter is pending.

SWOT Analysis

Strengths

| Largest Network: Awfis has the largest network of flexible workspaces in India, giving it a significant advantage in terms of scale and brand recognition. |

| Diverse Portfolio: The company offers a diverse portfolio of workspace solutions and formats to meet the needs of a wide range of clients. |

| Asset-Light Model: The MA model allows for rapid expansion with lower capital expenditure and risk. |

| Strong Technology Platform: Awfis leverages a robust technology platform to enhance client experience, streamline operations, and drive efficiency. |

| Experienced Management Team: The company has a seasoned management team with a deep understanding of the flexible workspace industry. |

Weaknesses

| Financial Losses: Awfis has incurred net losses in recent fiscal years, raising concerns about long-term profitability. |

| Dependence on MA Model: A significant portion of Awfis’s centers operate under the MA model, exposing the company to risks related to Space Owner Agreements, which is also evident from multiple litigations filed by the Company on parties related to these agreements. |

| Favourable Space Owner Agreements: Awfis’s growth and profitability depend on its ability to secure and maintain favourable agreements with space owners |

Opportunities

| Growing Flex Sector: The flexible workspace industry in India is experiencing rapid growth, presenting significant expansion opportunities for Awfis. The demand for flexible workspaces is rising as businesses adopt hybrid work models and seek cost-effective solutions. |

| Expansion into Tier 2 Cities: Awfis has a presence in eight Tier 2 cities and can further capitalize on the growing demand for flexible workspaces in these locations. |

Threats

| Competition: The flexible workspace industry is competitive, with both established players and new entrants vying for market share. |

| Economic Downturn: An economic slowdown could adversely impact demand for flexible workspaces, potentially affecting Awfis’s occupancy rates and revenue. |

| Changes in Market Trends: Shifts in work patterns and preferences could impact the demand for flexible workspaces. |

Porter’s Five Forces1

| Threat of New Entrants | HIGH |

| Low barriers to entry: The flexible workspace industry has relatively low barriers to entry. The industry’s rapid growth is likely to attract new players seeking to capitalize on the increasing demand. |

| Bargaining Power of Suppliers | MODERATE |

| Dependence on Space Owner Agreements: Awfis relies heavily on its managed aggregation (MA) model (66.43%), where it partners with space owners. This dependence on space owners gives them significant bargaining power, especially for prime locations. |

| Bargaining Power of Buyers | MODERATE |

| Diverse client base: Awfis caters to a wide range of clients, including freelancers, startups, SMEs, and large corporations, which reduces reliance on any single customer segment. Short-term commitments: A portion of Awfis’s clients enter into short-term agreements, giving clients some bargaining power to negotiate rates and switch providers |

| Threat of Substitute Products or Services | MODERATE |

| Traditional office spaces: Traditional office leases remain a substitute for flexible workspaces, especially for companies seeking long-term commitments and customized spaces. Remote work: The rise of remote work and work-from-home arrangements poses a potential substitute, particularly for freelancers and smaller teams. However, flexible workspaces offer advantages such as: Flexibility and scalability, Cost-effectiveness, Amenities and services. |

| Rivalry Among Existing Competitors | HIGH |

| Large number of players: The flexible workspace industry is fragmented, with over 430 operators in India, leading to intense competition. |

Peer Comparison

Revenue from Contracts with Customers: Awfis demonstrates strong revenue growth, reaching ₹545 Crore in Fiscal 2023. While a direct comparison is difficult due to varying reporting standards and the absence of publicly listed Indian peers with the MA model, Awfis is outperforming WeWork, COWRKS, Smartworks, and Tablespace in revenue growth from Fiscal 2021 to 2023.

Managed Aggregation (MA) Model: Awfis differentiates itself through its heavy reliance on the MA model. This approach contrasts with competitors like WeWork, Table Space, and Smartworks, which primarily utilize the Straight Lease (SL) model.

Awfis’s ROCE of 25.26% in Fiscal Year 2023 surpasses the ROCEs of WeWork, COWRKS, and Tablespace in the same period

Green Box

Financial Performance: Awfis exhibits a strong financial track record. From Fiscal 2021 to 2023, its revenue from contracts with customers grew at a CAGR of 74.85%.

Diverse Client Base: Awfis boasts a diversified clientele of 2,295 as of December 31, 2023, spanning various industries. This diverse base, with no single customer contributing over 10% of revenue, mitigates risks associated with over-reliance on specific clients.

Current Capacity Utilization: As of June 2024, the average occupancy rate for the company’s centres was 71%. The occupancy rate for centres older than 12 months was 84%

Operating Cash Flow: The company had positive cash flow from operations in FY 2023

Outlook: Awfis has a strong financial outlook with revenue of Rs. 849 Crore in FY24 and EBITDA of 31.0%.1 They also became PAT positive in Q4 of FY24. Awfis has experienced growth in operational MA seats and centres. Between FY21 and FY24, Awfis had a 3x growth in operational MA centres and a 4x growth in operational MA seats.

Added 48 centers and 30,156 seats since June 2023. YoY growth: 43% increase in operational seats and 40%increase in operational centres.

Amber Box

Flexible Workspace Industry Growth: The Indian office market is expected to grow at a CAGR of 6.3% from 2023 to 2026. (Source: CBRE Report), though Flexible workspace growth is estimated to be much higher.

Red Box

The company has a history of net losses. The company needs to generate and sustain increased revenues while managing its expenses to achieve profitability.

Images

- For Porter’s Five Forces, the force value of “LOW” is considered good. ↩︎

Disclaimer: The above information/document is based on publicly available sources and has been issued solely for educational and informational purposes and should not be considered as investment advice or as a Buy/Sell recommendation, or as a research report. Although due diligence has been done to ensure the accuracy of the data presented, the website or authors are not responsible for any decision arising out of an inadvertent mistake or error in the data presented on the website. The authors may also have equity shares in the companies mentioned in this report adhering to provisions of regulation 16 of the Securities and Exchange Board of India (Research Analysts) Regulations, 2014. The investor is advised to consult his/her investment advisor and undertake further due diligence before making any investment decision in the companies mentioned. Authors are not liable for any financial gains or losses due to investments made as per the information provided on this website (StocKernel.com).